Credit Cards

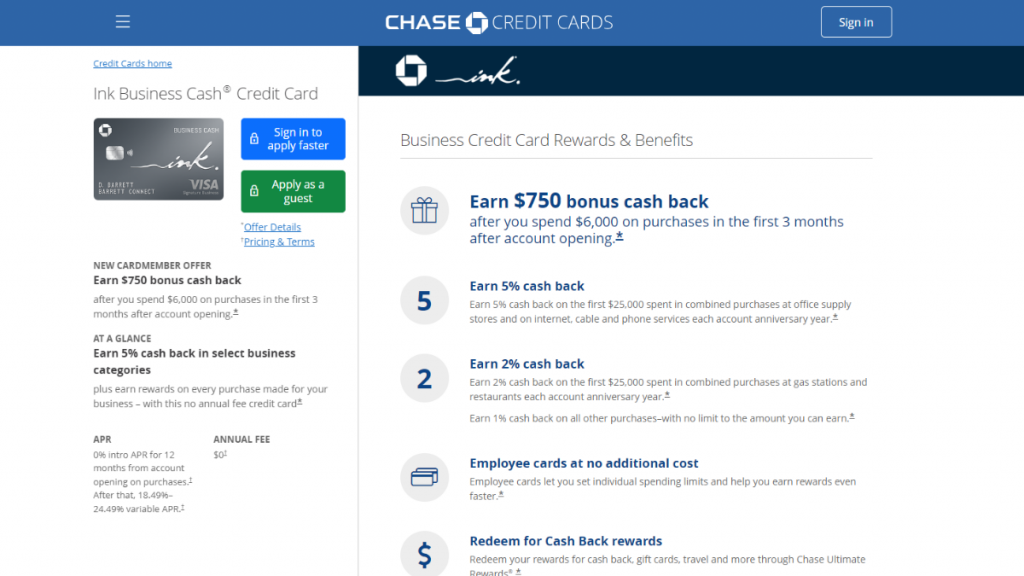

Ink Business Cash® Credit Card Review: up to 5% Cash Back

Save more on your small business with a card that offers up to 5% cash back on office supplies. Discover the potential of the Ink Business Cash® Credit Card in our detailed review.

Advertisement

Get 5% cash back on office supplies, internet, and cable, 2% on gas and restaurants, and 1% elsewhere

Small business owners understand the expense struggle. What if there was a credit card that could help you earn more cashback? Then let’s review the Ink Business Cash® Credit Card.

Apply for the Ink Business Cash® Credit Card

Discover step-by-step to apply for the Ink Business Cash® Credit Card online and get rewarded for your business expenses. Read on!

Get up to 5% cash back on select purchases with this game-changing card for small business owners. Discover the benefits of the Ink Business Cash® Credit Card and more. So stay tuned!

- Credit Score: 690-850 ( Good-excellent);

- Annual Fee: $0;

- Purchase APR: 0% intro APR on purchases for 12 months, then 17.74% – 25.74% (variable);

- Cash Advance APR: 29.49% ( variable)

- Welcome Bonus: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening;

- Rewards: Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year.

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Ink Business Cash® Credit Card: how does it work?

Indeed, the Ink Business Cash® Credit Card stands out with 5% cash back on essential business expenses like office supplies and communication services.

So, it’s an ideal choice for small business owners looking to maximize rewards without the burden of an annual fee.

Also, the accelerated cash back on specific categories ensures a rapid return on investment, making it particularly attractive for new businesses.

Business Perks

- Employee cards at no additional cost;

- 5% cash back on Lyft rides.

Advertisement

Rewards

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year.

Redemption Options

- Cashback;

- Travel through Chase Travel;

- Apple® Ultimate Rewards Store;

- Gift cards.

Advertisement

Welcome Bonus

You can earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

Travel Perks

- Roadside Dispatch;

- Purchase Protection;

- Extended Warranty Protection;

- Travel and Emergency Assistance services;

- Auto Rental Collision Damage Waiver;

- Terms apply.

Ink Business Cash® Credit Card: should you get one?

Furthermore, tailored for small business owners, this credit card offers a lucrative cash-back program with no annual fee.

So let’s review the pros and cons of the Ink Business Cash® Credit Card to make an informed decision.

Pros

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening;

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year;

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases;

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business; Checking account on your first card anniversary

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information;

- No Annual Fee;

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- 0% introductory APR for 12 months on purchases;

- Member FDIC.

Cons

- Spending cap on rewards;

- High fee for cash advances.

Credit score required

Furthermore, this credit card requires good to excellent (690-850) from applicants.

Ink Business Cash® Credit Card application: how to do it?

Take advantage of the Ink Business Cash® Credit Card benefits! Apply now to maximize your business expenses with rewarding cash back.

Moreover, learn more about the application process below.

Apply for the Ink Business Cash® Credit Card

Discover step-by-step to apply for the Ink Business Cash® Credit Card online and get rewarded for your business expenses. Read on!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Earn up to 5% cash back: Apply for Instacart Mastercard® today

Apply for the Instacart Mastercard® quickly with our guide. Elevate your grocery shopping experience and enjoy exclusive rewards. Read on!

Keep Reading

What happens if you don’t use your credit card?

Wondering what happens if you don't use your credit card? Well, then keep reading and learning! We'll explain everything you need!

Keep Reading

10 best credit cards with cashback rewards: reviews and offers 2022

Here you'll find a list of the best credit cards with cashback rewards for 2022. Check their benefits and choose yours to earn cashback.

Keep ReadingYou may also like

Capital One SavorOne Cash Rewards Credit Card review

Check out this Capital One SavorOne Cash Rewards Credit Card review to learn all about its benefits, such as cash back and ZERO annual fee!

Keep Reading

Wells Fargo Active Cash® Card application: how does it work?

Learn how to apply for a Wells Fargo Active Cash® Card. Earn 2% cash back on purchases! Read on to learn more!

Keep Reading

Bank of America Business Advantage Travel Rewards Card review

Get a full Bank of America Business Advantage Travel Rewards Credit Card review. Enjoy 0% intro APR for 9 months and much more!

Keep Reading