Credit Cards

Earn up to 5% cash back: Apply for Instacart Mastercard® today

Ready to save big on groceries? Follow our tutorial to apply for the Instacart Mastercard® and seize cash back - enjoy $0 annual fee! Read on!

Advertisement

Simplified Application Process: Instacart Mastercard® Step-by-Step Guide

Ready to supercharge your grocery shopping with exclusive discounts and rewards? It’s time to explore how to apply for the Instacart Mastercard® and unlock a world of savings.

Find out each step of the application and compare it with competitors to see if this is the credit card you’d like to add to your wallet. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

To get your hands on the Instacart Mastercard®, follow these simple steps to apply:

1. Have an Instacart Account

First, ensure you have an Instacart account, as this card is exclusively for Instacart users.

Advertisement

2. Access the Application

Then, visit the Chase website to find the Instacart card application page.

Once on the application page, hit “Apply Now” to get started.

3. Complete the Form

Fill out the application form with your details, including your full name, email, address, and income information.

Advertisement

4. Agree to Terms and Conditions

Then carefully read and agree to the Terms and Conditions. Finally, submit it, and the Chase team will process your application.

That’s it! Now, you just need to wait for Chase to process your request.

Apply using the app

Unfortunately, the Instacart Mastercard® application is not available within the app itself.

You’ll need to apply through the Chase website following the earlier steps.

Instacart Mastercard® vs. Blue Cash Preferred® Card from American Express

Consider the Instacart Mastercard® for more cash back on purchases or the Blue Cash Preferred® Card from American Express for more cash back at U.S. supermarkets.

Choose based on your grocery shopping habits and rewards priorities. Then see how they stack up below.

Instacart Mastercard®

- Credit Score: Good – Excellent;

- Annual Fee: None;

- Purchase APR: 20.24%–28.99% (variable);

- Cash Advance APR: 29.99% (variable);

- Welcome Bonus: Get a free year of Instacart membership and $100 free Instacart credit upon approval;

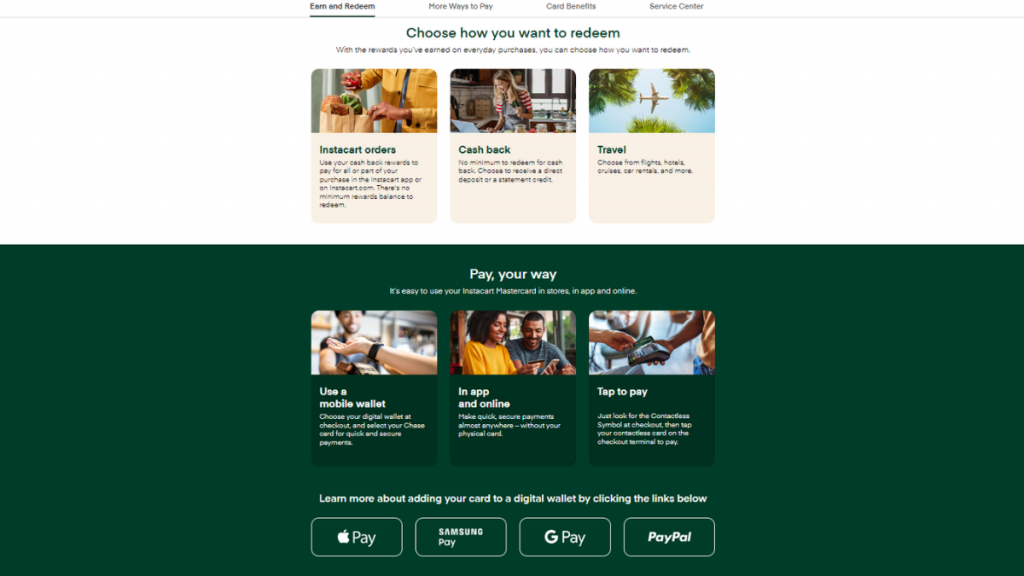

- Rewards: 5% cash back on Instacart.com and the Instacart app, 5% cash back on travel purchased over the phone with Chase Travel Center, 2% cash back at restaurants, gas stations, and eligible streaming services, plus 1% on everything else;

- Terms apply.

Blue Cash Preferred® Card from American Express

- Credit Score: 690 or better;

- Annual Fee: $0 for the first year, then $95 (see terms and fees);

- Regular APR: 0% intro APR for the first 12 months, then 19.24% to 29.99% (variable);

- Welcome Bonus: Earn $250 back as a statement credit when you spend $3,000 in purchases in the first six months;

- Rewards: 6% cash back at U.S. supermarkets yearly, 6% on eligible U.S. streaming subscriptions, 3% cash back on transit and gas in the U.S., and 1% cash back on other purchases.

Further, learn more about the Blue Cash Preferred® Card from American Express and how to apply for it in the post below. Check it out.

Blue Cash Preferred® Card from Amex application

Learn how to apply for the Blue Cash Preferred® Card from American Express and earn cash back. Keep reading!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Learn to apply easily for the Bank of America Mortgage

Apply for the Bank of America Mortgage today and achieve homeownership! Enjoy down payment and closing-cost assistance! Read on!

Keep Reading

How to apply for the Scotiabank Preferred Package

Apply for the Scotiabank Preferred Package with this easy-to-follow step-by-step guide, and get your chequing account going today.

Keep Reading

Apply For the OpenSky® Plus Secured Visa®

Ready to build your credit? Discover the essential steps to apply for the OpenSky® Plus Secured Visa® Credit Card in our guide. Read on!

Keep ReadingYou may also like

WWE Netspend® Prepaid Mastercard® review: Financial Flexibility

Looking for a prepaid card that makes managing your finances easy? Look no further than the WWE Netspend® Prepaid Mastercard® in this review.

Keep Reading

Apply for Marriott Bonvoy Business® American Express® Card today

Unveil the secrets to apply for the Marriott Bonvoy Business® American Express® Card - up to 6x points on purchases and more!

Keep Reading

Apply for MoneyLion Loans: Easy Credit Builder

Stuck in credit limbo? Keep reading to learn how to apply for MoneyLion Loans to the rescue! NO hard inquiry!

Keep Reading