Reviews

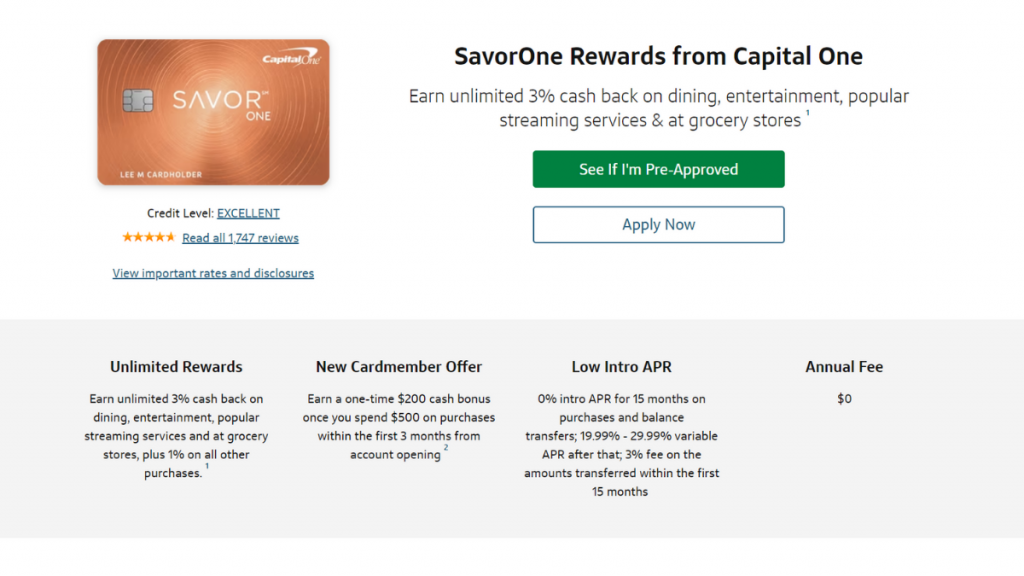

Capital One SavorOne Cash Rewards Credit Card review

The Capital One SavorOne Cash Rewards Credit Card offers unlimited cash back, bonuses, and more. Check out the full review!

Advertisement

Capital One SavorOne Cash Rewards Credit Card: earn unlimited cash back on all purchases

In this article, you will have access to all information regarding Capital One SavorOne Cash Rewards Credit Card.

This is one of the most beneficial and advantageous cards that are relevant in the bank credit market. In this brief reading, we will highlight everything you need to know. Stay tuned for information.

How to request Capital One SavorOne Cash Rewards

Learn how to apply for the Capital One SavorOne Cash Rewards Credit Card and enjoy unlimited cash back with no annual fee!

| Credit Score | Excellent |

| Annual Fee | $0 |

| Regular APR | 0% intro APR for 15 months on balance transfers and purchases. Then, 19.99% – 29.99% variable APR. 29.99% variable APR for cash advances. Balance Transfer Fee: 3% for the first 15 months; 4% at a promotional APR that Capital One may offer you at any other time. Cash Advance Fee: Either $5 or 5% of the amount of each cash advance, whichever is greater. |

| Welcome bonus | Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. |

| Rewards | 3% unlimited cash back on entertainment, dining, streaming services and at grocery stores (it does not include superstores like Walmart® and Target®); 1% cash back on all other purchases |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

A brief overview

If food and entertainment are not an important expense category for you, or if you want a flat rate of return for all expenses, other reimbursement cards may be more suitable for you.

If you are trying to earn points and miles to invest in travel, you should look for premium cards that provide the most redeemable revenue.

However, if you spend a lot of money on dining and entertainment and prefer the cash back, definitely consider using the Capital One SavorOne Cash Rewards Credit Card, especially for non-annual credit cards.

How can it benefit you?

For cards with no annual fee, Capital One SavorOne has some advantages. Meet them next!

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases.

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024.

- Earn 8% cash back on Capital One Entertainment purchases.

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn.

- 0% intro APR on purchases and balance transfers for 15 months; 19.99% – 29.99% variable APR after that; 3% fee on the amounts transferred within the first 15 months.

- No foreign transaction fee.

- No annual fee.

Advertisement

How to apply for the Capital One SavorOne Cash Rewards Credit Card?

So if you are interested in applying for the Capital One SavorOne Cash Rewards Credit Card, check out our post below where we will explain to you all the details regarding the application process!

How to request Capital One SavorOne Cash Rewards

Learn how to apply for the Capital One SavorOne Cash Rewards Credit Card and enjoy unlimited cash back with no annual fee!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Trending Topics

10 reasons not to refinance your home

There are many reasons why you might choose not to refinance your home. Here are the top 10! Check them out!

Keep Reading

Apply for Navy Federal cashRewards Credit Card: $0 annual fee

How to apply for the Navy Federal cashRewards Credit Card - everything you need! Earn cash back on purchases! Read on!

Keep Reading

Application for the Petal® 1 “No Annual Fee” Visa® Credit Card: how does it work?

Wondering how to get a Petal® 1 "No Annual Fee" Visa® Card? We can help you. Read this article to learn more about this credit card.

Keep ReadingYou may also like

Apply for Unique Platinum Card: quick and simple

Elevate your spending power with the Unique Platinum Card - apply today and enjoy exclusive benefits that only a select few can access.

Keep Reading

Rocket Mortgage review: how does it work and is it good?

Are you interested in a Rocket Mortgage review? Stay with us to learn about rates, fees, and more. Read on!

Keep Reading

Prosper Personal Loan review: how does it work and is it good?

Are you looking for a Prosper Personal Loan review? Keep reading to find out the pros and cons of this lender. Read on!

Keep Reading