Reviews

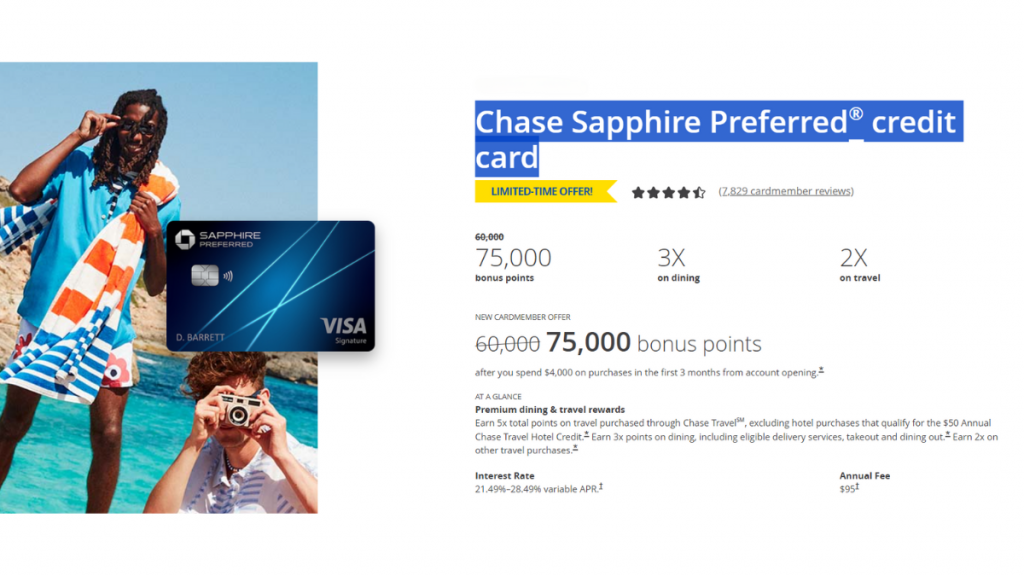

Chase Sapphire Preferred® Card review

Customers love The Chase Sapphire Preferred® card because of its lucrative sign-up bonus, big rewards, and flexible redemption options. Read this review to see if it's a good fit for you.

Advertisement

Chase Sapphire Preferred® Card: The card that takes your travel to the next level

Ready to make your travels even more rewarding? Stick to this Chase Sapphire Preferred® Card review. With exclusive discounts and generous rewards, this card is designed for all intrepid adventurers.

Chase Sapphire Preferred® Card application

Looking to start your journey with the Chase Sapphire Preferred® Card? Find out how you can begin applying and unlock all it offers.

Every purchase will take you closer to those unforgettable experiences worth their weight in gold. Learn why this credit card can be one of the most valuable investments on your next journey.

- Credit Score: Good to excellent;

- Annual Fee: $95;

- Regular APR: 20.74% – 27.74% variable APR on purchases and balance transfers; 29.49% variable APR for cash advances;

- Welcome bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠;

- Rewards: Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Chase Sapphire Preferred® Card: how does it work?

The Chase Sapphire Preferred® Card is a good choice for customers who need a rewarding travel card. Keep reading if you want to know why!

Travel Rewards Galore

Earn big with 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

Advertisement

Additional Benefits

The benefits don’t stop there. You also get a $50 annual Ultimate Rewards Hotel Credit as well as 3x points on dining and 2x points on all other travel purchases.

Plus, enjoy extra protection when you’re away from home with Trip Cancellation or Interruption Insurance, Auto Rental Collision Damage Waiver, and Lost Luggage Insurance provided by your card.

Also, this card is a member of the FDIC. Finally, you’ll have access to DashPass. With it, you can avoid delivery fees and lower other service fees.

Fees

- Annual fee: $95.

- Balance Transfers fee: Either $5 or 5% of the amount of each transfer, whichever is greater.

- Cash advance: Either $10 or 5% of the amount of each transaction, whichever is greater.

- Foreign Transactions fee: None.

Advertisement

Chase Sapphire Preferred® Card: should you get one?

The Chase Sapphire Preferred® Card is undeniably a good choice for those looking for multiple benefits. Check out the advantages and disadvantages of this card below.

Pros

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC.

Cons

- Annual fee;

- It requires a 690 credit score or higher.

Credit score required

To apply for the Chase Sapphire Preferred® Card, a credit score of 690 or higher is recommended. Achieving this level shows strong financial responsibility and puts you in a great position to use all this card offers.

Chase Sapphire Preferred® Card application: how to do it?

Are you considering applying for the Chase Sapphire Preferred® Card? Look no further—dive into our post and learn all about it.

Chase Sapphire Preferred® Card application

Looking to start your journey with the Chase Sapphire Preferred® Card? Find out how you can begin applying and unlock all it offers.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Checking account pros and cons: what to consider before opening one

If you're looking for a new checking account, these are the pros and cons to consider before opening one. Find out if it's right for you!

Keep Reading

What is a good credit score to rent a house?

Find out what is the minimum credit score to rent a house and make the renting process as smooth as possible! Keep reading and learn more!

Keep Reading

What is a balance transfer credit card: is it a good idea?

Do you know what is a balance transfer credit card? Read this article to see how getting one can help you get your finances on track!

Keep ReadingYou may also like

First Access Visa® Card application: how does it work?

Learn how the First Access Visa® Card application works and why you should consider applying for this credit card. Keep reading!

Keep Reading

Apply for the Delta SkyMiles® Reserve American Express Card

Do you need a card to make your travel experiences better? Read to learn about the Delta SkyMiles® Reserve American Express Card application!

Keep Reading

Bank of America Business Advantage Travel Rewards Card review

Get a full Bank of America Business Advantage Travel Rewards Credit Card review. Enjoy 0% intro APR for 9 months and much more!

Keep Reading