Reviews

Chase Sapphire Preferred® Card application: how does it work?

Our post is here to help you acquire the coveted Chase Sapphire Preferred® Card! Discover how easy it is to apply and enjoy great rewards today.

Advertisement

Earn triple points on your dining purchases!

Are you looking for a new way to earn rewards while traveling and shopping? Chase Sapphire Preferred® Card could be perfect. It offers great points on every purchase and also an easy application process.

This blog post will explain exactly how to apply for the Chase Sapphire Preferred® Card. Discover what makes the card worth signing up for today – let’s get started!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

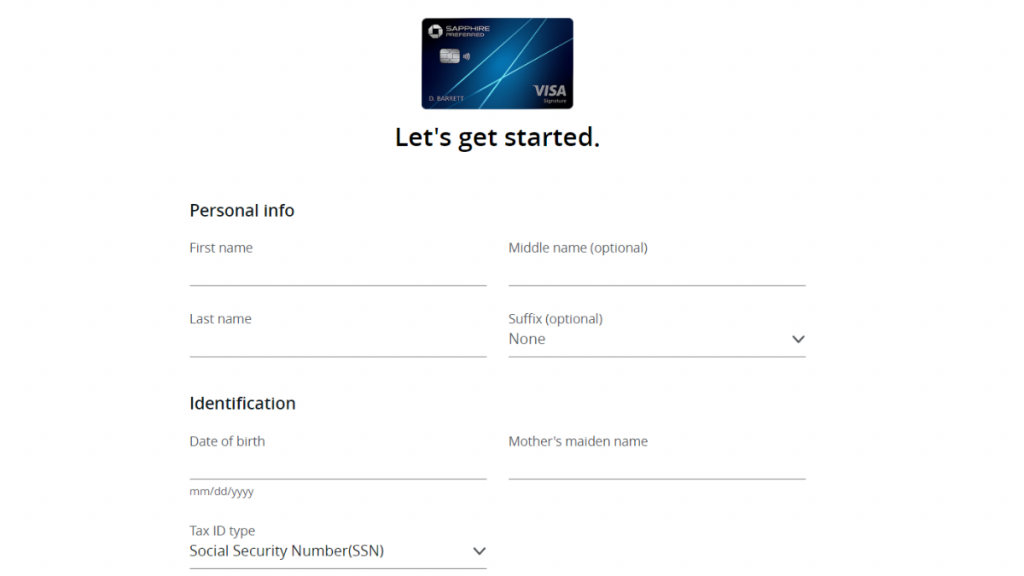

Apply online

The Chase Sapphire Preferred® is an excellent for your wallet, especially if you want to earn travel rewards. Here’s how to apply for it:

1. Go to the Chase website and find the application page.

2. Fill out the application form with your personal information, including your name, address, and Social Security number.

3. Indicate that you’re a U.S. resident and agree to the terms and conditions of the card.

4. Provide your financial information, including your annual income and total assets.

5. Review your application and submit it if everything looks correct.

You should receive a response within minutes.

Apply using the app

The application for the Chase Sapphire Preferred® Card is only available through their official website. However, Chase offers an excellent mobile app to their customers.

It is available for download at the Apple and Google Play Store. Cardholders can easily manage their accounts through the Chase Mobile app.

Advertisement

Chase Sapphire Preferred® Card vs. Wells Fargo Autograph℠ Card

The Chase Sapphire Preferred® Card is great for travelers because you earn 3x points on travel and dining at restaurants worldwide. And when you redeem those points for travel, you get 25% more value.

The Wells Fargo Autograph℠ Card doesn’t offer as many rewards but has some nice benefits, like cell phone protection and no annual fee. So it depends on what’s important to you.

If you’re looking for a card that offers great traveling and dining out rewards, go with the Chase Sapphire Preferred® Card.

But if you’re looking for a card with some nice perks that don’t have an annual fee, go with the Wells Fargo Autograph℠ Card.

Chase Sapphire Preferred® Card

- Credit Score: Good to excellent;

- Annual Fee: $95;

- Regular APR: 20.74% – 27.74% variable APR on purchases and balance transfers; 29.49% variable APR for cash advances;

- Welcome bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Rewards: Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Terms apply.

Advertisement

Wells Fargo Autograph℠ Card

- Credit Score: 690-850 (good to excellent);

- Annual Fee: $0 annual fee;

- Regular APR: 0% intro APR for the first 12 months for purchases, then 19.24%, 24.24%, or 29.24% variable APR for purchases and balance transfers;

- Welcome bonus: Earn 30K bonus points (equals $300 cash redemption value) after spending $1,500 in purchases during the first three months of account ( limited time offer);

- Rewards: Unlimited 3 points for purchases on restaurants, travel, gas, transit, popular streaming, and phone plans; 1 point on all other purchases.

Learn how to apply if you want more information about the Wells Fargo Autograph℠ Card. Keep reading our application guide post below.

Wells Fargo Autograph℠ Card application

Learn how to apply for the Wells Fargo Autograph℠ Card. Enjoy cash back reward and welcome bonus! Read on for more!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Chase Total Checking® application: how does it work?

Ready to take control of your financial future? Open a Chase Total Checking® — Find out how to do it here! No hidden fees and several perks.

Keep Reading

Learn how to easily build credit using a credit card!

If you don't know how to build credit using a credit card, don't miss this content. You will learn how to do it with simple tips.

Keep Reading

First Digital Mastercard® application: how does it work?

The First Digital Mastercard® was designed to help you rebuild your credit. Learn how to apply and start building a strong financial future!

Keep ReadingYou may also like

Delta SkyMiles® Platinum Business American Express Card review

Find out how you can earn miles on your purchases in this complete Delta SkyMiles® Platinum Business American Express Card review.

Keep Reading

How to earn extra money online: your guide to getting started

Learn how to earn money online with our step-by-step guide. We'll show you the best ways to make extra money home today!

Keep Reading

Mogo Prepaid Card Review

Read our Mogo Prepaid Card review to learn how this product can help you reduce your carbon footprint and manage your spending.

Keep Reading