Reviews

Application for the Chase Freedom Flex℠: how does it work?

If you're looking for a credit card with many benefits and cash back, this is it. You've just found the Chase Freedom Flex℠. Read on, and we'll tell you how to get it.

Advertisement

Chase Freedom Flex℠: get unlimited cash back on all your purchases

Interested in learning how the Chase Freedom Flex℠ application process works and enjoying great rewards on a card? In this post, we’ll break down what you need to know about the card’s features and how it can benefit your wallet.

This card is designed for people with good credit scores and has no annual fee. The Chase Ultimate Rewards® program is flexible, and your cash back will never expire for as long as your account is open.

All of these benefits with Chase’s reliability and a Mastercard signature. If you’re considering applying for the Chase Freedom Flex℠, we’ll tell you how to do it.

Apply online

You can apply for this card in minutes, and you don’t need to go anywhere – it is online. Open the Chase website and look for your card option.

It is always positive to read all about the card’s benefits and perks. Once you understand everything about the card offers, hit the apply button.

You’ll be redirected to the application form. If you’re already a Chase user, just sign up to make the process faster. Fill up the form carefully to not mistake any information.

Chase wants to know your full name, address, social security number, annual income, etc. After submitting the form, you’ll get an offer for the Chase Freedom Flex℠ or another card they think is better for you.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Once you get your Chase Freedom Flex℠ card, you can download the app to manage your account. But first, go to their website to apply for your credit card.

Chase Freedom Flex℠ vs. Chase Freedom Unlimited®

If you’re demanding with your credit cards, Chase has another option for you with no annual fee. They have different cash back rates, but they’re both excellent when it comes to their rewards and benefits.

Take a closer look at their features:

| Chase Freedom Flex℠ | Chase Freedom Unlimited® | |

| Credit Score | Good/Excellent | Good/Excellent |

| Annual Fee | $0 | $0 |

| Regular APR | 0% Intro APR for 15 months from account opening on purchases and balance transfers. Then, 20.49% – 29.24% variable APR; 29.99% variable APR for cash advances | 0% Intro APR for purchases and balance transfers for 15 months (from account opening). Then, 20.49% – 29.24% variable APR 29.99% variable APR for cash advances |

| Welcome bonus | $200 bonus after spending $500 in the first 3 months from opening the account | Earn an additional 1.5% cash back (on up to $20,000) on everything you buy in the first year- worth up to $300 cash back |

| Rewards* | 5% cash back on bonus categories up to $1,500 in combined purchases you activate quarterly 5% cash back on travel through Chase Ultimate Rewards® 3% on restaurants, including eligible delivery, takeout, and drugstores 1% on every other purchase *Terms apply | 6.5% cash back on travel purchased through Chase Ultimate Rewards® 4.5% cash back on drugstore purchases and dining at restaurants (which includes takeout and qualifying delivery service, plus 3% on all other purchases on up to $20,000 spent in your first year) After your first year or $20,000 spent: 5% cash back on travel you purchase through Chase Ultimate Rewards® 3% cash back on dining and takeout 3% back on drugstore 1.5% cash back on all other purchases |

As you can see, Chase Freedom Unlimited® has fewer bonus categories. However, the flat-rate cash back for most of your purchases is higher than what the Chase Freedom Flex℠ card offers.

If you prefer to apply for the Unlimited version, we can tell you more about it. Learn how to get yours.

How to get a Chase Freedom Unlimited®?

Looking to get more out of your credit card? Chase Freedom Unlimited® offers cash back, perks, and benefits that can help you make the most of your spending.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Discover it® Balance Transfer Credit Card application: how does it work?

Get the lowdown on how to apply for Discover it® Balance Transfer Credit Card! Enjoy 0% intro APR and more! Keep reading!

Keep Reading

Revvi Card: credit card for bad credit with cashback

The Revvi Card saves your bad credit while you get 1% cash back on all purchases. Read our review to learn more. Check it out!

Keep Reading

Wells Fargo Reflect® Card: La tarjeta de crédito de bajo APR que estabas buscando

Echa un vistazo al Wells Fargo Reflect® Card para ver si cumple con tus necesidades financieras. Sin tarifa anual y 0% de APR introductorio.

Keep ReadingYou may also like

Wells Fargo Autograph℠ Card application: how does it work?

Learn how to apply for the Wells Fargo Autograph℠ Card. Enjoy cash back reward and welcome bonus! Read on for more!

Keep Reading

Learn to apply easily for the Flagstar Bank Mortgage

Learn how to apply for a Flagstar Bank Mortgage. Enjoy several loan options and affordable pricing! Keep reading to learn more!

Keep Reading

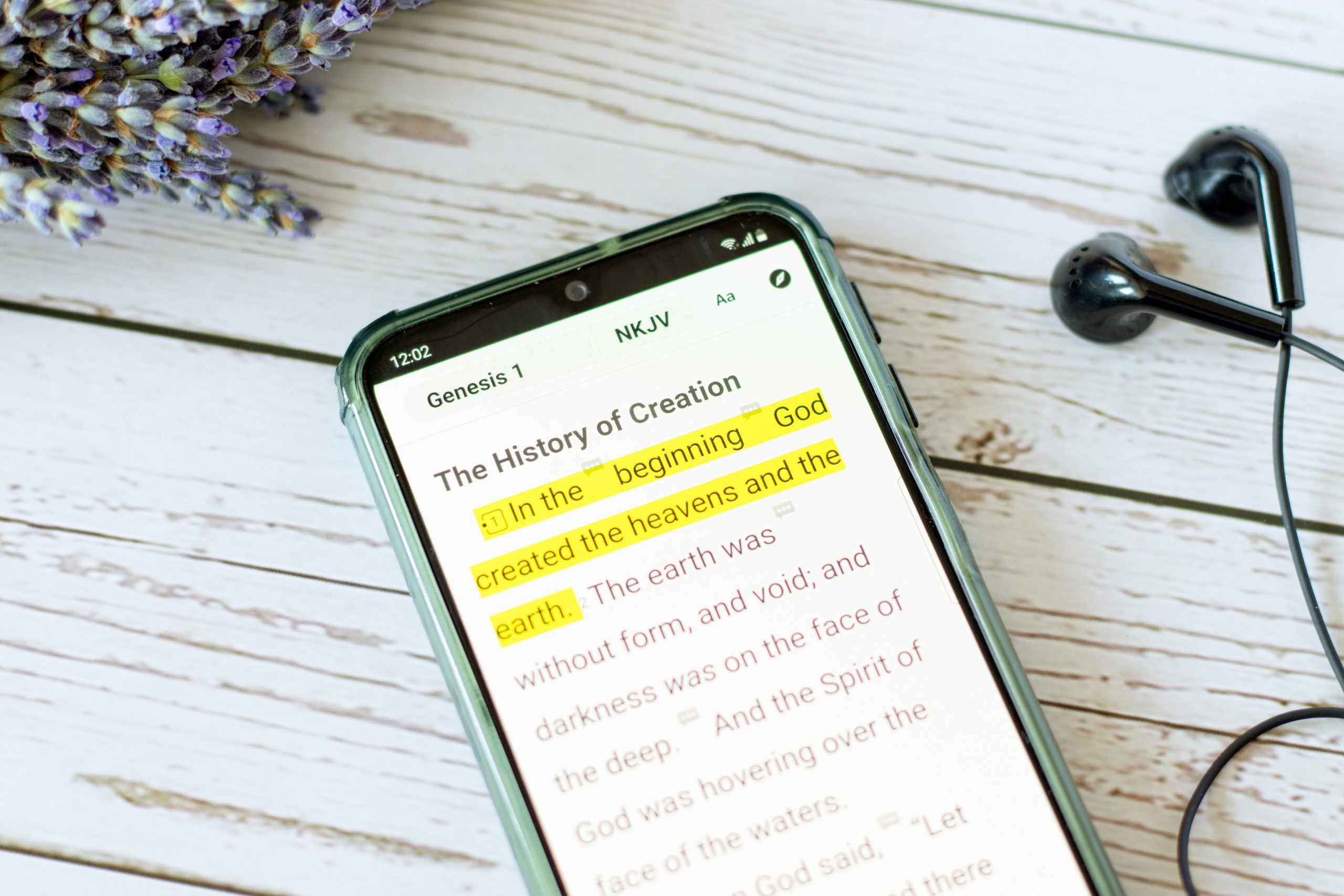

Holy Bible App: Listen online, download now!

Get the best Christian experience with a Holy Bible app! Read or listen to the scripture on your phone anytime, anywhere.

Keep Reading