Reviews

Apply for the Capital One Guaranteed Mastercard® Card

Discover the straightforward process to apply for the Capital One Guaranteed Mastercard® Card. Our guide covers eligibility, benefits, and tips to enhance your chances of approval. Start your financial journey today!

Advertisement

Rewrite your credit history with a simple, hassle-free online application!

Want to apply for the Capital One Guaranteed Mastercard® Card? It’s a straightforward process tailored for your convenience.

This card offers unique benefits and features. Curious about the application steps and tips? Dive into our full article to unlock the secrets of a successful application!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Firstly, to apply for the Capital One Guaranteed Mastercard® Card, visit Capital One’s official website. On the homepage, you’ll find the credit card section.

Clicking on it reveals a variety of card options, allowing you to select the Guaranteed Mastercard®. This is your starting point in securing a card tailored to your needs.”

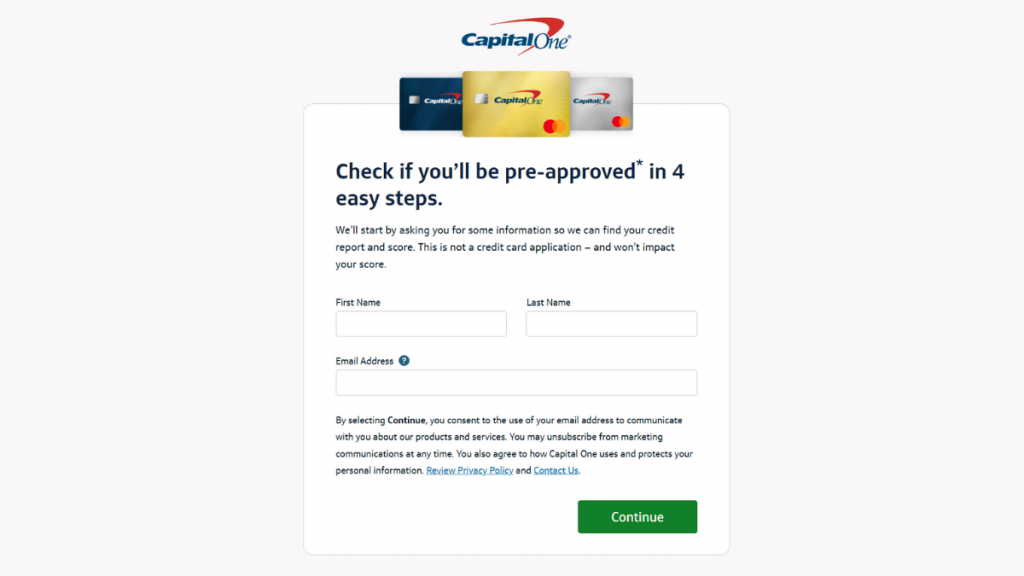

Once you select the Capital One Guaranteed Mastercard®, you’ll encounter the Quick Check® feature. This brilliant tool allows you to check for pre-approval without impacting your credit score.

After using Quick Check®, you’re ready to proceed. Click on the ‘Apply Now’ button. This takes you to the application form. Here, you’ll enter personal details like your name, address, and income.

Next, review your provided information. Double-check for any errors that might hinder your application. Then, read through the terms and conditions.

It’s crucial to understand the agreement you’re entering into. Once satisfied, submit your application. You’re now one step closer to approval.

Finally, await the response. Capital One processes applications swiftly, usually providing an answer quickly. If approved, you’ll receive your Capital One Guaranteed Mastercard® shortly.

Apply using the app

You’ll get the mobile app for online banking as soon as your online application gets approved. You’ll be able to manage your account in the palm of your hand.

Apply on the website to get your Capital One Guaranteed Mastercard® and use the mobile app.

Advertisement

Capital One Guaranteed Mastercard® Card vs. Neo Credit Card

The Capital One Guaranteed Mastercard® offers a secure way to build credit, with features tailored for easy financial management. It’s a reliable choice for many.

Looking for an alternative? Consider the Neo Credit Card. Known for its innovative rewards and flexible credit options, it’s a card that adapts to your lifestyle.

Capital One Guaranteed Mastercard®

- Credit Score: All credit scores are welcome to apply.

- Annual Fee: $59.

- Regular APR: 21.9%.

- Welcome bonus: N/A.

- Rewards: N/A.

Advertisement

Neo Credit Card

- Credit Score: You need a fair to good credit score to become eligible for this card.

- Annual Fee: There are no annual or monthly fees attached to the Neo Credit Card.

- Regular APR: A variable between 19.99% and 29.99%.

- Welcome bonus: Get up to a 15% cash back on your first purchase with Neo’s partners.

- Rewards: Get up to 5% cash back on selected purchases at Neo’s partners.

Intrigued by the Neo Credit Card? Discover more about its unique benefits and how to apply. Check the link below for a comprehensive guide to enhance your financial journey.

How do you get the Neo Credit Card?

Learn how to apply for the Neo Credit Card and enjoy exclusive perks without the common fees!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Trending Topics

Learn to apply easily for 247LoanPros

If you are considering applying for a loan with 247LoanPros of up to $35,000, use this guide on how to apply. Keep reading!

Keep Reading

Discover it® Secured credit card review: is it worth it?

The Discover it® Secured credit card is the first step on your journey to a healthy credit score. Read this review to learn how!

Keep Reading

Delta SkyMiles® Platinum American Express Card application

Do you love to travel and earn card perks while doing so? Read our post about the Delta SkyMiles® Platinum American Express Card application!

Keep ReadingYou may also like

Child and Adult Care Food Program (CACFP): see how to apply

Learn how to apply for CACFP Child and Adult Care Food Program (CACFP) and ensure access to nutritious food! Keep reading and understand how!

Keep Reading

8 smart ways to dig yourself out of debt

If you're looking for a way to get out of debt, read this content. We have the map to lead you out of this situation. But it depends on you.

Keep Reading

Discover it® Cash Back Credit Card application: how does it work?

Learn how to apply for the Discover it® Cash Back Credit Card. Earn up to 5% cash back on purchases and double it after the 1st year!

Keep Reading