Reviews

Apply for the Capital One Guaranteed Mastercard® Card

Discover the straightforward process to apply for the Capital One Guaranteed Mastercard® Card. Our guide covers eligibility, benefits, and tips to enhance your chances of approval. Start your financial journey today!

Advertisement

Rewrite your credit history with a simple, hassle-free online application!

Want to apply for the Capital One Guaranteed Mastercard® Card? It’s a straightforward process tailored for your convenience.

This card offers unique benefits and features. Curious about the application steps and tips? Dive into our full article to unlock the secrets of a successful application!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Firstly, to apply for the Capital One Guaranteed Mastercard® Card, visit Capital One’s official website. On the homepage, you’ll find the credit card section.

Clicking on it reveals a variety of card options, allowing you to select the Guaranteed Mastercard®. This is your starting point in securing a card tailored to your needs.”

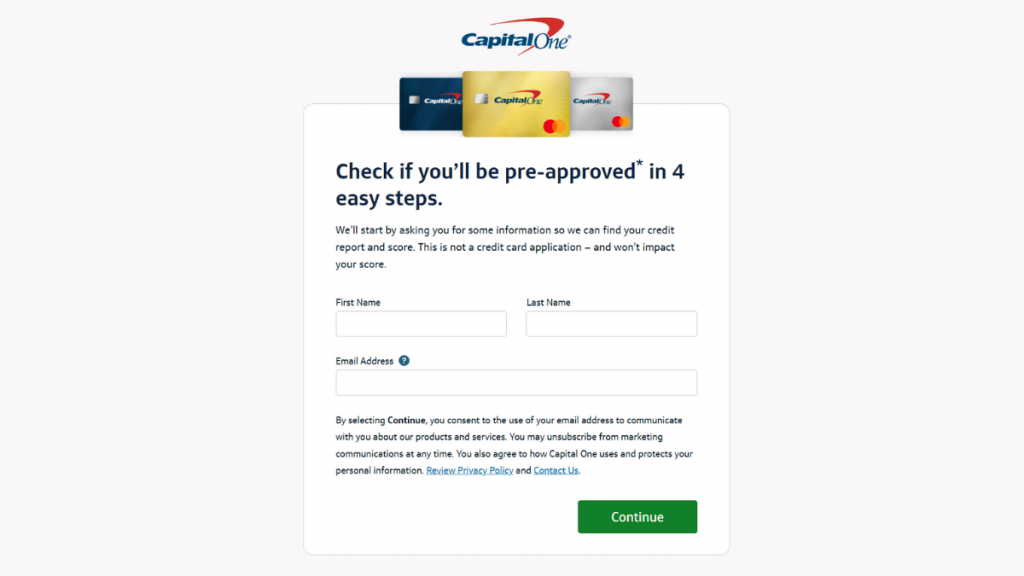

Once you select the Capital One Guaranteed Mastercard®, you’ll encounter the Quick Check® feature. This brilliant tool allows you to check for pre-approval without impacting your credit score.

After using Quick Check®, you’re ready to proceed. Click on the ‘Apply Now’ button. This takes you to the application form. Here, you’ll enter personal details like your name, address, and income.

Next, review your provided information. Double-check for any errors that might hinder your application. Then, read through the terms and conditions.

It’s crucial to understand the agreement you’re entering into. Once satisfied, submit your application. You’re now one step closer to approval.

Finally, await the response. Capital One processes applications swiftly, usually providing an answer quickly. If approved, you’ll receive your Capital One Guaranteed Mastercard® shortly.

Apply using the app

You’ll get the mobile app for online banking as soon as your online application gets approved. You’ll be able to manage your account in the palm of your hand.

Apply on the website to get your Capital One Guaranteed Mastercard® and use the mobile app.

Advertisement

Capital One Guaranteed Mastercard® Card vs. Neo Credit Card

The Capital One Guaranteed Mastercard® offers a secure way to build credit, with features tailored for easy financial management. It’s a reliable choice for many.

Looking for an alternative? Consider the Neo Credit Card. Known for its innovative rewards and flexible credit options, it’s a card that adapts to your lifestyle.

Capital One Guaranteed Mastercard®

- Credit Score: All credit scores are welcome to apply.

- Annual Fee: $59.

- Regular APR: 21.9%.

- Welcome bonus: N/A.

- Rewards: N/A.

Advertisement

Neo Credit Card

- Credit Score: You need a fair to good credit score to become eligible for this card.

- Annual Fee: There are no annual or monthly fees attached to the Neo Credit Card.

- Regular APR: A variable between 19.99% and 29.99%.

- Welcome bonus: Get up to a 15% cash back on your first purchase with Neo’s partners.

- Rewards: Get up to 5% cash back on selected purchases at Neo’s partners.

Intrigued by the Neo Credit Card? Discover more about its unique benefits and how to apply. Check the link below for a comprehensive guide to enhance your financial journey.

How do you get the Neo Credit Card?

Learn how to apply for the Neo Credit Card and enjoy exclusive perks without the common fees!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Trending Topics

Achieve Personal Loan (formerly FreedomPlus) review

Our Achieve Personal Loan review will examine its pros and cons, from fees to loan amounts. Borrow up to $50k and enjoy a rate discount!

Keep Reading

Aeroplan® Credit Card review: Up to 60,000 bonus points

This Aeroplan® Credit Card review is your one-stop for information about this card. Earn up to 3X points on every purchase! Read on!

Keep Reading

Unlimited reward: Apply for British Airways Visa Signature® Card

Discover the few easy steps you need to take to apply for the British Airways Visa Signature® Card and get access to exclusive rewards today.

Keep ReadingYou may also like

How to earn extra money online: your guide to getting started

Learn how to earn money online with our step-by-step guide. We'll show you the best ways to make extra money home today!

Keep Reading

Holiday budgeting: 10 best ways to save money

Holiday budgeting can help save a lot this holiday season. Check out these ten tips for slashing your holiday budget. Read on to learn more!

Keep Reading

Robinhood Investing is ready to take flight

Learn about the recent investments made in Robinhood and what this could mean for the future of the company. Read on for more!

Keep Reading