Credit Cards

Apply for the BMO Ascend World Elite®* Mastercard®*

Learn how to apply for the BMO Ascend World Elite®* Mastercard®* for unparalleled travel experiences. Enjoy elite rewards, comprehensive insurance, and access to exclusive luxury perks. Elevate your travel game.

Advertisement

Earn generous points on travel, groceries, daily expenses, and more!

If you’d like to learn how to apply for the BMO Ascend World Elite®* Mastercard®*, we have prepared a detailed step-by-step guide to help.

See how to easily get this card and enjoy its benefits, such as a generous welcome bonus and high rewards on every purchase you make.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

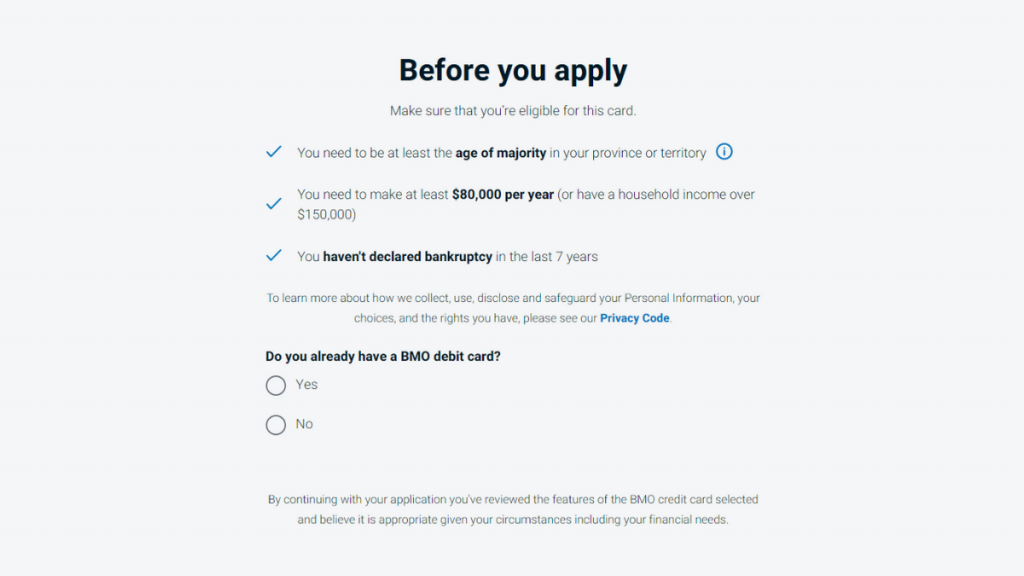

To apply for the BMO Ascend World Elite®* Mastercard®* you need to fulfill these requirements:

- Be a Canadian resident with at least 18 or 19 yo (depending on your province).

- Have an annual income of at least $80,000. You have the option to declare your household income of at least $150,000.

- Good or excellent credit score.

- No bankruptcy in the last 7 years.

Find the BMO Ascend World Elite®* Mastercard®* on BMO’s website and click to view its details. Learn about its benefits and features on this page.

Review the card’s features, benefits, and eligibility on its page. Understanding these details is crucial for a smooth application.

Ready to apply? Click ‘Apply Now’ on the card’s page. Fill in the online application with your personal and financial information.

After filling out the form, double-check your information. Submit your application and await a response. If approved, your card will arrive by mail.

Apply using the app

As soon as you become a BMO Ascend World Elite®* Mastercard®* cardholder, you’ll get to download the app to manage your account.

It has many features, and is so safe that BMO guarantees to reimburse your money if someone gets to break into the app.

However, to apply for the BMO Ascend World Elite®* Mastercard®*, you need to visit their website and fill out the onlie application.

Advertisement

BMO Ascend World Elite®* Mastercard®* vs. BMO CashBack® Business Mastercard®*

The BMO Ascend World Elite®* Mastercard®* offers unparalleled travel perks and rewards. Ideal for those who love luxury and convenience on their journeys.

Alternatively, consider the BMO CashBack® Business Mastercard®*. It’s perfect for business owners seeking valuable business benefits.

| BMO Ascend World Elite®* Mastercard®* | BMO CashBack® Business Mastercard®* | |

| Credit Score | Good/Excellent. | Good/Excellent. |

| Annual Fee | $150 (waived in the first year as a member) | $0 |

| Regular APR | 20.99% on purchases; 23.99% for cash advances (21.99% for Quebec residents). | 19.99% interest on purchases. 22.99% interest on advance. |

| Welcome bonus | Earn up 60,000 bonus points. (Minimum spending required) | 10% cash back on gas, office supplies and cellphone and internet bill payments for 3 months! *Tems apply |

| Rewards | 5x points on travel; 3x points on dining, entertainment, and recurring bills; 1x points on every other purchase. | 1.75% back at Shell gas stations; 1.5% on gas, internet bills, phone bills and office supplies; 0.75% on everything else. |

Discover more about the BMO CashBack® Business Mastercard®* and its advantages. Ready to apply? Check the link below for the application process.

Apply for the BMO CashBack® Business Mastercard®*

Learn how to easily apply for the BMO CashBack® Business Mastercard®* and enjoy its many perks.

Trending Topics

Consolidate Your Debt with Confidence: Best Loans

Discover if debt consolidation loans are right for you and learn all about the benefits, drawbacks, and options available. Keep reading!

Keep Reading

Learn to apply easily for the Prosper Personal Loan

Find out how to apply for the Prosper Personal Loan and quickly get the money you need. Read on to learn more!

Keep Reading

Sam´s Club Credit Plus Member Mastercard credit card review: is it worth it?

Find out if the Sam’s Club Credit Plus Member Mastercard credit card, which offers cash back on gas and dining, is a good option for you.

Keep ReadingYou may also like

Delta SkyMiles® Platinum American Express Card application

Do you love to travel and earn card perks while doing so? Read our post about the Delta SkyMiles® Platinum American Express Card application!

Keep Reading

No need to leave home: 10 best Pregnancy Test Apps to download

Expecting a baby? Don't miss out on our top 10 picks for the best pregnancy test apps to make your journey easier.

Keep Reading

How to apply and get verified on the Electro Finance Lease easily

Learn how to apply for an Electro Finance Lease today in just a few steps and receive your electronic products in as little as one day!

Keep Reading