Reviews

Assent Platinum Secured credit card review: is it worth it?

Assent Platinum Secured credit card is for people who want to establish their credit, don’t have enough documentation, or just need a better card to manage cash. Learn all about it in this review!

Advertisement

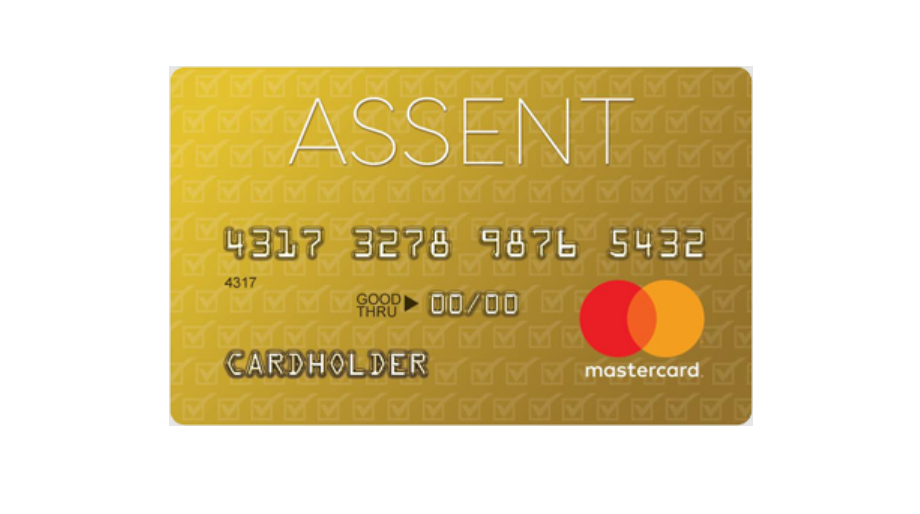

Assent Platinum Secured credit card

The Assent Platinum is an excellent secured credit card perfect for those who want to build their score without sacrificing comfort and quality.

When you’re working to rebuild your credit, the idea of getting a credit card can seem daunting. But with the right card, you can start to build your credit back up and improve your financial standing.

The Assent Platinum Secured credit card is an excellent option for those who want to take advantage of some unique features not commonly found on secured credit cards. After six months of interest-free purchases, cardholders enjoy an exceptionally low APR.

The Assent Platinum Secured credit card is one option that may be worth considering. In this Assent Platinum Secured review, we’ll take a closer look at what this card has to offer and who it’s best suited for.

| Credit Score | Very poor (300) and poor (550) |

| Annual Fee | $49 |

| Regular APR | 12.99% variable based on the Prime Rate |

| Welcome bonus | Does not offer a signup bonus |

| Rewards | Does not offer rewards or cash back |

Learn how to apply for the Assent Platinum Secured

Learn how to apply for Assent Platinum Secured, a card with no credit history required and that helps you build your credit score!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Assent Platinum Secured credit card: how does it work?

Assent Platinum Secured credit card is issued by Synovus Bank. It’s considered a great deal for people who have poor credit. It offers an amazing 0% intro APR on purchases for the first six months.

This card also offers a standard interest rate that is way lower than the APR with most competitor cards.

If you’re looking to build a credit history or to establish credit for the first time, this might be just the perfect fit for you – the card reports to the major credit bureaus every month. With regular reporting to the three major agencies (Equifax, Experian, and TransUnion), you can quickly raise your credit as long as on-time payments are made.

Many secured cards require a deposit, which can be a major obstacle for people on a tight budget, and while the Assent Platinum Secured credit does require deposits too, they offer a refund for the amount.

The maximum deposit is $2,000, and the minimum amount is $200. When applying, you’ll pay for the deposit, and once the account is open, applicants can raise their credit limit with an additional deposit which means that if you close your account, you’ll receive your full deposit back.

This card is good for Car Rental, Hotels – anywhere that credit cards are accepted, you’ll be able to use it. The Assent Platinum Secured is a full-fledged MasterCard financial product, and this is the reason why the card is accepted anywhere.

Assent Platinum Secured card benefits

Check out now what are the benefits and downsides of this credit card!

Advertisement

Pros

- Lower than average purchase APRs

- 0% APR on new purchases during the first 6 months

- Feel peace of mind with the Identity Theft Protection

- You can apply even with fair or poor credit

- It reports to multiple credit bureaus

Cons

- Charges an annual fee of $49

- Does not offer a signup bonus, rewards or cash back

- Charges a foreign transaction fee of 3%

- It does not have many credit card benefits

Advertisement

The credit score need to be good?

If you’re interested in applying for the Assent Platinum Secured card and you don’t have a good credit, this might be just the perfect fit for you.

To apply, you need a very poor (300) or poor (550) credit score.

Want to apply for Assent Platinum Secured?

If you are interested in applying for this credit card, click at the following link where we will show you an easy step-by-step!

Learn how to apply for the Assent Platinum Secured

Learn how to apply for Assent Platinum Secured, a card with no credit history required and that helps you build your credit score!

Trending Topics

Capital One Venture Rewards Credit Card review: is it worth it?

Wondering if Capital One Venture Rewards Credit Card is worth it? It has excellent benefits for travelers. Check the pros and cons here!

Keep Reading

Choose the best Social Welfare Programs for you!

Check out our guide to learn more about the social welfare programs available in the U.S., including who is eligible. Keep reading!

Keep Reading

5 best credit cards for groceries

Discover the best credit cards for groceries and their benefits, such as cashback, welcome bonus, $0 annual fee, and more. Keep reading!

Keep ReadingYou may also like

WWE Netspend® Prepaid Mastercard®: apply today

Get the WWE Netspend® Prepaid Mastercard® today and enjoy its advantages, such as low monthly fees, no purchase, or cash advance fees.

Keep Reading

Learn to easily apply for the Upgrade Personal Loan

Are you looking for personal loans of up to $50,000? If so, read our post to learn how to apply for Upgrade Personal Loan!

Keep Reading

Qtrade Direct Investing Review: Build Your Wealth

Explore our Qtrade Direct Investing review for exceptional customer service and a user-friendly platform, ideal for smart investing choices.

Keep Reading