Credit Cards

Apply for the Hilton Honors American Express Card in a Flash

Looking to apply for the Hilton Honors American Express Card? Follow our guide for a hassle-free application. Earn 80K bonus points and much more!

Advertisement

Earn up to 7 points on purchases with $0 annual fee!

Save time: Apply for the Hilton Honors American Express Card in 3 steps with our help.

Get the zero annual fees Hilton Hotels card to enhance your stay. Here’s how to quickly complete your application online. Read on!

Apply online

Find out how to apply for the Hilton Honors American Express Card using these simple steps:

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

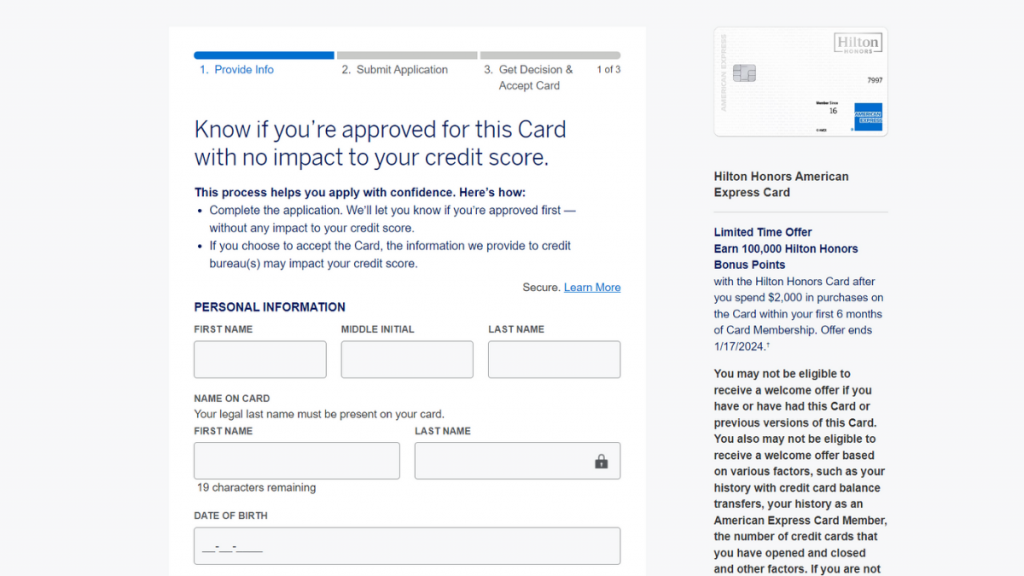

1. Provide Your Information

Firstly, start by entering your personal and financial details needed for the application:

- Name;

- Email Adress;

- Phone Number;

- Home address;

- Social Security number;

- Employment details;

- Financial information (such as income and expenses).

2. Submit Your Application

After that, visit the American Express website.

Then, head to the dedicated application page for the Marriott Bonvoy Bevy™ Card.

Fill out the online application form. Make sure to review the application thoroughly before you send it.

3. Receive Decision & Accept the Card

Thirdly, American Express will review your information to see if your qualifications meet their requirements.

So if approved, you’ll receive your card in 7-10 business days at your mail.

Apply using the app

Indeed, the application is inaccessible via the app.

However, following our instructions, anyone can access American Express’s website directly and apply for their cards.

Hilton Honors American Express Card vs. Blue Cash Everyday® Card from American Express

Here is a hard-to-decide battle of two cards: the Hilton Honors American Express and the Hilton Honors American Express Card vs. Blue Cash Everyday® Card from Amex.

On one hand, the Hilton Honors American Express suits budget-conscious travelers; it comes with no annual fee, and you can earn up to 7 points on purchases.

On the other hand, the Blue Cash Everyday® brings an amazing 15 months of 0% intro APR and up to 3% cash back on purchases.

Ultimately, select the credit card that aligns with your needs and budget. Dive into the comparison of these exceptional hotel cards below!

Hilton Honors American Express Card

- Credit Score: Good – Excellent;

- Annual Fee: $0;

- Purchase APR: 20.99% to 29.99% variable;

- Cash Advance APR: 29.99% variable;

- Welcome Bonus: Earn 80,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership;

- Rewards: 7 points on eligible hotels and resorts/ 5 points on dining (U.S restaurants, takeout, and delivery), groceries (U.S supermarkets), and gas/ plus 3 points on all other eligible purchases;

- See Rates & Fees

Blue Cash Everyday® Card from American Express

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: Get 15 months of 0% intro APR; after that, 19.24% – 29.99% variable;

- Cash Advance APR: 29.99% variable;

- Welcome Bonus: Earn $200 statement credit after spending $2K in the first 6 months;

- Rewards: Earn 3% cash back on U.S. supermarkets, online retail stores, and gas stations up to $6,000 annually. Then, 1%. 1% on all eligible purchases;

- See Rates & Fees

Are you fond of the Blue Cash Everyday® Card from American Express? Then, see how to apply for it in our post below. Read on!

Apply for the Blue Cash Everyday® Card

Get your Blue Cash Everyday® Card from American Express easily with our guide – Read now to learn how to apply! 0% intro APR for 15 months!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Unsecured and secured loans: all you need to know before applying

Find out about secured and unsecured loans, their pros and cons, and which one to choose for your needs. Read on!

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep Reading

Cheap JetBlue Airways flights: Incredible offers every day!

Learm how to find JetBlue Airways cheap flights on their website. It's easy! Just follow these simple steps.

Keep ReadingYou may also like

How to buy cheap Breeze Airways flights

Flying doesn't have to be expensive. Learn how you can save money on your next Breeze Airways flight with these easy tips!

Keep Reading

The Perfect Card for Savvy Spenders: Marshland Visa® Credit Card review

Are you a thrifty spender looking for a card to keep up with your lifestyle? Read our Marshland Visa® Credit Card review!

Keep Reading

Citi Custom Cash℠ Card review: is it worth it?

The Citi Custom Cash℠ Card is a good opportunity to earn rewards and enjoy other perks. It offers a welcome bonus, no annual fee, and more!

Keep Reading