Credit Cards

Get the Ulta Credit Card: A Simple Way to Apply Today!

You can now get your cherished beauty products from Ulta while earning points that can be converted into discounts. Read on and learn more!

Advertisement

Discounts Fit for Royalty: Earn More and Save More on Beauty

Ulta Beauty passionates can easily apply for the Ulta Credit Card online, and we can help with that!

Coming up: requirements, an explained application process, and much more. Stay tuned for all the details!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Interested in obtaining the Ultimate Rewards Credit Card?

You have two convenient options for applying – online or through the mobile app provided by Comenity Bank, the card issuer.

To ensure eligibility, make sure you meet the following criteria:

- Legal age;

- Possession of a government-issued photo ID;

- Tax identification number;

- Valid mailing address (PO Boxes not accepted).

Step-by-Step to Apply

Start by creating an account on ulta.com. If you already have an existing account, sign in. During this step, you’ll need to provide your email address.

Next, let’s move on to your contact information. Include your first and last name, home address, city, ZIP code, mobile, and phone numbers.

For verification purposes, you must also provide your date of birth, annual income, and social security number.

If you’re considering adding someone to your credit card account, you can find additional information about this process by following the provided link.

Lastly, the application will require electronic consent to allow Comenity Bank access to your personal information.

Advertisement

Apply using the app

You can download the Ulta Beauty app on your phone and follow their instructions to apply for an Ulta Credit Card.

Indeed, the app runs on Android and iPhones and is free to download.

Ulta Credit Card vs. Torrid Credit Card

Ulta and Torrid offer credit cards with rewards for purchases made at their respective stores and websites issued by the same bank, Comenity Bank.

Cardholders can earn points that can be redeemed for discounts on future purchases or cash back, as well as access to exclusive sales and events.

Choose the card that aligns with your interests and spending habits. Compare them below!

Advertisement

Ulta Credit Card

- Credit Score: 640 or higher;

- Annual Fee: $0;

- Purchase APR: 30.99% (variable);

- Cash Advance APR: N/A;

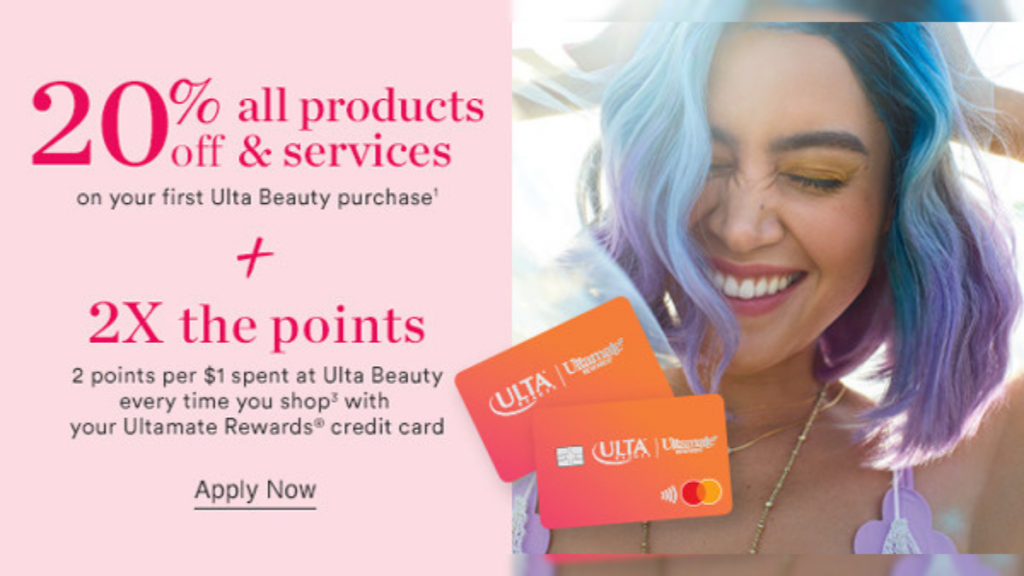

- Welcome Bonus: Get a 20% discount on your first purchase at Ulta Beauty;

- Rewards: Earn 2 points on the dollar spent at Ulta Beauty, website, and salon.

Torrid Credit Card

- Credit Score: 630 or higher;

- Annual Fee: $0;

- Purchase APR: 25.99% Variable;

- Cash Advance APR: N/A;

- Welcome Bonus: 40% off your first purchase after opening and using the Torrid Credit Card online, plus $15 off $50 purchase once your Torrid card arrives;

- Rewards: 5% off on all purchases using the card.

Get the scoop on how to apply for the Torrid Credit Card below to start earning discounts on your fashion purchases as soon as possible.

Up to 40% off Now: How to Apply for Torrid Card

Are you a Torrid lover? Learn to apply for the Torrid Credit Card now and score a 5% discount on all your purchases. Keep reading!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Learn to apply easily for CarLoans.com

Have you been thinking of buying a new car? Then learn how to apply for CarLoans.com! Get approved in 2 minutes! Keep reading!

Keep Reading

Merrick Bank Personal Loan review: how does it work and is it good?

In this Merrick Bank Personal Loan review, you will learn about how it works, and the pros and cons of their personal loan products.

Keep Reading

Discover it® Cash Back Credit Card review: Earn up to 5% cashback

Read our Discover it® Cash Back Credit Card review to find out how this credit card works! It offers 0% intro APR and more.

Keep ReadingYou may also like

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Read our Applied Bank® Gold Preferred® Secured Visa® Credit Card to see how this product can help you get your finances in check!

Keep Reading

Alaska Airlines Visa® Credit Card application: how does it work?

Interested in the details of the Alaska Airlines Visa® Credit Card application? Find out all of them here. Keep reading!

Keep Reading

Upgrade Triple Cash Rewards Visa® review: is it legit and worth it?

Upgrade Triple Cash Rewards Visa® gives you cash back and great payment conditions: learn more about this card by reading this review.

Keep Reading