Reviews

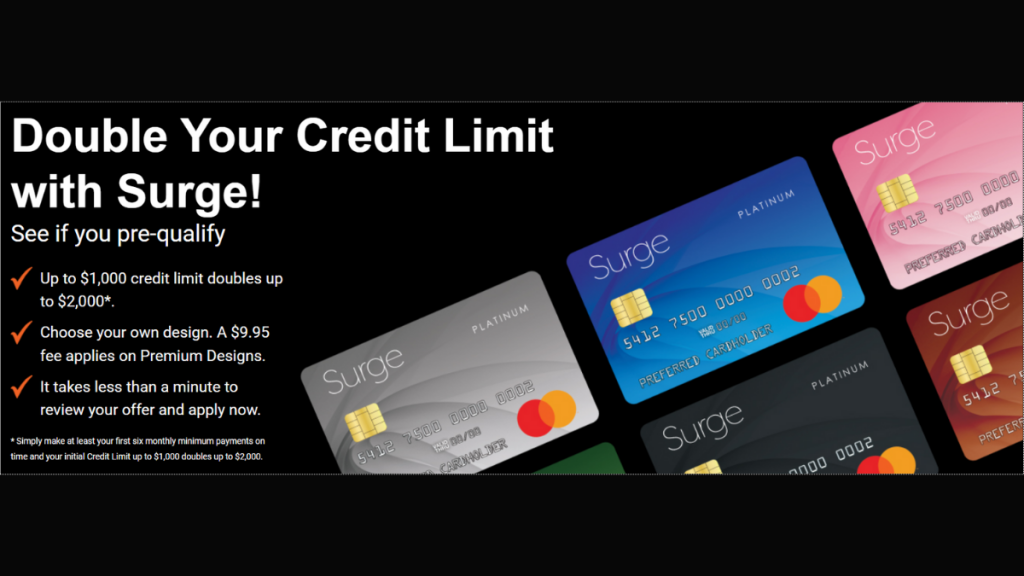

Surge® Platinum Mastercard® credit card application: how does it work?

Do you want to build your credit score with the help of a credit card? If so, read our post to learn how to apply for the Surge® Platinum Mastercard® credit card!

Advertisement

Surge® Platinum Mastercard® credit card: apply online and get a response in minutes!

Surge® Platinum Mastercard® credit card came to fix your bad credit.

It’s no secret that a good credit score is key to unlocking all sorts of opportunities in life. It means you can get the best interest rates on mortgages, car loans, and more.

But what if your score is less than perfect? Don’t worry – there are still ways to get ahead. One option is to apply for a Surge® Platinum Mastercard® credit card.

Below, you’ll find all you should know about the application for this card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The pre-qualification for the Surge® Platinum Mastercard® starts with an online application on their website.

On what concerns the requirements to qualify, have a look at them:

- You must be at least 18 years old;

- You must be a US resident;

- You must have a valid social number to apply;

- A checking account is necessary.

You are ready to start the process if you thick all the boxes. Then you’ll have to answer personal and financial questions there.

After that, you need to submit the pre-qualification forms for their analysis. In a few hours, you’ll receive denial or approval feedback.

Then, you can decide whether to finish your application or not. If you aren’t accepted, don’t worry! Because that won’t affect your credit history.

Apply using the app

The Surge® Platinum Mastercard® app is available for you to monitor your account. However, it is not possible to apply using it. You must use their website to do that.

Advertisement

Surge® Platinum Mastercard® credit card vs. Total Visa® Card

It has similar features and reports to the three credit bureaus, which will also help brush up your credit. Let’s see the comparison between them:

Surge® Platinum Mastercard® credit card

- Credit Score: See website for Details;

- Annual Fee: $75 – $125;

- Monthly Fee: Credit Limit of $300 or $500: $0 introductory fee for the first year, then $150 thereafter (billed $12.50 per month);

- Regular APR: 35.90% fixed APR;

- Welcome bonus: N/A;

- Rewards: N/A.

Advertisement

Total Visa® Card

- Credit Score: Bad to fair;

- Annual Fee: $75 in the first year and $48 after;

- Regular APR: 34.99% for purchases and cash advances;

- Welcome bonus: N/A;

- Rewards: N/A.

And if you like the Total Visa® Card features, you can check out our post below to learn how to apply for it!

Application for the Total Visa® Card

Learn how to apply for the Total Visa® credit card and get your credit history restored. It is a good solution if you want to rebuild your credit or fix poor credit!

Trending Topics

How to create an easy budget plan in 5 steps

Find out how to create a budget. Here are the steps to start and stick with a budget that will work for you.

Keep Reading

Hassle-free experience: Apply for LendKey Student Loans

Learn to apply for LendKey Student Loans and secure your education funding. Plus, discover a student-friendly credit card option!

Keep Reading

Quontic Bank High Interest Checking application: how does it work?

Maximize your banking benefits with the Quontic Bank High Interest Checking account. Earn APY and free over 90K free ATMs. Keep reading.

Keep ReadingYou may also like

Personal loan interest rate: what is it?

Wondering what is a personal loan interest rate? Get all the information you need here, including average rates and how to get the best deal.

Keep Reading

Hassle-free process: Apply for Avant Credit Card

Building better credit has never been easier. Apply for an Avant Credit Card online with a soft pull and enjoy the benefits immediately!

Keep Reading

Mission Lane Visa® Credit Card review: Improve your score with a $300 limit

Read on to get a full Mission Lane Visa® Credit Card review! This credit card will help you build credit! Enjoy the initial limit of $300!

Keep Reading