Credit Cards

R.I.A. Federal Credit Union Mastercard® Rewards Card: apply today

Unlock the potential of shopping with the R.I.A. Federal Credit Union Mastercard® Rewards Card! Apply today and start saving big!

Advertisement

Online and easy process for obtaining a card in a few days

Are you in the market for a new credit card? Look no further than the R.I.A. Federal Credit Union Mastercard® Rewards Card. But how can you apply for this?

With its impressive rewards program and competitive interest rates, this card is a great option. Check out how to apply!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

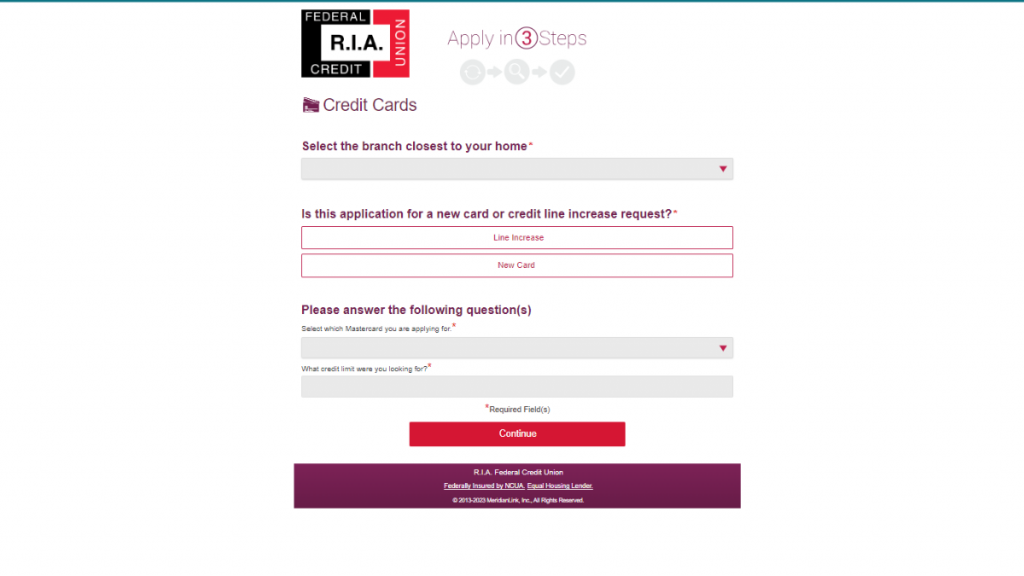

Apply online

If you’re interested in applying for the R.I.A. Federal Credit Union Mastercard® Rewards Card, you can apply online from the comfort of your home.

To apply, simply complete the application form and visit the R.I.A. Federal Credit Union website.

You will be asked to provide basic information, such as your name, address, employment status, and income. You must also provide your SSN and other info.

Once you have submitted your application, the credit union will review your information and let you know whether you have been approved.

If approved, you will receive your new credit card in the mail within a few days.

Apply using the app

Do you prefer to apply using your mobile device? No problem!

The R.I.A. Federal Credit Union mobile app allows you to apply for the Mastercard® Rewards Card from your smartphone or tablet.

The app is available for both iOS and Android devices and can be downloaded for free from the App Store or Google Play.

Advertisement

R.I.A. Federal Credit Union Mastercard® Rewards Card vs. Upgrade Cash Rewards Visa®

If you’re considering the R.I.A. Federal Credit Union Mastercard® Rewards Card, you may also be interested in the Upgrade Cash Rewards Visa®.

While both cards offer rewards programs and low annual fees, there are some key differences between the two.

So, R.I.A. Federal Credit Union Mastercard® Rewards Card is a great option for those with good credit.

On the other hand, the Upgrade Cash Rewards Visa® has a more lenient credit score requirement, accepting applicants with fair to excellent credit.

See the comparison and choose the best option for you:

R.I.A. Federal Credit Union Mastercard® Rewards Card

- Credit Score: 680 or higher (good to excellent);

- Annual Fee: $0;

- Purchase APR: 17.50% – variable;

- Cash Advance APR: Not disclosed;

- Welcome Bonus: None;

- Rewards: 1.5% of cashback on selected purchases.

Advertisement

Upgrade Cash Rewards Visa®

- Credit Score: Fair to Excellent;

- Annual Fee: $0;

- Purchase APR: 14.99% – 29.99% variable APR;

- Cash Advance APR: N/A;

- Welcome Bonus: $200 bonus after opening a Rewards Checking account and making 3 debit card transactions;

- Rewards: 1.5% cashback, unlimited, earned every time you pay your credit card bill.

Nevertheless, the Upgrade Cash Rewards Visa® can be your ideal option. So, do you want to learn more about the application? See the tips in the post below.

Upgrade Cash Rewards Visa®

If you're wondering how to get an Upgrade Cash Rewards Visa®, read this article with the step-by-step. This card has no annual fee and gives you cash back.

Trending Topics

Checking account pros and cons: what to consider before opening one

If you're looking for a new checking account, these are the pros and cons to consider before opening one. Find out if it's right for you!

Keep Reading

Luxury Black or Luxury Gold card: choose the best!

Are you thinking about getting a Luxury Black or Luxury Gold card? First, read this article to learn about their benefits to choose the best.

Keep Reading

How to budget for an apartment

Discover how to make your money stretch! Find out how to budget for an apartment to secure that perfect place easily!

Keep ReadingYou may also like

Amazon Rewards Visa Signature Card review: What’s Great and Not So Great

How to shop on Amazon and Whole Foods with cashback? Find out here in this Amazon Rewards Visa Signature Card review. Read on!

Keep Reading

Choose the perfect loan for you: see the best options!

Wondering what to consider in a loan? Learn how to choose a loan, what to look for, and much more. Read on!

Keep Reading

Gemini Credit Card® application: how does it work?

The application for the Gemini Credit Card® is simple and quick. Earn up to 3% cash back on purchases and more! Read on!

Keep Reading