Credit Cards

Apply for Navy Federal cashRewards Credit Card: $0 annual fee

Looking to apply for the Navy Federal cashRewards Credit Card? We'll guide you through an easy online application. $0 annual fee and $250 bonus cash back!

Advertisement

Military members average credit card with great benefits

Apply for the Navy Federal cashRewards Credit Card in less than 10 minutes by following our guide.

We’ve broken the application into easy, intuitive steps so you can do it quickly. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The Navy Federal cashRewards Credit Card is an appealing option for military members, family members, veterans, and workers of the Department of Defense.

It requires an average credit score but offers big rewards.

You can earn 1.75% on all purchases without an annual fee and also an attractive welcome bonus.

Here is how to apply for the Navy Federal cashRewards Credit Card online.

Step 1: Providing Personal Information

To get started with your application, Navy Federal requires some personal information and details about your housing.

This includes your name, address, and contact information.

Advertisement

Step 2: Credit Score Evaluation

Firstly, Navy Federal will check your credit score with one of the three major credit bureaus.

To qualify, your credit score should be average.

You can also check if you qualify without affecting your credit score by doing a “soft pull” on the Navy Federal website.

This way, if you don’t meet the eligibility criteria, your credit score won’t be affected.

Step 3: Notification via Text or Letter

If approved, you’ll then get a text message. If not, you’ll receive a response within 30 days.

Advertisement

Step 4: Receiving Your Credit Card

After you get approved for a Navy Federal credit card, the last step is to wait for it to arrive in your mailbox.

This usually takes about 7 to 10 business days.

Apply using the app

You can use the Navy app to manage your account after you get your credit card in the mail. However, you can’t apply using it.

Navy Federal cashRewards Credit Card vs. Navy Federal More Rewards American Express® Card

Both Navy Federal cards are rewarding, but the Navy Federal cashRewards Credit Card requires a lower credit score.

On the other hand, the Navy Federal More Rewards American Express® Card offers a higher rewards rate.

So, if you qualify in the select group of Navy Federal, you can choose the best card for your finances.

Check out more differences below.

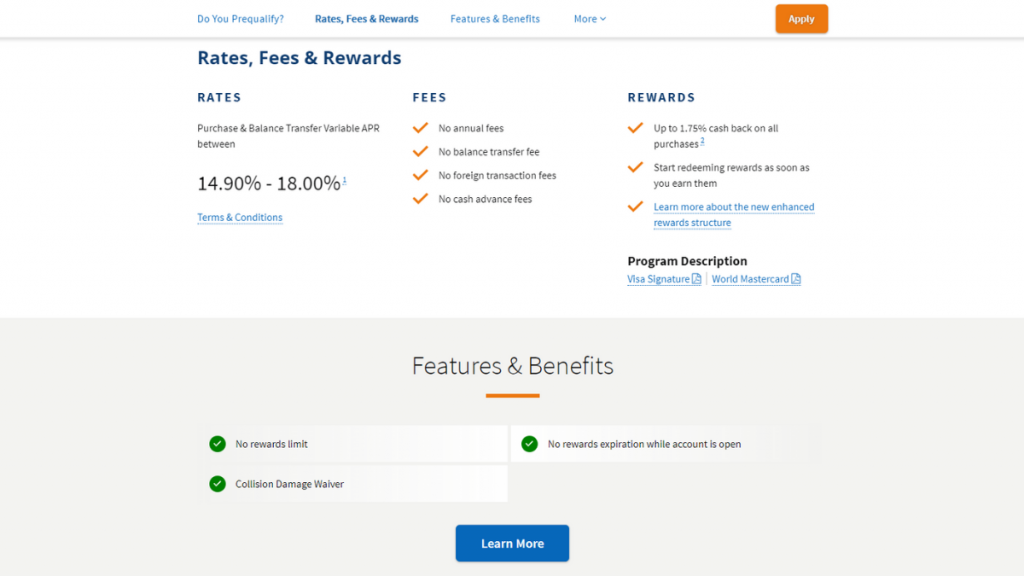

Navy Federal cashRewards Credit Card

- Credit Score: Good to excellent;

- Annual Fee: $0;

- Purchase APR: 14.90% – 18.00% (variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: Get a $250 bonus cash back after spending $2,500 after 90 days of account opening, also a One-time $98 statement credit for an annual Walmart+ membership;

- Rewards: Get up to 1.75% cash back on all purchases.

Navy Federal More Rewards American Express® Card

- Credit Score: Good to Excellent;

- Annual Fee: $0;

- Purchase APR: 14.65% – 18.00% (variable);

- Cash Advance APR: 2% above variable APR;

- Welcome Bonus: Earn 25k bonus points after spending $3,000 in the first 90 days of account opening;

- Rewards: 3 points at restaurants and food delivery, supermarkets, gas, and transit, plus 1 point on all other purchases.

Would you like to apply for the Navy Federal More Rewards American Express® Card? Read on to learn more!

Apply Navy Federal More Rewards American Express®

Apply for the Navy Federal More Rewards American Express® Card today – pay no hidden fees and earn 25K bonus points! Read on!

Trending Topics

The most common myths about your credit score

There are a lot of credit score myths. Find out the truth behind the top five misconceptions people have. Read on!

Keep Reading

123 Money Loans Review: Payday Loans for All Credit Scores

Explore the pros and cons of 123 Money Loans in our review. From quick cash to potential pitfalls, make an informed decision!

Keep Reading

Credit score: top 10 questions answered

Find the answers to the most frequent credit score questions. Learn how it works and what you can do if you want to improve it.

Keep ReadingYou may also like

How to build credit fast from scratch with our tips for beginners!

Learn how to build credit and get the best offers from lenders and credit card issuers. This can make a difference in achieving your plans.

Keep Reading

A 101 guide on what is cryptocurrency: start investing now!

If you want to keep up with the crypto market, you need to know what cryptocurrency is. We'll tell you everything about it in this article.

Keep Reading

The best apps for anxiety: take a deep breath and download one

Everybody needs a break, and these apps for anxiety are the best way to get some minutes of peace inside your head during the day.

Keep Reading