Credit Cards

Apply for the Ink Business Cash® Credit Card: Maximized rewards

Seamlessly apply for the Business Cash® Credit Card online with this guide and turn your business expenses into cashback. Keep reading!

Advertisement

Your business doesn’t need to meet exceptional requirements to get this card and seize its amazing cashback offer

The Ink Business Cash® Credit Card is a popular choice for small business owners to manage finances. We can help you apply.

Discover the application process’s ins and outs and compare it with another crowd-favorite credit card – the American Express Blue Business Cash™ Card. So, don’t stop reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The Ink Business Cash® Credit Card can be a great solution if you are a small business owner.

This credit card provides numerous benefits for your employees, such as cashback rewards, travel insurance, and free cards.

Best of all, you can apply for the Ink Business Cash® Credit Card online.

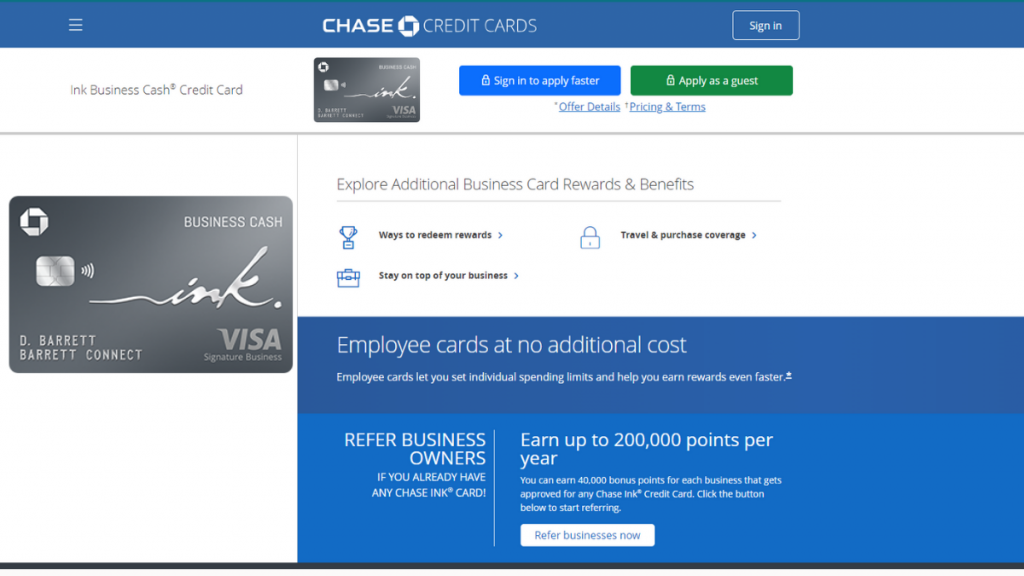

Step 1: Visit the Chase Website

To apply for the Ink Business Cash® Credit Card, visit the Chase website and select “Ink Business Cash”. Then, it will take you to the card’s page.

Advertisement

Step 2: Fill in the Application Form

Then, you can begin the application by providing the following:

Personal Information

- Full name;

- Date of birth;

- Tax ID type;

- SSN;

- Domestic address with ZIP code;

- Email address;

- Phone number;

- Total gross annual income.

Advertisement

Business Information

You’ll be asked for more in-depth business information, such as the type, number of employees, and annual revenue.

Also, you’ll need to fill out the form with the following information:

- Legal business structure;

- Business legal name;

- Desired name on card;

- Business Category.

Step 4: Review and Submit Application

After that, double-check all the provided information before submitting.

Once you do it, then Chase will review it, which usually takes a few days.

Apply using the app

It’s not possible to apply for a business card through the Chase app.

Ink Business Cash® Credit Card vs. American Express Blue Business Cash™ Card

In short, the American Express Blue Business Cash™ Card provides a 2% cash back on eligible business purchases.

In contrast, the Ink Business Cash® Credit Card has reward caps for their primary cashback offer of 5% on office supplies. So, the decision is yours to make.

Ink Business Cash® Credit Card

- Credit Score: 690-850 ( Good-excellent);

- Annual Fee: $0;

- Purchase APR: 0% intro APR on purchases for 12 months, then 17.74% – 25.74% (variable);

- Cash Advance APR: 29.49% (variable);

- Welcome Bonus: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening;

- Rewards: Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year.

- Terms apply.

American Express Blue Business Cash™ Card

- Credit Score: Good-excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR on purchases for 12 months of account opening, then 17,99%-25,99%;

- Welcome Bonus: Earn a $250 statement credit after spending $3,000 in purchases during the first 3 months of account opening;

- Rewards: 2% cash back on eligible business purchases ( up to $50k per calendar year), 1% on all other eligible purchases after the first $50k spent on your credit card.

Ready to apply for the American Express Blue Business Cash™ Card? So, keep reading!

Apply for The American Express Blue Business Cash™

Follow this guide to apply for The American Express Blue Business Cash™ Card, and make the most out of your business expenses. Read on!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Upgrade Cash Rewards Visa® review

The Upgrade Cash Rewards Visa® is perfect for you who need a higher credit limit. Enjoy a card with no annual fee and cash back!

Keep Reading

American Airlines AAdvantage® MileUp® review: Fly with ease!

See the American Airlines AAdvantage® MileUp® review and discover how it allows you to earn rewards and save money. Read on!

Keep Reading

Learn to apply easily for CashUSA.com

Ensure you know how to apply for the CashUSA.com personal loan and get the best rates for your needs. Find out more! Up to $10k!

Keep ReadingYou may also like

Upgrade credit card review: a credit card that works like a personal loan

If you're looking for a good card to rebuild your score, you've just found the Upgrade credit card. It will give you excellent benefits.

Keep Reading

Learn to apply easily for Auto Credit Express

Discover how to apply for a loan with Auto Credit Express online and quickly. Keep reading to find out more!

Keep Reading

Visa vs. Mastercard: are they really different?

Find out if there's a big difference between the two major credit card companies: Visa vs. Mastercard, and which one is best for you to get.

Keep Reading