Credit Cards

Apply for the First Citizens Bank Smart Option Card: fast process

Want to know how to apply for the First Citizens Bank Smart Option Credit Card? Our guide has got you covered! Follow our simple instructions, and you'll be on your way to enjoying all the benefits of this great card.

Advertisement

The application is straightforward, and you can do it in less than 10 minutes

If you’re considering getting a First Citizens Bank Smart Option Credit Card, you should know that only clients can apply online.

Luckily, the online application is hassle-free. We’re here to guide you through the process so you can complete it in less than 10 minutes. Keep reading to learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Do you want to apply for the First Citizens Smart Option Credit Card? Then, you must be their customer first.

If you are already one, you can visit the First Citizens Bank website, the credit card page, and log in to your customer account.

Then, complete the application form by providing your personal information and financial status.

But, before submitting, make sure you understand all the conditions. After the submission, you just need to wait for approval.

Finally, if you are approved, you’ll receive the First Citizens Bank Rewards Card in your mail within 7-10 business days.

Apply using the app

Managing your finances just got easier with First Citizens Digital Banking. This service lets you control your money via your smartphone, from checking your account balance to transferring funds.

However, if you want a credit card, you must head to their website to apply. Once you get a card, you can easily manage it using their app.

Advertisement

First Citizens Bank Smart Option Credit Card vs. Capital One VentureOne Rewards Credit Card

You should consider what matters most if you’re trying to decide between the First Citizens Bank Smart Option Credit Card and the Capital One VentureOne Rewards Credit Card.

For example, The First Citizens Bank Smart Option Credit Card offers a low introductory APR on balance transfers, which can be helpful if you’re looking to save money on interest charges.

However, if you’re interested in earning rewards for your spending, the Capital One VentureOne Rewards Credit Card may be a better choice, as it also offers a 0% intro APR on balance transfers, plus travel rewards.

First Citizens Bank Smart Option Credit Card

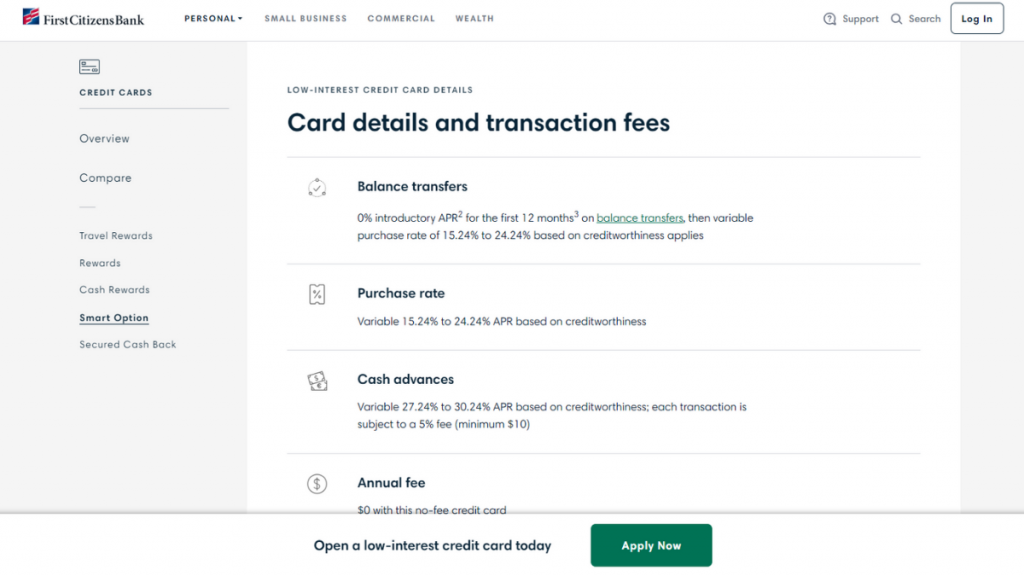

- Credit Score: Fair- Excellent;

- Annual Fee: No annual fee;

- Purchase APR: 15.24% to 24.24% (variable);

- Cash Advance APR: 27.24% to 30.24%(variable);

- Welcome Bonus: 0% intro APR on balance transfers for the first 12 months of account;

- Rewards: N/A.

Advertisement

Capital One VentureOne Rewards Credit Card

- Credit Score: Good-excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR for the first 15 months, then 19.99%, 26.24%, or 29.99%, depending on your creditworthiness);

- Cash Advance APR: 29.99% ( variable);

- Welcome Bonus: Earn 20K bonus miles after spending $500 on purchases during the first 3 months of account opening;

- Rewards: Earn 1,25 miles on every purchase and 5 miles on hotels and car rentals booked through Capital One Travel.

Are you interested in getting the Capital One VentureOne Rewards Credit Card?

We’ve covered you with a simple guide on applying for this card and taking full advantage of its rewards. So, keep reading to find out more!

Apply for the Capital One VentureOne Rewards Card

Don't waste time searching for ways to apply for the Capital One VentureOne Rewards Credit Card. Earn unlimited miles on purchases!

Trending Topics

Calm App review: Find relaxation to your anxious mind

Anxious? Stressed? Can't seem to find peace? Check out our Calm app review and learn how to relax finally. Read on!

Keep Reading

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

Read the Surge® Platinum Mastercard® credit card review. This card comes with zero fraud liability and the ability to repair your credit score

Keep Reading

Simplify experience: PayPal Prepaid Mastercard® Review

Get the full scoop on the PayPal Prepaid Mastercard® in our review. Ensure a hassle-free process and grant the card you need! Read on!

Keep ReadingYou may also like

First Progress Platinum Prestige Mastercard® Secured Credit Card review

Do you have bad credit? If so, read our review to learn all about the First Progress Platinum Prestige Mastercard® Secured Credit Card!

Keep Reading

How to build credit as a college student

Are you wondering how to build credit as a college student? It's not too hard, and this guide will show you how. Read on!

Keep Reading

Application for the Freedom Gold card: how does it work?

Get your Freedom Gold card to buy everything you need from the Horizon Outlet. The application is easy and you can make it right now.

Keep Reading