Credit Cards

Apply First Citizens Bank Rewards Credit Card: Earn more

Apply for the First Citizens Bank Rewards Credit Card in no time with our help! Enjoy amazing reward program and 0% intro APR on balance transfers!

Advertisement

First Citizens Bank customers can apply for this card online- no hassle!

You must be a client if you want to apply for a First Citizens Bank Rewards Credit Card. The online application is easy, but it is exclusive to customers.

In this post, we will help you demystify this application process and also show you the three easy steps to complete in less than 10 minutes. Read on!

Apply online

To apply for the First Citizens Bank Rewards Credit Card online, you must be their customer.

So, if you are already a client, follow the step-by-step below.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Step 01

Start by visiting the First Citizens Bank website. Then, head to the credit card page to apply.

The next step is to log in to your customer account.

Step 02

Once you do that, just follow the guidelines to complete your application.

Firstly, complete the forms with your personal information and financial status.

Secondly, make sure you understand all the conditions before you submit it.

Step 03

After completing your application form, submit it.

Then, if you receive approval, you should receive the First Citizens Bank Rewards Card in your mail in about 7 -10 business days.

Apply using the app

First Citizens Digital Banking is a service that helps you manage your money using your phone.

So, you can check your account balance, transfer money, and do other things like that.

But if you want a credit card, you’ll still have to visit their website to apply.

Once you have your card, you can use their app to manage it.

First Citizens Bank Rewards Credit Card vs. Ally Everyday Cash Back Mastercard®

Choosing between the First Citizens Bank Rewards Card and Ally Everyday Cash Back Mastercard® depends on your priorities.

So, if you seek diverse rewards and prioritize flexibility, the First Citizens Bank Rewards Credit Card might be your match.

But if you want straightforward, no-frills 1% cash back, then the Ally card wins.

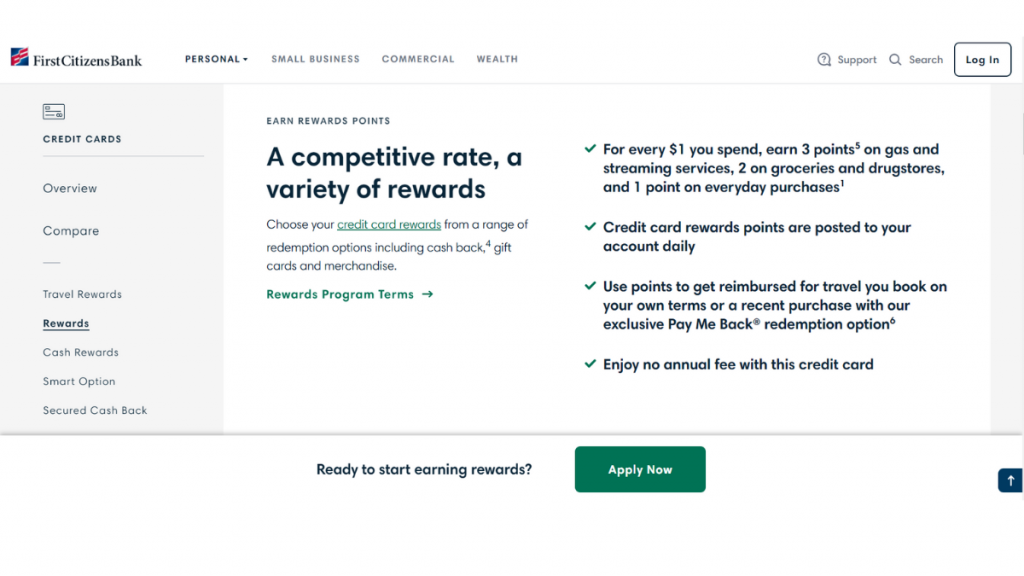

First Citizens Bank Rewards Credit Card

- Credit Score: Good-Excellent;

- Annual Fee: No annual fee;

- Purchase APR: 18.24% – 27.24% (variable);

- Cash Advance APR: 27.24% – 30.24%;

- Welcome Bonus: 0% intro APR on balance transfers for the first 12 months;

- Rewards: Earn 3 points on gas and streaming services, 2 points on groceries and drugstores, and 1 point on everyday purchases.

Ally Everyday Cash Back Mastercard®

- Credit Score: N/A;

- Annual Fee: $0-$39 ( depending on creditworthiness);

- Purchase APR: 19.99%-29.99%, variable;

- Cash Advance APR: 5% or $10, whichever is greater;

- Welcome Bonus: None;

- Rewards: 3% cash back at gas stations, grocery stores, and drugstores, plus 1% on everything else.

Get the Ally Everyday Cash Back Mastercard® for simpler spending—details on applying are in our post below. Read on!

Apply for Ally Everyday Cash Back Mastercard®

Score 3% cash back on everyday essentials! Cracking the code on how to apply for the Ally Everyday Cash Back Mastercard® in under 5 minutes.

Trending Topics

Southwest Rapid Rewards® Premier Credit Card review

Want affordable travel? Our Southwest Rapid Rewards® Premier Credit Card review reveals how to earn points and travel more for less!

Keep Reading

Chase Freedom Flex vs Chase Freedom Unlimited: card comparison

Learn the main differences between the Chase Freedom Flex or Chase Freedom Unlimited credit cards, their perks, benefits and rewards.

Keep Reading

More Rewards, Fewer Fees: X1 Credit Card Review

Check out this comprehensive review of the X1 Credit Card! $0 annual fee and unlimited rewards - read on and learn more!

Keep ReadingYou may also like

Revvi Card application: how does it work?

Earn cash back on all your purchases without worrying about a secured deposit. See how to apply for the Revvi Card and enjoy its benefits!

Keep Reading

A small glossary of investment terms: a guide for starters!

We've made this glossary of investment terms to help you understand them better and start investing with confidence. Check this article.

Keep Reading

Wells Fargo Reflect® Card: La tarjeta de crédito de bajo APR que estabas buscando

Echa un vistazo al Wells Fargo Reflect® Card para ver si cumple con tus necesidades financieras. Sin tarifa anual y 0% de APR introductorio.

Keep Reading