Credit Cards

Apply First Citizens Bank Rewards Credit Card: Earn more

Apply for the First Citizens Bank Rewards Credit Card in no time with our help! Enjoy amazing reward program and 0% intro APR on balance transfers!

Advertisement

First Citizens Bank customers can apply for this card online- no hassle!

You must be a client if you want to apply for a First Citizens Bank Rewards Credit Card. The online application is easy, but it is exclusive to customers.

In this post, we will help you demystify this application process and also show you the three easy steps to complete in less than 10 minutes. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

To apply for the First Citizens Bank Rewards Credit Card online, you must be their customer.

So, if you are already a client, follow the step-by-step below.

Step 01

Start by visiting the First Citizens Bank website. Then, head to the credit card page to apply.

The next step is to log in to your customer account.

Advertisement

Step 02

Once you do that, just follow the guidelines to complete your application.

Firstly, complete the forms with your personal information and financial status.

Secondly, make sure you understand all the conditions before you submit it.

Step 03

After completing your application form, submit it.

Then, if you receive approval, you should receive the First Citizens Bank Rewards Card in your mail in about 7 -10 business days.

Advertisement

Apply using the app

First Citizens Digital Banking is a service that helps you manage your money using your phone.

So, you can check your account balance, transfer money, and do other things like that.

But if you want a credit card, you’ll still have to visit their website to apply.

Once you have your card, you can use their app to manage it.

First Citizens Bank Rewards Credit Card vs. Ally Everyday Cash Back Mastercard®

Choosing between the First Citizens Bank Rewards Card and Ally Everyday Cash Back Mastercard® depends on your priorities.

So, if you seek diverse rewards and prioritize flexibility, the First Citizens Bank Rewards Credit Card might be your match.

But if you want straightforward, no-frills 1% cash back, then the Ally card wins.

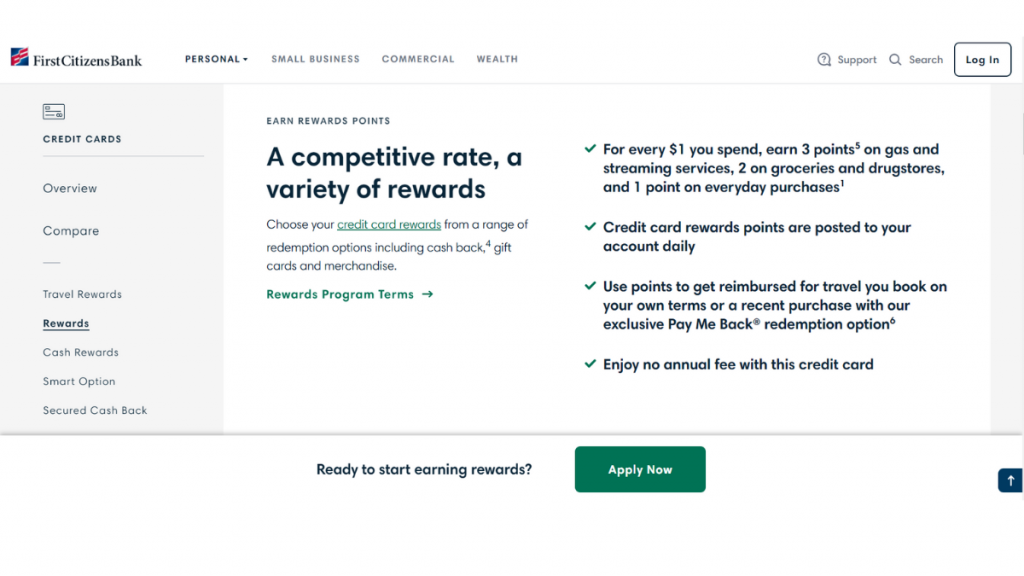

First Citizens Bank Rewards Credit Card

- Credit Score: Good-Excellent;

- Annual Fee: No annual fee;

- Purchase APR: 18.24% – 27.24% (variable);

- Cash Advance APR: 27.24% – 30.24%;

- Welcome Bonus: 0% intro APR on balance transfers for the first 12 months;

- Rewards: Earn 3 points on gas and streaming services, 2 points on groceries and drugstores, and 1 point on everyday purchases.

Ally Everyday Cash Back Mastercard®

- Credit Score: N/A;

- Annual Fee: $0-$39 ( depending on creditworthiness);

- Purchase APR: 19.99%-29.99%, variable;

- Cash Advance APR: 5% or $10, whichever is greater;

- Welcome Bonus: None;

- Rewards: 3% cash back at gas stations, grocery stores, and drugstores, plus 1% on everything else.

Get the Ally Everyday Cash Back Mastercard® for simpler spending—details on applying are in our post below. Read on!

Apply for Ally Everyday Cash Back Mastercard®

Score 3% cash back on everyday essentials! Cracking the code on how to apply for the Ally Everyday Cash Back Mastercard® in under 5 minutes.

Trending Topics

BMO CashBack® Business Mastercard®* Review

Maximize business spending with the BMO CashBack® Business Mastercard®*, offering valuable perks for savvy entrepreneurs.

Keep Reading

WWE Netspend® Prepaid Mastercard® review: Financial Flexibility

Looking for a prepaid card that makes managing your finances easy? Look no further than the WWE Netspend® Prepaid Mastercard® in this review.

Keep Reading

The US economy could enter a state of stagflation soon

Economist Mohamed El-Erian warns that the US economy is on the brink of stagflation, even if the Fed manages to avoid a recession.

Keep ReadingYou may also like

Apply for the Ascent Student Loans: fast and simple

Here is a guide to apply for Ascent Student loans and enjoy its flexible financing options. Build credit and enjoy a hassle-free process!

Keep Reading

How to buy cheap flights on SkyScanner

Are you looking for ways to save money when you travel? Use these tips to buy cheap flights on Skyscanner. Keep reading!

Keep Reading

First Citizens Bank Cash Rewards Card Review: $0 annual fee

Get the First Citizens Bank Cash Rewards Credit Card scoop with our review. Earn 1.5% cash back and enjoy a straightforward card. Read now!

Keep Reading