Reviews

Citi Rewards+® Card application: how does it work?

The application for the Citi Rewards+® Card is easy and takes only a few minutes. Read on to learn how to do it.

Advertisement

Important Note: Current Status of the Citi Rewards+® Card

Updated on July 1, 2025

For those looking to apply for the Citi Rewards+® Card, please be aware that it has been discontinued for new applications.

Citi is re-launching this product as the Citi Strata℠ Card. Existing Rewards+ accounts will be converted to the Strata Card starting July 20, 2025.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The Citi Strata℠ Card is expected to be available for new applications later this summer [Northern Hemisphere] in 2025.

Citi Rewards+® Card: Apply online with simple questions

With the Citi Rewards+® Card, you’ll earn valuable rewards on everyday purchases – with no hassle or annual fee. Read on to learn about the application process!

So, if you want to learn how to apply for this fantastic points card, stay with us!

Advertisement

Apply online

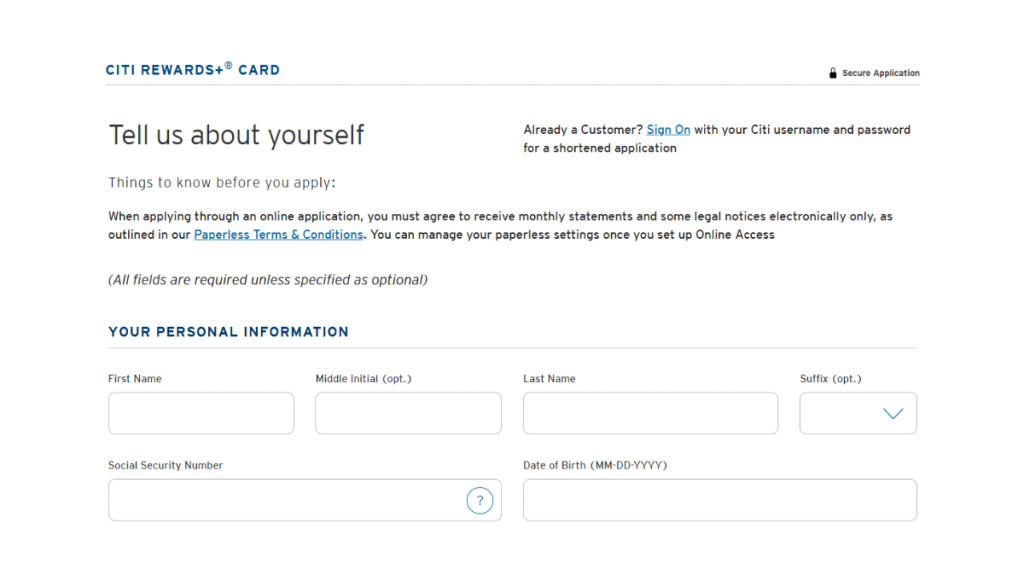

The application for a Citi Rewards+® Card is online, and you can do it on your computer or your phone.

First, find the application page for the Citi Rewards+® Card. Then fill out the form with your personal and income information.

Once you submit, you’ll receive a response email in minutes with the approval decision.

As this card requires, applicants must be at least 18 years old, be U.S residents with a valid Social Security number, and have at least good credit.

Apply using the app

The Citi Mobile® App is available for iPhones and Androids. It’s free, and you can download it easily on the Play Store or Apple Store.

It enables cardholders to manage their accounts, check balances and redeem rewards.

However, you must make the application for a Citi Rewards+® Card on the website by following the step-by-step above.

Advertisement

Citi Rewards+® Card vs. Bank of America Customized Cash Rewards Card

If you are shopping around for a rewards card but aren’t sure if the Citi Rewards+® Card is what you are looking for, let us help!

We have another recommendation for you to compare: the Bank of America Customized Cash Rewards Card.

This option offers a $250 online cash rewards bonus offer and 3% cash back to spend in a category of your choice. Let’s review both cards in a nutshell.

Citi Rewards+® Card

- Credit Score: Good;

- Annual Fee: $0;

- Regular APR: 0% Intro APR on balance transfers for 15 months from the date of the first transfer and on purchases from the date of account opening. After that, the variable APR will be 18.49% – 28.49%, based on your creditworthiness, and a 29.99% variable APR for cash advances;

- Welcome bonus: Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com.

- Rewards: 2X ThankYou® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points. Plus, earn 1X ThankYou® Points on All Other Purchases;

- Other rewards: The only credit card that automatically rounds up to the nearest 10 points on every purchase (no cap).

- Terms apply.

Bank of America Customized Cash Rewards Card

- Credit Score: Good;

- Annual Fee: $0;

- Regular APR: 0% intro for 18 billing cycles for purchases, then 16.99% – 26.99% (variable);

- Welcome bonus: $250 online cash rewards bonus;

- Rewards: 3% cash back in a category you choose among the eligible ones; 2% cash back at grocery stores and wholesale clubs; 1% cash back on any other purchase.

- Terms apply.

If you want to know more about the Bank of America Customized Cash Rewards Card, read the post below.

How to apply for Bank of America Customized Cash

Learn how to apply for the Bank of America Customized Cash Rewards card and get yourself a credit card with a rewards program that you can tailor to your spending habits.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Apply for Ally Everyday Cash Back Mastercard®: 3% cash back

Score 3% cash back on everyday essentials! Cracking the code on how to apply for the Ally Everyday Cash Back Mastercard® in under 5 minutes.

Keep Reading

Delta SkyMiles® Gold Business American Express Card review

Here is the Delta SkyMiles® Gold Business American Express Card review to help you understand how it works. Keep reading!

Keep Reading

MaxCarLoan Review: Quick Loans, Dream Cars!

Need car financing? MaxCarLoan loan broker, in this review, helps you find the best broker on the market. Learn more!

Keep ReadingYou may also like

No annual fee: Apply for U.S. Bank Visa® Platinum Card

Get the step-by-step process to apply for the U.S. Bank Visa® Platinum Card! Instant decision! Enjoy an intro APR!

Keep Reading

15K bonus points: My GM Rewards® Mastercard® review

Earn points to reduce expenses with the My GM Rewards® Mastercard® - Full review here! Ensure 0% intro APR period - keep reading!

Keep Reading

Bank of America Mortgage review: how does it work and is it good?

This comprehensive Bank of America Mortgage review delves into the details, including loan types and fees. Enjoy flexible rates and terms!

Keep Reading