Credit Cards

Apply for First Citizens Bank Cash Rewards Card: Earn back

From application to activation: Discover the simplest form to apply for the First Citizens Bank Cash Rewards Credit Card here- eligibility- and a complete step-by-step guide to ease the process. Stay tuned!

Advertisement

Cashback nirvana: This card is your one-stop shop for rewarding every purchase

Ready to unlock 1,5% cash back on all purchases? This guide is your A-Z roadmap to apply for your First Citizens Bank Cash Rewards Credit Card.

We’ll walk you through every step, from eligibility requirements to application submission. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

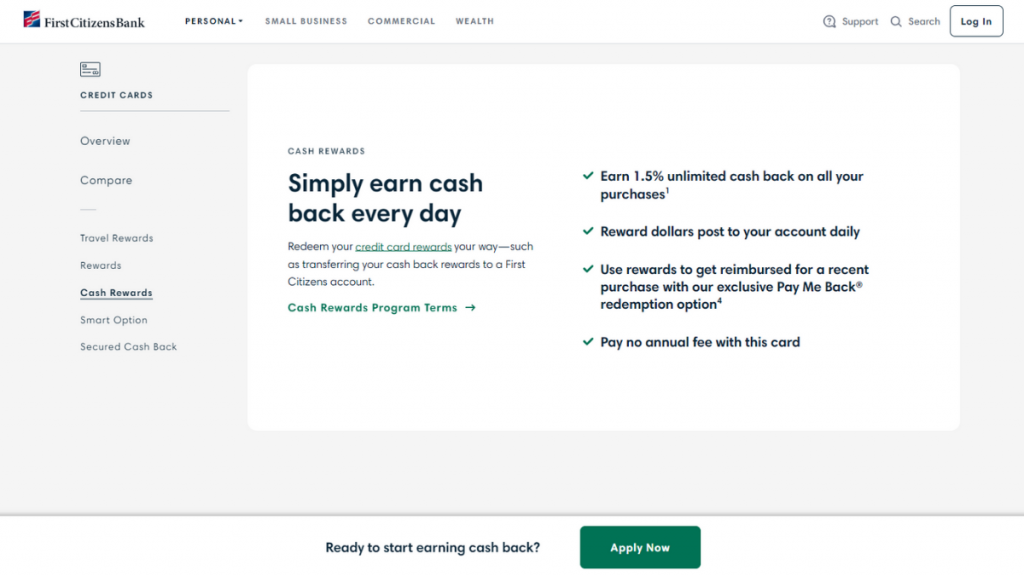

Do you often get confused by point systems and rotating categories? Then, the First Citizens Bank Cash Rewards Credit Card is your key to plain rewards.

Earn 1.5% cash back on everything you buy, from groceries to getaways.

So, dive into our A-Z guide and learn how to apply for your First Citizens Bank Cash Rewards Credit Card today.

Eligibility

This card is only available for people with First Citizens Bank accounts.

So, if you don’t have one yet, you can open an account first and then apply for the card.

Advertisement

Application Process

Once you have your account, then you can head to the First Citizens Bank website and find the credit card page.

Then, you will log in to your existing customer account and locate the First Citizens Bank Cash Rewards Credit Card.

Also, carefully fill out the form with your personal information and financial details.

Finally, don’t forget to review the terms and conditions thoroughly before submitting.

Reviewing Your Application

After you apply for a loan, it takes time for the bank to review your application.

During this process, the bank will check your financial history and determine if you are approved.

Advertisement

Approval and Card Delivery

If approved, then your First Citizens Bank Cash Rewards Credit Card will arrive in the mail within 7-10 business days.

Apply using the app

If you want a credit card, then you’ll need to visit their website to apply.

Once you have the card, you can effortlessly track your transactions and payments through the First Citizens Digital Banking app.

First Citizens Bank Cash Rewards Credit Card vs. First Citizens Bank Smart Option Credit Card

Consider First Citizens Bank’s Cash Rewards Credit Card for 1.5% cash back on all purchases or the Smart Option Credit Card for a zero introductory rate on balance transfers and purchases.

Choose based on your financial goals and spending habits.

First Citizens Bank Cash Rewards Credit Card

- Credit Score: 670-850;

- Annual Fee: $0;

- Purchase APR: 18.24% to 27.24% ( variable);

- Cash Advance APR: 27.24% to 30.24% ( variable);

- Welcome Bonus: 0% intro APR on balance transfers during the first 12 months of the account;

- Rewards: 1.5% cash back per $1 on all purchases.

First Citizens Bank Smart Option Credit Card

- Credit Score: Fair- Excellent;

- Annual Fee: No annual fee;

- Purchase APR: 15.24% to 24.24% (variable);

- Cash Advance APR: 27.24% to 30.24%(variable);

- Welcome Bonus: O% intro APR on balance transfers for the first 12 months of account;

- Rewards: N/A.

Learn how to apply for the First Citizens Bank Smart Option Credit Card in our upcoming post. Read on!

Apply for the First Citizens Bank Smart Option

Apply for the First Citizens Bank Smart Option Credit Card easily? Keep reading for all the details you need to know! $0 annual fee!

Trending Topics

Gemini Credit Card® review: Earn crypto on your purchases

Love crypto? Get a Gemini Credit Card® review with pros and cons! Pay no annual fee and earn crypto on every purchase!

Keep Reading

Shop Your Way Mastercard® review: up to 5% cash back

Explore the benefits of the Shop Your Way Mastercard® in our review – a no-annual-fee rewards card that earns you points on gas and dining!

Keep Reading

What are the chances of the US going into another recession?

The recent economic volatility has many people worried about recession fears. But just how high is the risk of another crash?

Keep ReadingYou may also like

Consolidate Your Debt with Confidence: Best Loans

Discover if debt consolidation loans are right for you and learn all about the benefits, drawbacks, and options available. Keep reading!

Keep Reading

R.I.A. Federal Credit Union Mastercard® Rewards Card: apply today

Unlock the potential of shopping with the R.I.A. Federal Credit Union Mastercard® Rewards Card! Apply today and start saving big!

Keep Reading

How to request Capital One SavorOne Cash Rewards Credit Card

Learn how to apply for the Capital One SavorOne Cash Rewards Credit Card today and enjoy unlimited cash back with no annual fee!

Keep Reading