Loans

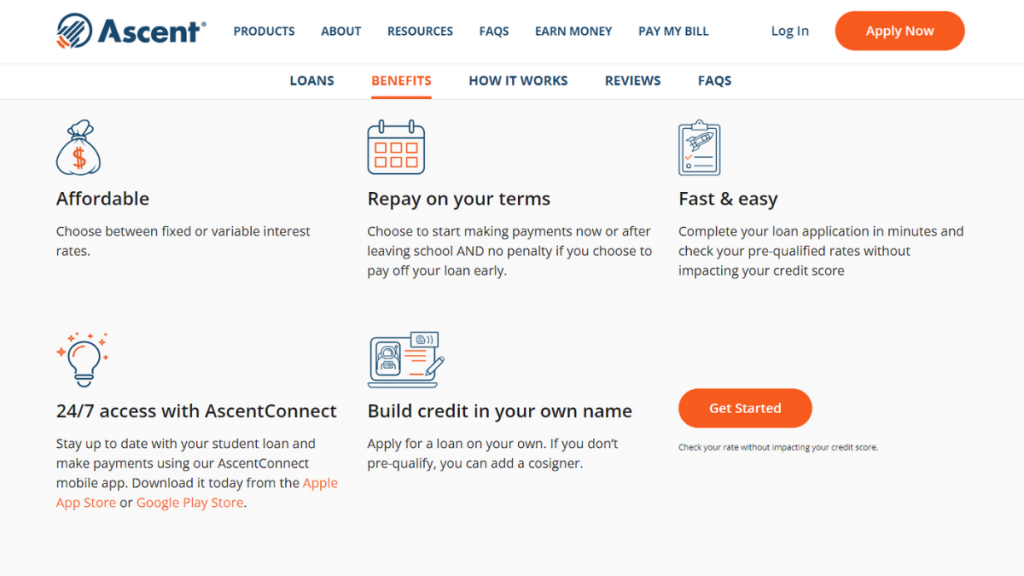

Apply for the Ascent Student Loans: fast and simple

Get ready to discover the easiest way to apply for Ascent Student Loans! Stay tuned, and you'll be on your way to achieving your academic dreams in no time.

Advertisement

Discover Loan Eligibility and Amounts Available

Ready to chase your educational goals? This guide will walk you through how to apply for Ascent Student Loans, offering a seamless path to funding your future.

Explore flexible options and launch your academic adventure today. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

It’s that time of the year when many students are thinking about college and how to pay for it.

If you’re considering getting a student loan from Ascent, we can help you to apply online. Check out our guide below to make it easier for you.

Step 01: Pre-Qualification

If you’re considering taking out a student loan with Ascent, the first step is to check if you’re eligible to pre-qualify.

To do this, you’ll need to provide some basic information such as your name, address, date of birth, the school you’ll be attending, and your employment details.

If you decide to apply with a cosigner, you must also gather their information. So, make sure you have all the necessary details handy to complete the process smoothly.

Advertisement

Step 02: Finding Repayment Options for you

Once Ascent approves your request, you can see different options to repay the loan.

You can choose the one that suits your budget the best.

Step 03: Ascent Portal Task

Once you finish your loan application and select the loan terms, you will be prompted to complete some tasks on your Ascent portal.

One of the tasks is a financial quiz, which will ask you some questions to help prepare your loan application.

Advertisement

Step 04: Paying for School

Finally, after you’ve finished all your tasks, Ascent will send your loan for school certification.

Once that’s done, they’ll send the funds directly to your school.

Requirements

If you’re looking to get student loans with Ascent, there are a few things you need to know before you apply.

First, you must be at least 18 years old and a citizen or permanent resident of the United States.

You also need to meet certain credit score requirements: your score needs to be at least 540 if you’re the borrower and at least 620 if you have a co-signer.

The other requirements will depend on whether or not you have a cosigner.

Apply using the app

The application for Ascent Student Loans is not available in the app.

Other options for students: Discover it Student Chrome Credit Card

The Discover it Student Chrome Credit Card is a great option for students who want to start building their credit history.

It comes with a special offer of 0% interest on purchases for the first 6 months, and you won’t have to pay an annual fee.

Check out its main features below to see if it’s a good fit for you.

- Credit Score: All types of credit;

- Annual Fee: $0;

- Purchase APR: 0% APR for 6 months, then 18.24% – 27.24%;

- Cash Advance APR: 29,99% (variable)

- Welcome Bonus: Unlimited Cashback Match: you’ll have your cash back match earned at the end of the first year to turn $50 into $100, for example;

- Rewards: Earn 2% cash back at gas stations and restaurants (up to $1,00/quarter) and 1% on all other purchases.

Discover the power of the Discover it Student Chrome Credit Card and apply easily!

Our upcoming post will guide you through the application process step-by-step. Don’t miss out, keep reading!

How do you get the Discover it Student Chrome?

Get a credit card to start building your credit history in your student years. The Discover It Student Chrome credit card will give you double cashback on the first year.

Trending Topics

3 Best student credit cards: choose yours!

Discover the 3 best student credit cards on the market, and learn what is really important when deciding which one is the best for you.

Keep Reading

Discover it® Balance Transfer Credit Card review: 0% intro APR

This Discover it® Balance Transfer Credit Card review will cover this product's perks! Pay no annual fee and earn up to 5% cashback.

Keep Reading

Tomo Credit Card review: Build Credit with no interest

Build credit without breaking the bank. Discover the Tomo Credit Card in this review - ensure amazing discounts at your favorite brands.

Keep ReadingYou may also like

Flagstar Bank Mortgage review: how does it work and is it good?

This Flagstar Bank Mortgage review will uncover all this lender's details! Options with 0% to 3% minimum down payment and affordable loans.

Keep Reading

Upgrade Triple Cash Rewards Visa® review: is it legit and worth it?

Upgrade Triple Cash Rewards Visa® gives you cash back and great payment conditions: learn more about this card by reading this review.

Keep Reading

BankAmericard® Secured Credit Card review: build credit fast

Read our BankAmericard® Secured Credit Card review and discover a great tool to build credit - pay $0 annual fee and enjoy amazing features!

Keep Reading