Reviews

The Platinum Card® from American Express review: is it worth it?

VIP access and exclusive benefits in hotels, airlines, and entertainment services. The Platinum Card® from American Express is one of the best of its level and desired for many credit card users. Learn everything about it!

Advertisement

The best travel card with reward points and VIP benefits

The Platinum Card® from American Express is beautiful. You can’t mistake the silver metal design for any other card. Considered for some as an extravagance, for others, it is an important tool to optimize money with its facilities.

That’s because it is one of the best travel cards on the market. It has a lot of reliability, as you can find it in wallets around since 1984. It is still a symbol of status, as it provides VIP experiences for the Platinum members.

Apply for The Platinum Card® from American Express

It is simple to apply for The Platinum Card® from American Express. If you love getting benefits and traveling the world, apply now for it.

This unmistakable card has a lot of benefits in entertainment, hotels, insurances, rental companies, airlines, and more. Keep reading, you’ll find everything about this card in the following.

| Credit Score | Recommended above 720. |

| Annual Fee | $695. |

| Foreign Transaction Fee | None. |

| Regular APR | See Pay Over Time APR. |

| Welcome bonus | Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. |

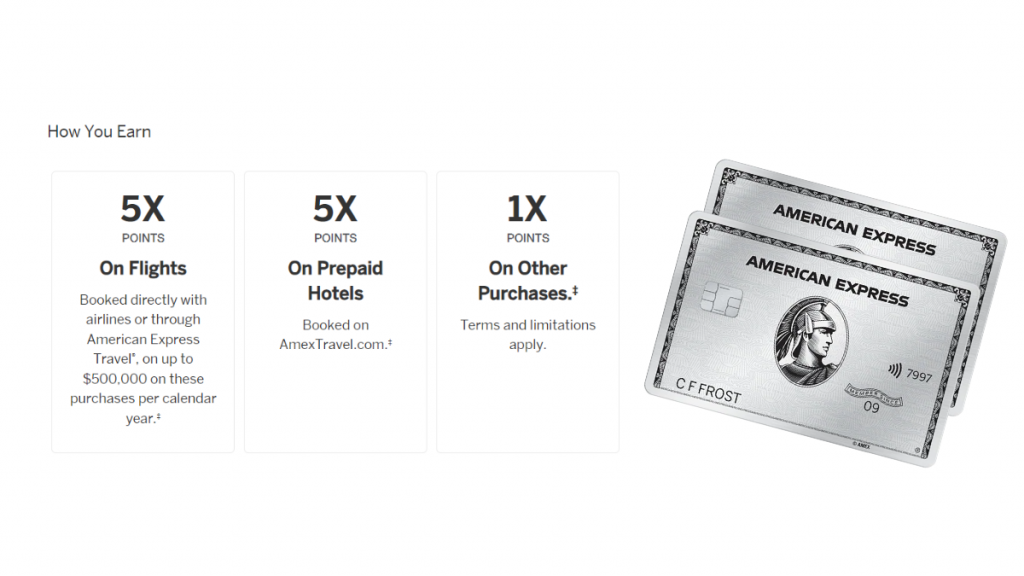

| Rewards | 5x points on flights you book directly through airlines or American Express Travel (up to $500,000 on these purchases per calendar year); 5x points on prepaid hotels (valid for those you book through AmexTravel.com); 1x point on any other eligible purchase. |

See Rates & Fees

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The Platinum Card® from American Express

With more than 40 years active in the market, it has a great reputation. It is a great achievement for travel enthusiasts. The Platinum Card® from American Express has wide acceptance in the market.

As it has no preset credit limit, which means you have a flexible spending limit, it is unlike that the purchase won’t be approved.

However, the amount you can spend will vary based on some factors, such as purchase, payment, and credit history.

As it has been said, the Platinum is a travel card. It means that the majority of its benefits are directed towards airline tickets, booking hotels, and rental services. And you have 5 times more reward points on eligible purchases.

It doesn’t mean that it doesn’t work as a normal credit card. It does, you still earn 1 reward point for every dollar spent on every purchase.

Also, you have discounts and “coupons” for daily activities too, like gym, streaming services, sports events, and so on.

It is true that you’ll have to use specific services in specific companies to have benefits. That’s why some critics call it a “coupon credit card”. But a lot of credit card companies operate like this.

The Platinum Card® from American Express: should you get one?

There are a few things to consider before asking for your Amex silver card.

You need to put into account how much its benefits value versus how much you’ll pay for it. It is a top credit card, so you can find dozens of great reviews and videos with different points of view.

One thing to know for sure is that The Platinum Card® from American Express is a powerful card. If you can afford it and it suits your lifestyle, it is a big yes.

Advertisement

Pros

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, SiriusXM, and The Wall Street Journal.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

- Benefits targeted toward travels, not the best card for regular use for the majority.

- Without the welcome bonus, the benefits will decrease after the first year.

- With a high annual fee of $695, the cardholder has to plan really well its use to take advantage of it.

Advertisement

Credit scores required

A powerful card will require a credit score at the same level. It is not really specified, but you’ll need a credit score of 720 or above.

Your credit history will be taken into consideration, so it is not a card to start building your credit story.

The Platinum Card® from American Express application: how to do it?

Do travel benefits and reward points seem good for you? Then you should apply for The Platinum Card® from American Express.

It is simple to apply, and you can make it online in a few seconds. In the following article, we’ll show you the step-by-step.

Apply for The Platinum Card® from American Express

It is simple to apply for The Platinum Card® from American Express. If you love getting benefits and traveling the world, apply now for it.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

How much should you save to move out: is $5000 enough?

Is $5000 enough to move out? Here are the most important things to consider before and during moving. Read on!

Keep Reading

Wayfair Credit Card review

Read out the Wayfair Credit Card review and learn how this card works. Cash back rewards and welcome bonuses! Keep reading to learn more!

Keep Reading

The impact of your credit score on your mortgage rate

Are you wondering how much your credit score impacts your mortgage rate? Get the answer here. Keep reading!

Keep ReadingYou may also like

Investing for students: how to get started today!

If you're a student, this guide will help you get started with investing today. Learn 5 steps for beginnig your investment journey. Read on!

Keep Reading

How to build credit fast from scratch with our tips for beginners!

Learn how to build credit and get the best offers from lenders and credit card issuers. This can make a difference in achieving your plans.

Keep Reading

How to start planning your retirement

Wondering how to plan for retirement? Check out our top tips on how to save enough money and create a plan that's just right for you.

Keep Reading