Accounts

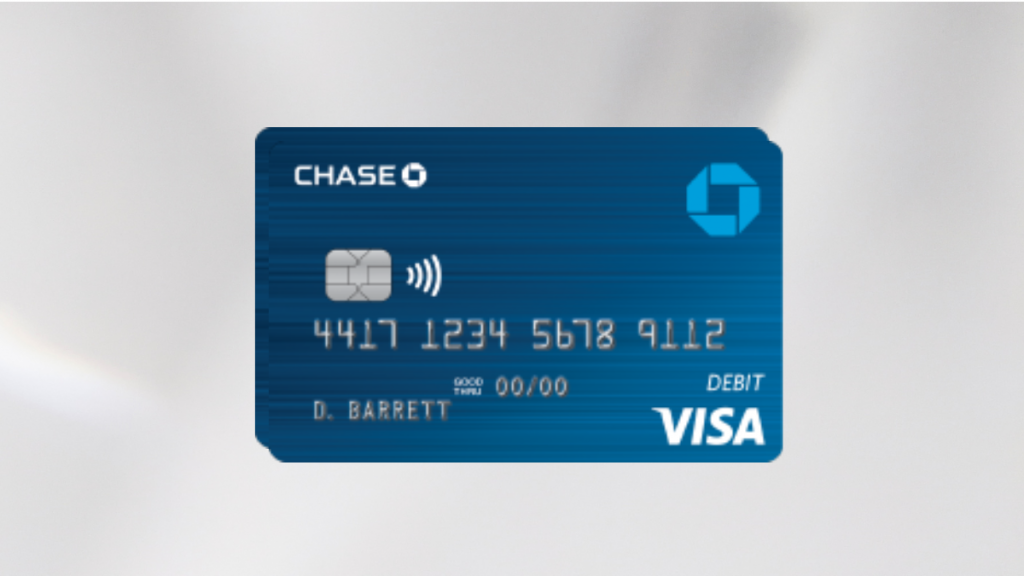

Chase Secure Banking℠ application: how does it work?

Are you looking for a simple and budget-friendly way of managing your finances? Check out Chase Secure Banking℠! This simple guide will help set up your financial future. Read on!

Advertisement

Chase Secure Banking℠: Make your application in about 10 min with our tips!

Chase Secure Banking℠ is a modern online banking platform that offers resources and features guaranteed to make managing money easier.

We can guide you through the application process and outline all that joining this revolutionary service has to offer – so don’t miss out on an opportunity like this. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Suppose you’re 18 years or older and have a valid U.S. street address, Social Security Number, and any applicable information on your current employer. In that case, it’s time to learn how to apply for this account.

Opening a Chase Secure Banking℠ account is simple; all these requirements help ensure the process goes smoothly so that you can take advantage of their amazing services as soon as possible.

Here’s how to apply for a Chase Secure Banking℠ account:

- First, go to the Chase website and click “Open an account;”

- Next, choose the account you want and click on “Apply now;”

- Then, fill out the application form with your personal information. Ensure accurate data is provided, as this will be necessary for identity verification;

- Finally, review your application and submit it. You should receive a confirmation email shortly after submitting your application.

Apply on the mobile app

With the Chase Mobile app, current account holders can access an array of convenient features – checking balances and transferring funds in a few clicks.

Unfortunately, it’s not currently possible for new customers to open accounts through the same app.

Advertisement

Chase Secure Banking℠ or Porte Mobile Banking?

Chase Secure Banking℠ is a great option for people who want the convenience of online banking with the peace of mind that comes with knowing that information comes with protection by encryption technology.

On the other hand, Porte Mobile Banking offers similar features and benefits, plus the added convenience of banking on the go.

Chase Secure Banking℠ and Porte Mobile Banking offer users 24/7 account access, check deposits, and transfers between accounts.

However, Chase offers bill pay and other features like budgeting tools and educational resources. So depending on your needs, one of these two banks may be a better fit for you.

Chase Secure Banking℠

- Fees: Monthly fee: $4.95;

- Minimum balance: No minimum balance;

- APY: No APY;

- Credit score: No credit scores are required;

- Rewards: $100 sign-up bonus;

- Terms apply.

Advertisement

Porte Mobile Banking

- Fees: Monthly fees: $9.95 (can be waived with eligible direct deposit);

- Minimum balance: No minimum balance;

- APY: Not applied;

- Credit score: No minimum credit score;

- Rewards: Earn cash back at select retailers.

Do you want to learn a bit more about Porte Mobile Banking? Get the scoop about it in our post below.

Porte Mobile Banking application: how does it work

Don't miss out; explore the incredible benefits of Porte Mobile Bank. See how to apply, step by step, now in our post! No ATM fees.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Learn to apply easily for CashUSA.com

Ensure you know how to apply for the CashUSA.com personal loan and get the best rates for your needs. Find out more! Up to $10k!

Keep Reading

How to start investing with Robinhood Investing?

Have you heard about Robinhood Investing? It is one of the best investing platforms for beginners for several reasons. Learn how to join it.

Keep Reading

First Access Visa® Card review

Should you give this excellent credit card a try? Find out in the First Access Visa® Card review. Keep reading!

Keep ReadingYou may also like

The impact of your credit score on your mortgage rate

Are you wondering how much your credit score impacts your mortgage rate? Get the answer here. Keep reading!

Keep Reading

MoneyLion Loans Review: Credit Score SOS

This review examines the pros and cons of MoneyLion Loans credit builder loans: fees, benefits, cons, and more. Read on!

Keep Reading

Learn to apply easily for Pick a Lender Personal Loan

Learn how to apply for Pick a Lender Personal Loan! Get up to $40K and use it for several purposes! Read on!

Keep Reading