Reviews

Walmart MoneyCard® application: how does it work?

Learn how easy and fast it is to apply for the Walmart MoneyCard® and make the most out of your Walmart shopping - online and in-store!

Advertisement

Walmart MoneyCard®: Earn cash back when you shop at Walmart!

Are you looking for a safer way to shop or a better way to manage your finances? We’ve got the answer! Check out how easy the Walmart MoneyCard® application process is below.

This debit card offers cash back for online purchases, in-store or official Walmart fuel stations. So, if you like it, keep reading to find out how to apply for one.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

To apply for a Walmart MoneyCard®, you should be at least 18 years old, have a valid social number, and be an American resident.

If you meet the requirements, you’ll be able to apply for free on their website. It will be necessary to provide some basic information and agree with their electronic service terms.

Once you agree to all terms, you’ll receive a confirmation email from Walmart. And as soon as you have your card in your hands, you can reload it and activate it with a $1.00 fee. Simple, isn’t it?

Apply using the app

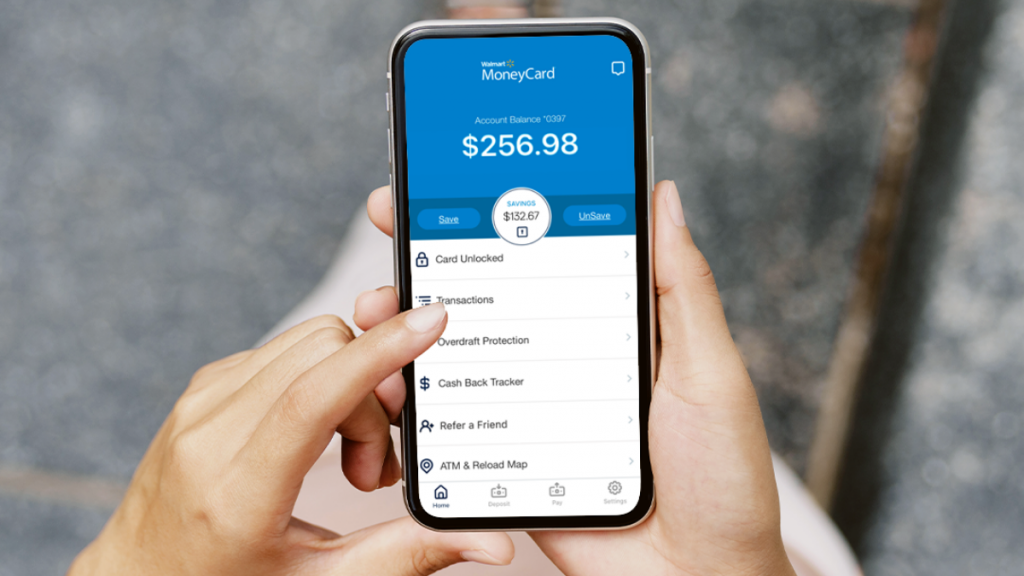

The Walmart MoneyCard® debit card also has a mobile and device app that you can download on Androids, iPhones, and computers.

It makes it easy to check your balance, track your spending, and find ATMs near you. You can also add new family members to your account and reload it free.

However, the app offers no options for new applicants to qualify. You must visit the website.

Advertisement

Walmart MoneyCard® vs. Mission Money card

If the Walmart MoneyCard® doesn’t suit you, we have another recommendation: the Mission Money card.

It is a free-fee debit card and has a mobile app with useful features, such as balance checks, transfers, and much more.

Walmart MoneyCard®

- Credit Score: Available for all credit scores;

- Annual Fee: Monthly fees of $5.94 (waive the fee with a direct deposit – see terms);

- Regular APR: N/A;

- Welcome bonus: None, currently;

- Rewards: 3% cash back at walmart.com; 2% cash back at Walmart fuel stations; 1% cash back at Walmart stores (reward valid for up to $75 each year).

Advertisement

Mission Money card

- Credit Score: no credit score required;

- Annual Fee: $0;

- Regular APR: N/A;

- Welcome bonus: N/A;

- Rewards: N/A.

In case you like the Mission Money Card, don’t forget to read our post about how to apply at the link below!

How to apply for Mission Money Card

Are you looking for a better way to spend your money? If so, take a look at the Mission Money card, and simplify your life. Learn how to apply for it right here.

Trending Topics

How to fight back inflation hitting American households

Learn about the new strategies Americans are using to fight the ongoing inflation in their households and make ends meet. Read on for more!

Keep Reading

How to buy cheap Delta Air Lines flights

Find the best places to buy cheap Delta Air Lines flights with our insider tips. Find flights from $79.99 and save a lot!

Keep Reading

HSBC Premier Checking review: Is the 75,000 minimum balance worth it?

This HSBC Premier Checking review brings a scoop on account details, benefits, drawbacks, and more. Open your account for free. Read on!

Keep ReadingYou may also like

Unique Platinum Card review: Elevate your spending power

Looking to elevate your spending power? Then don't miss our Unique Platinum Card review! 0% APR and amazing benefits! Read on!

Keep Reading

Citi® / AAdvantage® Executive World Elite Mastercard® application: how does it work?

Learn how to apply for a Citi® / AAdvantage® Executive World Elite Mastercard® quickly and online to earn the best miles. Read on!

Keep Reading

Credit repair companies: worth it or not?

This article is about the pros and cons of credit repair companies. If you are considering using credit repair services, read this first!

Keep Reading