Credit Cards

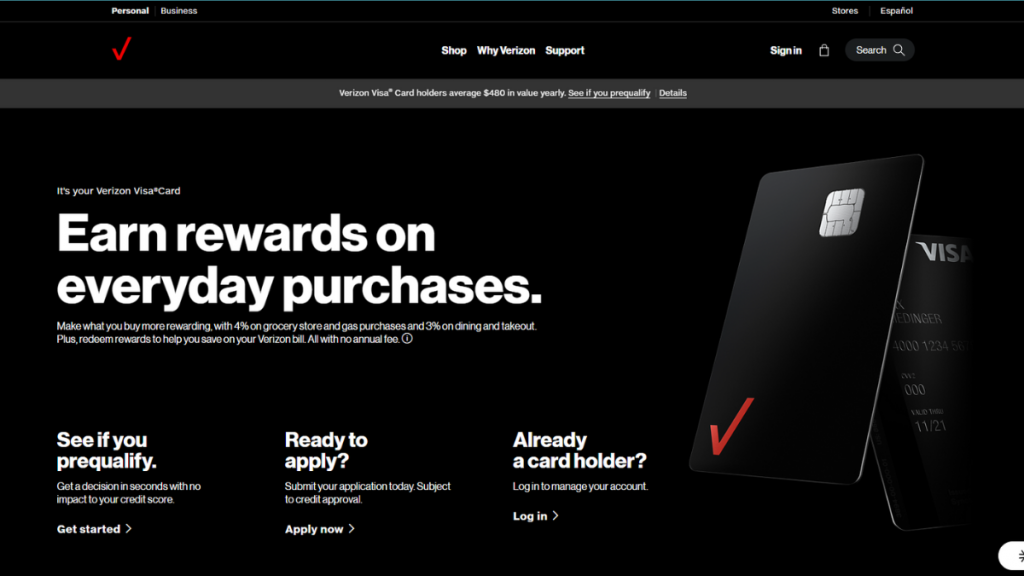

Earn up to 4% back: Verizon Visa® Card Review

From earning cashback on everyday expenses to enjoying travel benefits, the Verizon Visa® Card has something for everyone. Have a look!

Advertisement

Is the Verizon Visa® Card Worth Your Wallet? We Investigate

Are you a Verizon customer and curious to learn more about their credit card? Then stick around for a thorough review of the Verizon Visa® Card.

Apply for the Verizon Visa® Card

You can apply for a Verizon Visa® Card easily! Earn up to 4% cash back with no annual fee! Read on and learn more!

This card comes with no annual fee, allowing you to convert your everyday purchases into rewards. Further, let’s delve into the specifics.

- Credit Score: Good-Excellent;

- Annual Fee: None;

- Purchase APR: 26.99% or 30.99% (variable);

- Cash Advance APR: N/A;

- Welcome Bonus: $ 100 statement credit on your credit card bill after spending $1,000 during the first 90 days of account opening;

- Rewards: 4% back on grocery store and gas purchases, 3% on dining purchases (takeout included), 2% on Verizon purchases, and 1% on everything else.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Verizon Visa® Card: how does it work?

The Verizon Visa® Card is a partnership between a credit card issuer and one of the largest telecommunications companies in the United States, Verizon.

To acquire this card, you must be a Verizon customer. It’s designed to reward you for your loyalty and everyday spending.

Rewards

This card offers a generous rewards program:

- 4% back on grocery store and gas purchases;

- 3% back on dining purchases, including takeout;

- 2% back on Verizon purchases;

- 1% back on everything else.

Your rewards have no caps or expiration dates as long as you remain a Verizon customer and redeem some rewards at least every 24 months.

You earn “Verizon Dollars,” each worth $1.

These can be used for various purposes, such as purchasing new phones or accessories, paying your Verizon phone or Fios internet bill, booking travel, or even getting gift cards.

Advertisement

Travel Perks

For the globetrotters, this card offers two free TravelPasses per calendar year, allowing you to use your phone abroad without worrying about exorbitant roaming charges.

Autopay Discounts

By signing up for autopay, you can save up to $10 per account monthly.

Additionally, the card is smoothly integrated with your Verizon account as a payment method.

Advertisement

Welcome Bonus

The Verizon Visa® Card sweetens the deal with a generous $100 statement credit when you spend $1,000 within the first 90 days of opening your account.

It’s essential to note that cashback isn’t an option with this card. You can only redeem for Verizon Dollars. Also, this card does not offer phone protection.

Verizon Visa® Card: should you get one?

If you want the Verizon Visa® Card, review its advantages and disadvantages before deciding. Have a look below!

Pros

- No annual fee;

- Rewards on everyday purchases;

- Autopay discounts;

- Welcome bonus.

Cons

- No cell phone protection.

Credit score required

To be eligible for the Verizon Visa® Card, a good to excellent credit score is recommended.

Verizon Visa® Card application: how to do it?

Ready to apply for the Verizon Visa® Card? It’s a straightforward process, so keep reading to find out how to maximize your rewards and benefits.

Apply for the Verizon Visa® Card

You can apply for a Verizon Visa® Card easily! Earn up to 4% cash back with no annual fee! Read on and learn more!

Trending Topics

100 Lenders personal loan review: how does it work and is it good?

Do you need a personal loan for an emergency or to pay off debt? If so, read our 100 Lenders personal loan review and learn more about it!

Keep Reading

How to earn extra money online: your guide to getting started

Learn how to earn money online with our step-by-step guide. We'll show you the best ways to make extra money home today!

Keep Reading

RBC Bank Application: Simplify Your Banking Experience

This is a quick, simple and easy-to-follow RBC Bank application guide. Come along with us and get your new bank account going today!

Keep ReadingYou may also like

OneMain Financial Personal Loan review: how does it work and is it good?

This OneMain Financial Personal Loan review is full of details about this lender. Ensure up to $20,000! Secured loan options. Read on!

Keep Reading

CashUSA.com review: how does it work and is it good?

Read our CashUSA.com review and discover how to get the money you need fast! Connect with several lenders and borrow up to $10,000 fast!

Keep Reading

10 reasons not to refinance your home

There are many reasons why you might choose not to refinance your home. Here are the top 10! Check them out!

Keep Reading