Credit Cards

How to request US Bank Altitude® Go Visa Signature® Card

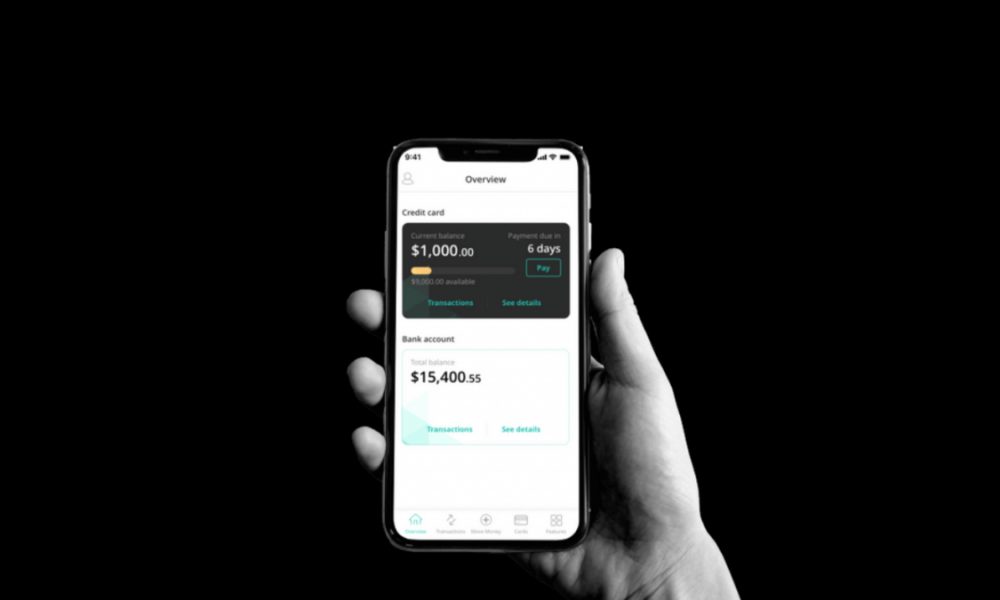

Check out how to apply for the US Bank Altitude® Go Visa Signature® card and start earning rewards and cash back today! Plus, you don't have to worry about annual or foreign transaction fees.

Advertisement

About the US Bank Altitude® Go Visa Signature® Card

More and more consumers are looking for credit cards that offer advantages and rewards for using them on a daily basis when shopping normally or in specific situations, such as restaurant purchases. This is the case with the US Bank Altitude® Go Visa Signature®, a credit card that has a number of rewards for those who like to eat out.

If you are curious and want to know how to apply for it, follow our article and find out everything about this credit card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

How to apply for the US Bank Altitude® Go Visa Signature® Card?

You can apply for your credit card over the internet, just go to the official US Bank website, where you will fill out a form with your personal information.

After filling out the application form, you will undergo a very quick review and you will receive a response within minutes saying whether or not you have been approved for the US Bank Altitude® Go Visa Signature®.

How many credit points do I need to apply for the US Bank Altitude® Go Visa Signature® Card?

The US Bank Altitude® Go Visa Signature® requires an excellent credit score, between 750 to 850. However, it is important to remember that the bank will evaluate other criteria in your profile in addition to your credit score, such as your source of income monthly.

This will greatly influence the outcome of your bank profile analysis and you can get the card even without having a very high credit score.

Another important point is that you can also be denied the application, even if the credit score is within the necessary amount.

Advertisement

Qualifications and Application Requirements

- You must be over 18 years of age on the day of application;

- It is necessary to provide some personal data, such as full name, country of origin, date of birth, among others;

- Provide home address and contact details, such as phone number, email, how you live (rent or own home);

- Data on your financial profile, such as monthly expenses, rent, employment, annual income and source of income.

US Bank Altitude® Go Visa Signature® card vs. The Platinum Card® from American Express

Are you still in doubt about the best credit card for your financial life?

Don’t worry! You can check out our article below to learn more about another option available on the market, the American Express Platinum credit card!

Application for the American Express Platinum card

It is simple to apply for The Platinum Card® from American Express. If you love getting benefits and traveling the world, apply now for it.

Trending Topics

Apply for Marriott Bonvoy Business® American Express® Card today

Unveil the secrets to apply for the Marriott Bonvoy Business® American Express® Card - up to 6x points on purchases and more!

Keep Reading

Learn to apply easily for SpeedyNetLoan

Getting a loan online is easier and faster than you might think. Read this post to understand how to apply for a SpeedyNetLoan. Stay tuned!

Keep Reading

How to apply for the Sable bank account easily

If you're tired of old-fashioned banks, learn how to apply for a Sable bank account and enjoy your online account with a $0 annual fee.

Keep ReadingYou may also like

Capital One Platinum Secured Credit Card review: is it worth it?

Read this Capital One Platinum Secured Credit Card review and learn all about its perks, such as flexible security deposit and no annual fee!

Keep Reading

Amazon Rewards Visa Signature Card: apply today

Step-by-step guide: How to apply for the Amazon Rewards Visa Signature Card. Earn 3% back on Amazon purchases, plus rewards on all spendings.

Keep Reading

Budgeting for travel: see how to plan your next trip!

A step-by-step guide on budgeting for travel. This article shares tips on planning a vacation without breaking the bank. Read on!

Keep Reading