Credit Cards

Beauty on a Budget? An Ulta Credit Card Honest Review

An Ulta Credit Card Review: Discover its enticing rewards, exclusive perks, and potential pitfalls. Earn points on purchases and much more!

Advertisement

Everything you need to know before signing up for the Ulta Credit Card

This Ulta Credit Card review will provide a comprehensive analysis for Ulta Beauty lovers considering this card to maximize their savings.

Get the Ulta Credit Card: Apply now!

Buy more beauty products with exclusive sales and points at Ulta. Find out how to apply for the Ulta Credit Card now!

Gain a comprehensive understanding of the benefits, advantages, and limitations of making a well-informed choice. Keep reading!

- Credit Score: 640 or higher;

- Annual Fee: $0;

- Purchase APR: 30.99% ( variable);

- Cash Advance APR: N/A;

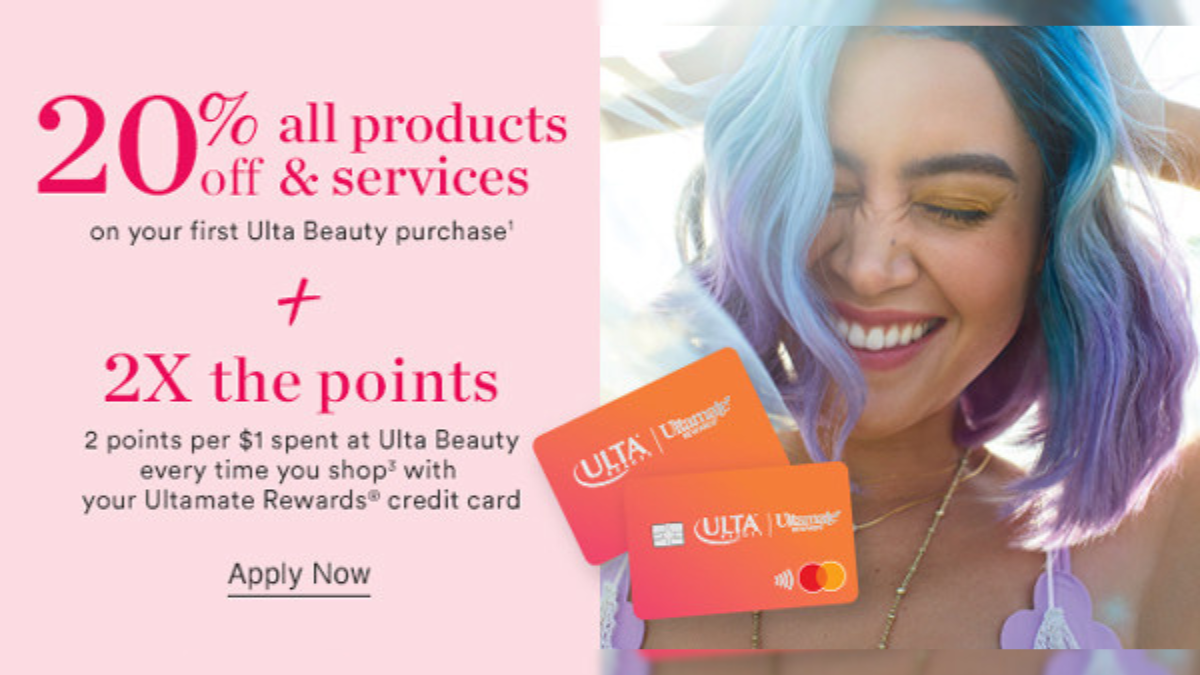

- Welcome Bonus: Get a 20% discount on your first purchase at Ulta Beauty;

- Rewards: Earn up to 2 points on the dollar spent at Ulta Beauty, website, and salon.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Ulta Credit Card: how does it work?

If you’re an avid Ulta shopper, constantly buying makeup and other beauty products, the Ulta Credit Card is more than worthy.

Not only will you save money on your first purchase, but those points will quickly add up, providing more opportunities for additional discounts.

However, it may not be the best fit if you don’t shop at Ulta frequently or struggle with high-interest credit card debt.

Let’s start by breaking down the benefits of the Ulta Credit Card.

Rewards

With the Ultamate Rewards Credit Card, you receive 20% off your first purchase, 2 points for every dollar spent at Ulta, and no annual fee.

So, as an example, for every $500 you spend, you’ll receive a $10 reward that you can use towards future purchases.

Advertisement

Exclusive Advantages for Cardholders

Not to mention, cardholders also receive exclusive emails featuring special deals and promotions.

Limited to Ulta Beauty

However, this card also has its downsides. One of the biggest drawbacks is that you can only redeem rewards at Ulta Beauty’s website and salon for salon services.

Advertisement

Fees and Rates

The Ulta Credit Card doesn’t charge an annual fee or APR for balance transfers and Cash Advances.

However, the high ongoing APR of 30.99% can make carrying a balance on this card quite costly.

In addition, two other fees might apply:

- Late Payment Fee: Up to $41;

- Returned Payment Fee: Up to $41.

If you aren’t sure if this credit card would suit you, pay close attention to the next topic.

Ulta Credit Card: should you get one?

The Ultamate Rewards Credit Card is an awesome choice for loyal Ulta shoppers who love splurging on beauty and salon services.

Before diving in, check out these factors to weigh the pros and cons of applying.

Pros

- Exclusive offers and discounts for cardholders;

- 2 points per dollar spent at Ulta, with no cap;

- Birthday gifts and access to special shopping events;

- No annual fee.

Cons

- Restricted reward system only redeemable at Ulta;

- Exclusive for Ulta Beauty and Ulta.com.

Credit score required

Before applying for the Ulta Rewards Credit Card, you should review if you have a FICO credit score of at least 640.

If your credit score is lower, improving it before applying is best.

Ulta Credit Card application: how to do it?

Learn how to get the Ulta Credit Card effortlessly. Apply within minutes using our guide. Continue reading to discover more!

Get the Ulta Credit Card: Apply now!

Buy more beauty products with exclusive sales and points at Ulta. Find out how to apply for the Ulta Credit Card now!

Trending Topics

Cheap Spirit Airlines flights: Fantastic fares!

Find out how Spirit Airlines cheap flights policy works, and book your ticket today for some of the best prices. Keep reading!

Keep Reading

Gemini Credit Card® review: Earn crypto on your purchases

Love crypto? Get a Gemini Credit Card® review with pros and cons! Pay no annual fee and earn crypto on every purchase!

Keep Reading

Temporary Assistance for Needy Families (TANF): a guide for the program

This guide provides an overview of Temporary Assistance for Needy Families (TANF), including who is eligible and how to apply. Read on!

Keep ReadingYou may also like

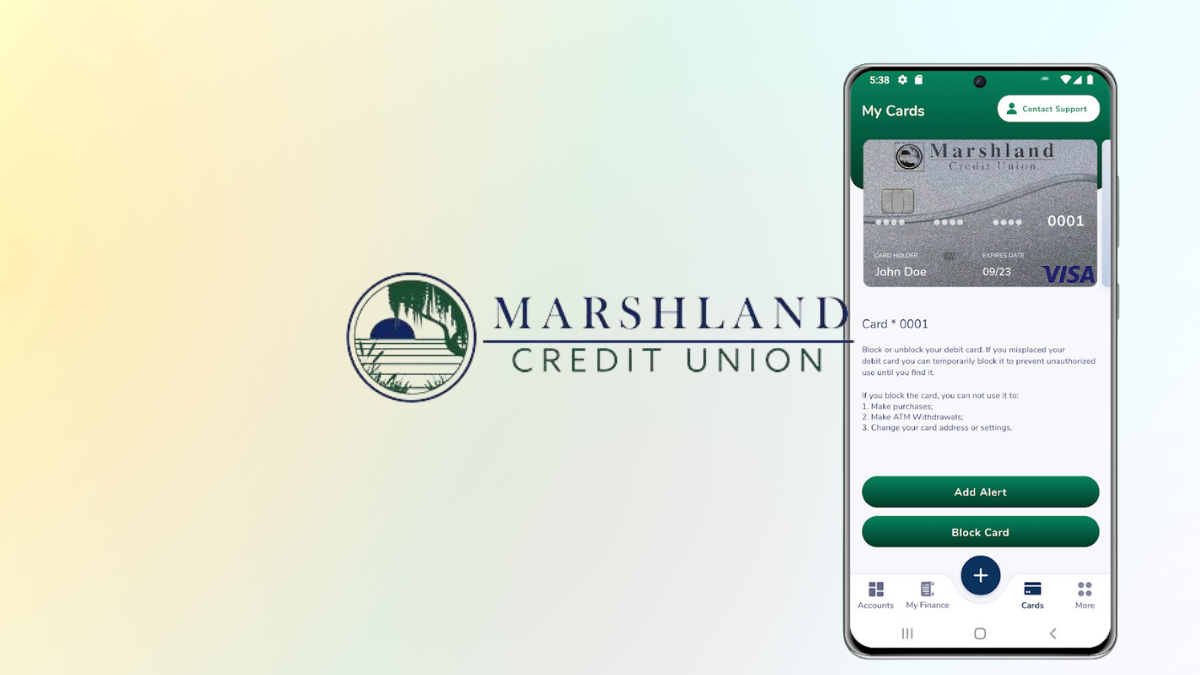

The Perfect Card for Savvy Spenders: Marshland Visa® Credit Card review

Are you a thrifty spender looking for a card to keep up with your lifestyle? Read our Marshland Visa® Credit Card review!

Keep Reading

Rocket Loans review: how does it work and is it good?

Get the financial flexibility you need with this Rocket Loans review! Up to $45,000 with fast funding. Read on and learn more.

Keep Reading

Capital One Bank review: is it the best choice for you?

Capital One Bank offers a high-interest savings account which won't lock up your money, and you can access it whenever you want.

Keep Reading