Credit Cards

Torrid Credit Card Review: Big Discounts on all Purchases

Find out how to get fashion discounts with the Torrid Credit Card in our review! Discover rewards for cardholders now. Keep reading!

Advertisement

Pay less every time you shop at Torrid and Save more!

If you’re a fan of Torrid, you might have heard of its store credit card. But is it worth your while? In this blog post, we’ll review the Torrid Credit Card and see if it fits you well.

Up to 40% off Now: How to Apply for Torrid Card

Are you a Torrid lover? Learn to apply for the Torrid Credit Card now and score a 5% discount on all your purchases. Keep reading!

We’ve got you covered, from how it works to its rewards, fees, and credit score requirements. So, let’s dive in.

- Credit Score: 630 or higher;

- Annual Fee: $0;

- Purchase APR: 25.99% Variable;

- Cash Advance APR: N/A;

- Welcome Bonus: 40% off on your first purchase after opening and using the Torrid Credit Card online, plus $15 off $50 purchase once your Torrid card arrives;

- Rewards: 5% off on all purchases using the card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Torrid Credit Card: how does it work?

The Torrid Credit Card is store-branded, allowing you to purchase at Torrid stores and online.

It offers discounts and rewards without an annual fee.

However, it’s important to note that the card also comes with a high APR and fees. Further, let’s break down its features:

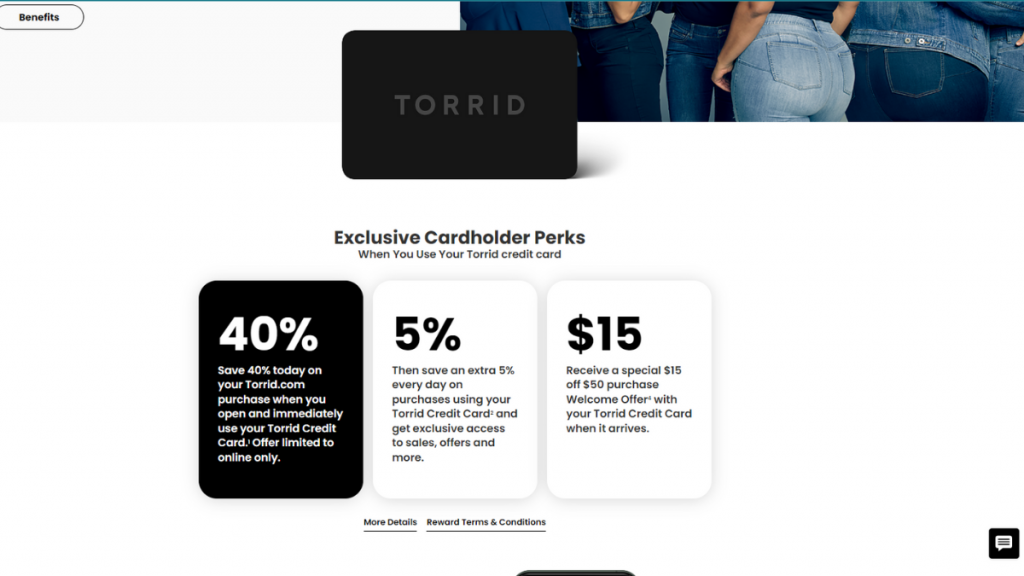

Welcome Bonus

When you open and use the Torrid Credit Card online, you’ll receive 40% off your first purchase, and once your card arrives, you’ll get $15 off a $50 purchase.

Advertisement

Rewards

With the Torrid Credit Card, you’ll enjoy 5% off on all purchases made with the card.

Additionally, you’ll gain access to exclusive sales and offers unavailable to non-cardholders.

Loyalty Program

The Torrid Credit Card’s loyalty program has three tiers: Insider, Loyalist, and VIP.

Your tier will depend on your spending.

You’ll earn rewards for every 250 points collected and a birthday gift for members.

Advertisement

Credit Reports

Indeed, it’s worth noting that your account activity is reported to credit bureaus, allowing you to improve your credit by making regular, on-time payments.

Torrid Credit Card: should you get one?

If you’re a frequent Torrid shopper who plans to make big purchases, the Torrid Credit Card might be worth considering.

However, it’s not the best option for people who carry a balance or have less than great credit scores.

Pros

- No Annual fees;

- High rewards and bonuses;

- Exclusive discounts and perks;

- Loyalty program.

Cons

- High APR;

- Late payment and returned payment fees.

Credit score required

To qualify for the Torrid Credit Card, you must review your score and see if it’s 630 or higher.

Torrid Credit Card application: how to do it?

Ready to apply for the Torrid Credit Card and earn a 5% discount on all your purchases? Then keep reading to get started!

Up to 40% off Now: How to Apply for Torrid Card

Are you a Torrid lover? Learn to apply for the Torrid Credit Card now and score a 5% discount on all your purchases. Keep reading!

Trending Topics

Holiday shopping: 7 best credit card safety tips

Take these credit card safety tips to protect your hard-earned money from thieves and hackers during the holiday. Learn how to be safe.

Keep Reading

The best apps for anxiety: take a deep breath and download one

Everybody needs a break, and these apps for anxiety are the best way to get some minutes of peace inside your head during the day.

Keep Reading

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Read our Applied Bank® Gold Preferred® Secured Visa® Credit Card to see how this product can help you get your finances in check!

Keep ReadingYou may also like

Chase Secure Banking℠ review: How is this account different from the others?

Get a better understanding of this product in our Chase Secure Banking℠ review today! Earn a $100 sign-up bonus!

Keep Reading

CitiBusiness® / AAdvantage® Platinum Select® Mastercard® review

Read our CitiBusiness® / AAdvantage® Platinum Select® Mastercard® review to see how this card can help you save on airfare and baggage fees!

Keep Reading

Capitec Bank App review: the easiest way to take care of your finances

Read our Capitec Bank App review to have an in-depth look at this app that helps you keep on top of your finances. Read on!

Keep Reading