Credit Cards

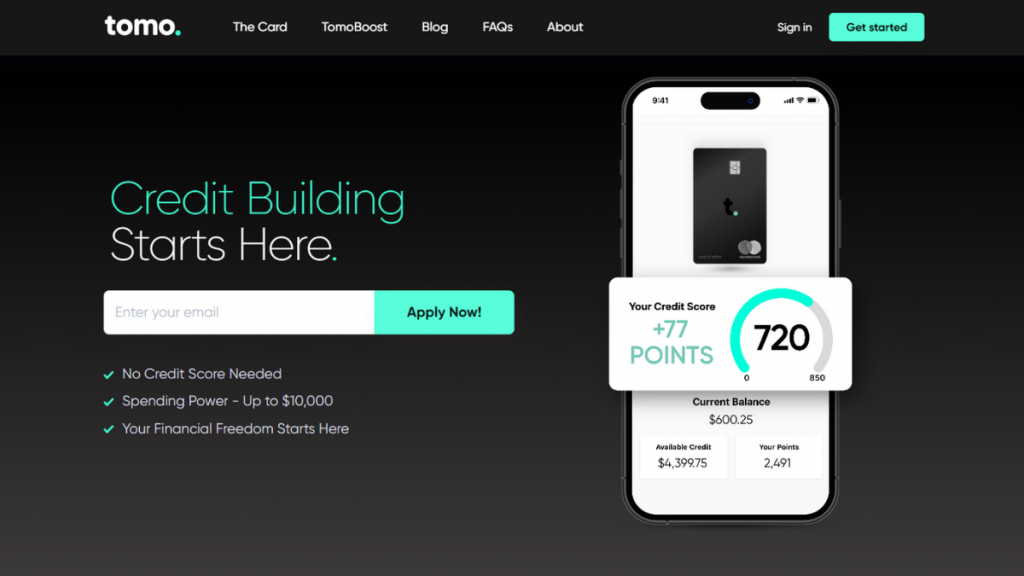

Tomo Credit Card review: Build Credit with no interest

Accessible to all credit types, Tomo Credit Card offers 0% purchase APR, and benefits on popular brands. Keep reading and learn more!

Advertisement

Special discounts on amazing brands

If you’re looking for a credit card to build credit, this Tomo Credit Card review might be just what you need.

No credit score needed: Apply forTomo Credit Card

Apply for the Tomo Credit Card today and take advantage of its 0% APR and various discounts and benefits on popular services.

After all, with no interest and a focus on helping people, this card is designed to be accessible. So keep reading and learn more!

- Credit Score: All types of credit are accepted;

- Annual Fee: $2.99 per month ($35.88 annually);

- Purchase APR: 0%;

- Cash Advance APR: Not Disclosed;

- Welcome Bonus: None;

- Rewards: Discounts and benefits on Doordash, ShopRunner, HelloFresh, and Lyft.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Tomo Credit Card: how does it work?

The Tomo Credit Card is a Mastercard for all types of credit scores. So you can build credit easily with this credit card.

Unlike many traditional credit cards, the Tomo Credit Card is designed to be accessible so you won’t pay interest rates!

Therefore, once approved, you’ll receive a credit limit based on your income and creditworthiness.

Moreover, you can use your card to make purchases just like any other credit card, and you’ll have the option to pay off your balance over time or in full each month.

Besides, the Tomo Credit Card also offers discounts and benefits on brands like Doordash, ShopRunner, HelloFresh, and Lyft.

Tomo Credit Card: should you get one?

If you’re in the market for a credit card and are considering the Tomo Credit Card, you may wonder if it’s the right choice. So, check out the pros and cons.

Advertisement

Pros

- All types of credit are accepted: The Tomo Credit Card is accessible to all types of credit and is designed to cater to those with no credit history or poor credit;

- Discounts and benefits: The card offers discounts and benefits on popular brands, which can help you save money;

- 0% purchase APR: The Tomo Credit Card offers a 0% purchase APR for a limited time, which can be a great way to save money on interest charges.

Cons

- Monthly Fee: It does charge a $2.99 monthly fee, which can add up over time;

- Limited rewards: Are limited to discounts and benefits on a few popular brands. If you’re looking for a card with more robust rewards, you might want to consider a different card.

Advertisement

Credit score required

Tomo Credit Card designers aimed to make it accessible to people with all types of credit, including those with no credit history or poor credit.

While the card doesn’t disclose a specific credit score requirement, it’s a good choice for anyone who wants to build credit or improve their credit score.

Tomo Credit Card application: how to do it?

If you want to apply for the Tomo Credit Card, it’s a fairly straightforward process.

Moreover, simply visit their website and follow the steps to complete the application.

Finally, visit the Tomo Credit Card website today to learn more about the application process and start your application.

No credit score needed: Apply forTomo Credit Card

Apply for the Tomo Credit Card today and take advantage of its 0% APR and various discounts and benefits on popular services.

Trending Topics

Auto Credit Express review: how does it work and is it good?

Find out how to get an auto loan with specialists in bad credit. Read on to an Auto Credit Express review and learn more.

Keep Reading

3 Best student credit cards: choose yours!

Discover the 3 best student credit cards on the market, and learn what is really important when deciding which one is the best for you.

Keep Reading

The American Express Blue Business Cash™ Card review

Learn how to earn cash back and improve your business' workflow with our The American Express Blue Business Cash™ Card review!

Keep ReadingYou may also like

Southwest Rapid Rewards® Premier Credit Card review

Want affordable travel? Our Southwest Rapid Rewards® Premier Credit Card review reveals how to earn points and travel more for less!

Keep Reading

Aeroplan® Credit Card application: how does it work?

Get the latest info to apply for an Aeroplan® Credit Card! Earn up to 3x points on all purchases! Keep reading and learn more!

Keep Reading

Assent Platinum Secured credit card review: is it worth it?

Looking for a secured credit card that offers quality and convenience? Then check out this Assent Platinum Secured card full review!

Keep Reading