Credit Cards

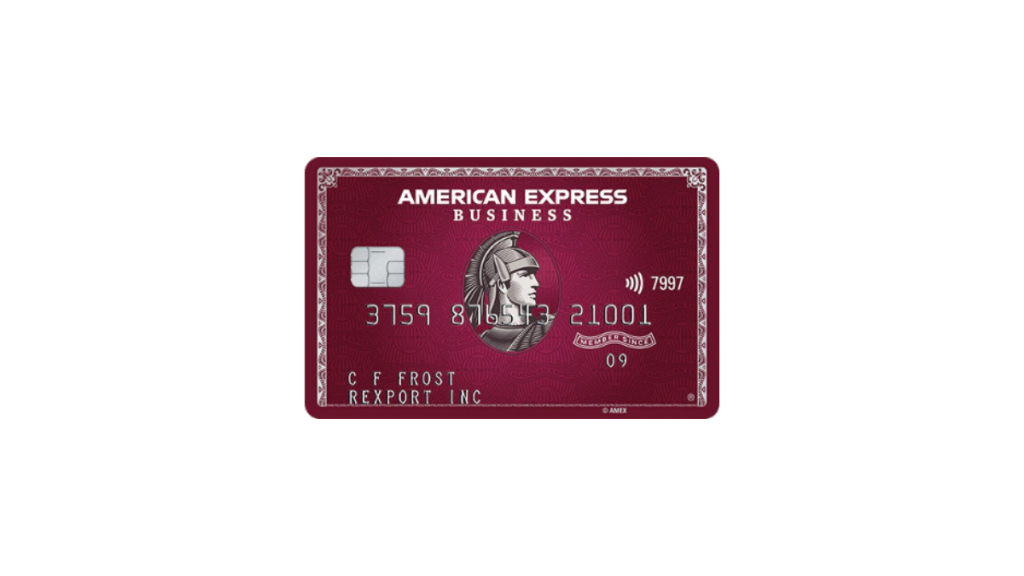

The Plum Card® from American Express review

Looking for a card with great rewards and flexible terms for your business? The Plum Card® from American Express is your choice!

Advertisement

Ensure no preset spending limit!

Are you looking for a The Plum Card® from American Express review? Then you just found it! It is the perfect solution for your financial needs!

The Plum Card® from American Express application

Get approved for The Plum Card® from American Express! Master the application process with our tips. Pay early and earn 1.5% cash back!

This credit card offers unlimited cash back when you pay early and a grace period for payments without interest. Then keep reading to learn more!

- Credit Score: Good-Excellent.

- Annual Fee: $250.

- Regular APR: N/A.

- Welcome bonus: N/A.

- Rewards: Get an unlimited 1.5% Early Pay Discount on eligible charges within 10 days of your statement closing date and see the discount applied to your next statement when you pay at the least the Minimum Payment Due by the Please Pay By date.

- See Rates & Fees

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The Plum Card® from American Express: how does it work?

The Plum Card® from American Express is a credit card specifically designed to meet the needs of small business owners. Check out some of this card’s most interesting features.

Earn cash back by paying early

Unlimited 1.5% cash back on your balance if you pay early, within 10 days before the closing date.

This offer applies to all purchases made with the card, and there is no cap on your earnings.

Furthermore, your cash back redemption will be directly credited as savings on the next billing statement.

Advertisement

Grace period

Get a 60-day grace period to pay without interest. Pay the minimum, and don’t worry about fees during this period.

No preset limit

There’s no preset limit for this card. However, the credit amount you’ll get depends on your credit history and financial resources.

Advertisement

Other features

- Choose your billing cycle;

- Have purchase and rental car protection;

- No foreign transaction fee;

- Get Employee cards with no additional annual fee;

- 24/7 Global Assistance Hotline.

- See Rates & Fees

The Plum Card® from American Express: should you get one?

The Plum Card® from American Express is a good fit for small businesses with irregular cash flow, which need payment flexibility.

Here are some pros and cons so you can decide if it’s what you’re looking for.

Pros

- Paying early pays off: get an unlimited 1.5% Early Pay Discount on eligible charges within 10 days of your statement closing date and see the discount applied to your next statement when you pay at the least the Minimum Payment Due by the Please Pay By date.

- Take up to 60 days to pay with no interest, when you pay your minimum due by the Payment Due Date.

- Use the power of the Plum Card to buy big for your business.

- No Foreign Transaction Fees.

Cons

- Requires good or excellent credit;

- Annual fee.

Credit score required

With the Plum Card® from American Express, you must have a strong credit score for approval.

The ideal range is good to excellent, so ensure your finances are in order before applying!

The Plum Card® from American Express application: how to do it?

Are you ready to give our business that payment flexibility? Great!

Take control of cash flow in a way that works for you – so apply today for the Plum Card® from American Express with our tips below.

The Plum Card® from American Express application

Get approved for The Plum Card® from American Express! Master the application process with our tips. Pay early and earn 1.5% cash back!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Costco Anywhere Visa® Card by Citi review: The rewards card for Costco members

Discover how Costco members can earn cash back on purchases with the Costco Anywhere Visa® Card by Citi review. Read on!

Keep Reading

Regional Finance Personal Loans review: how does it work and is it good?

Check out this complete Regional Finance Personal Loans review to decide if this is the loan for your needs. Keep reading!

Keep Reading

Marcus by Goldman Sachs Personal Loans review

Read our Marcus by Goldman Sachs Personal Loans review to learn how this loan can help you achieve your financial goals with zero fees.

Keep ReadingYou may also like

Axos High Yield Savings Account review: is it good?

Are you after a high yield savings account? Check out our Axos High Yield Savings Account review to see if it's the right fit for you.

Keep Reading

Learn to apply easily for the LendingPoint Personal Loan

Discover how easy it is to apply for LendingPoint Personal Loan and get the money you need in less than 24 hours. Read on!

Keep Reading

How to make $5000 a month: 10 simple strategies anyone can use

Discover how to make $5000 a month with these simple strategies and secrets that anyone can use. Keep reading!

Keep Reading