Loans

SimpleLoans123 Review: Quick Personal Loans Marketplace

SimpleLoans123 review: the marketplace to get loans for emergencies online. Discover key details about APR, loan amounts, and credit requirements here. Read on!

Advertisement

Fast and Easy Personal Loans at Your Fingertips

Looking for a trustworthy personal loan marketplace? Check out SimpleLoans123 in our review. They offer quick loans with clear terms and no complicated credit scores.

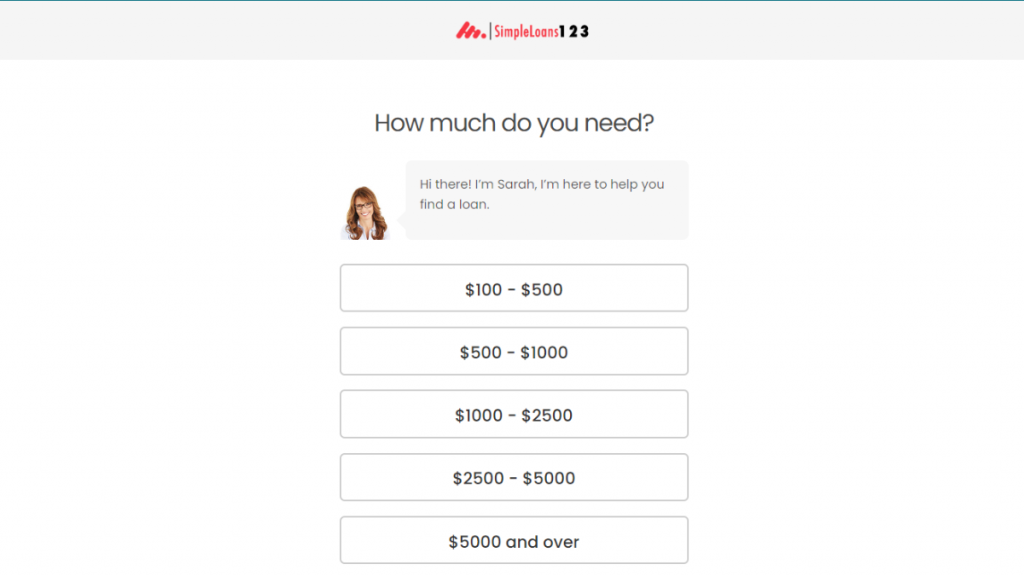

Apply for SimpleLoans123: Fast-track Approval

Unlock financial freedom! Apply for the SimpleLoans123 in just 3 steps with our easy-to-follow guide. Read on!

Read on to get an overview of fees, terms, and amounts so that you can make an informed decision. Keep reading!

- APR: Varies by lender;

- Loan Purpose: Personal and Vehicle loans;

- Loan Amounts: $100-$35,000;

- Credit Needed: All credit scores accepted;

- Origination Fee: Varies by a lender;

- Late Fee: Varies by a lender;

- Early Payoff Penalty: Varies by lender.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

SimpleLoans123 overview

SimpleLoans123 is a place where you can find different lenders who are ready to provide personal loans of up to $35,000.

The best part is that you can apply for a loan online with SimpleLoans123, and the process is very easy and fast.

You can get the money you need in about a business day.

Loan Terms

If you’re looking to borrow money from SimpleLoans123, you’ll have the flexibility to choose a repayment period that works for you, with options of up to 60 months.

However, most lenders will show their terms, so then you’ll choose the option that works for you.

So, it’s important to keep in mind that each lender has its own renewal policy, which means the terms of each loan will be unique.

In conclusion, to make the best decision for your financial situation, make sure you carefully read the terms, fees, and credit score requirements of each lender’s offer.

Advertisement

Understanding Personal Loans

Personal Loans are very useful when you need money quickly for unexpected situations, such as covering emergency medical expenses or repairing your car after an accident.

Finally, it’s recommended only to borrow what you need and create a plan to pay back the loan on time to avoid accruing unnecessary debt.

SimpleLoans123: pros and cons

Like many other personal loan marketplaces, SimpleLoans123 gathers loans nationwide willing to offer short-term loans for unexpected expenses.

So, to review if this is the best option to find a legit lender for your needs, check out the advantages and disadvantages of SimpleLoans123 below.

Advertisement

Pros

- Diverse lender network: You can borrow from different lenders with diverse terms and conditions;

- Quick access to funds: Receive the money in about one business day;

- All credit scores are welcome: There is a lender waiting for you, even if you have bad credit;

- Online application: No need to leave home.

Cons

- Varied terms and fees;

- APR can be high.

Minimum credit score

SimpleLoans123 is a lender that offers loans to people regardless of their credit scores.

Unlike other lenders with strict rules for approving loans based on credit scores, SimpleLoans123 is more flexible and welcomes applicants with all credit scores.

Want to apply for the SimpleLoans123? We will help you!

Do you want to know how to apply for a loan through SimpleLoans123? Then check out our post below. Read on!

Apply for SimpleLoans123: Fast-track Approval

Unlock financial freedom! Apply for the SimpleLoans123 in just 3 steps with our easy-to-follow guide. Read on!

Trending Topics

Child and Adult Care Food Program (CACFP): Nutritious food care!

Grant nutrition meals for infants, children, and adults. The Child and Adult Care Food Program will provide the help you need!

Keep Reading

Learn to apply easily for the Flagstar Bank Mortgage

Learn how to apply for a Flagstar Bank Mortgage. Enjoy several loan options and affordable pricing! Keep reading to learn more!

Keep Reading

Happy Money Personal Loan review: how does it work and is it good?

Read the Happy Money personal loan review to understand how it works and how it might benefit you. Check it out!

Keep ReadingYou may also like

Southwest Rapid Rewards® Plus Credit Card application: how does it work?

Apply for the Southwest Rapid Rewards® Plus Credit Card faster and easier with our tips! Read on to learn how to apply!

Keep Reading

401 (k) plan: what is it and how does it work?

Learning what a 401(k) is will help you understand your rights and prepare for retirement. This article will get you well informed.

Keep Reading

Chase Ultimate Rewards partners: complete list

There are a number of Chase Ultimate Rewards partners for you to redeem your points with, but what’s the smartest way of doing it?

Keep Reading