Reviews

R.I.A. Federal Credit Union Mastercard® Classic Card review

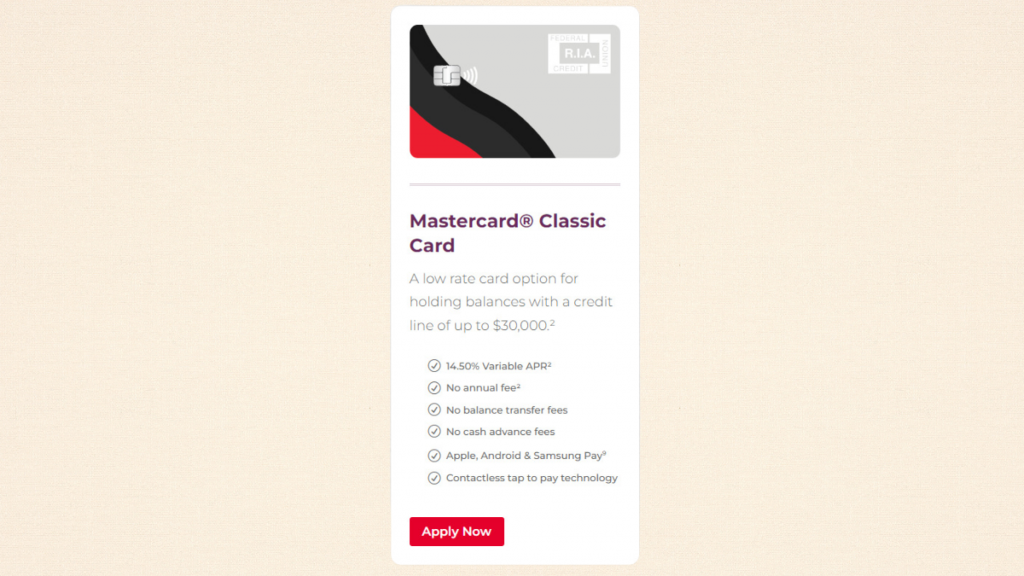

With a variable APR of 14.00%, no annual fee, and contactless payment technology, this card could be a solid choice for your financial needs.

Advertisement

Pay no hidden fees – convenient banking!

If you’re in the market for a credit card with a good rewards program and no annual fee, you might want to consider the R.I.A. Federal Credit Union Mastercard® Classic Card.

Apply R.I.A. Credit Union Mastercard® Classic

Ready to take control of finances? Learn how to apply for the R.I.A. Federal Credit Union Mastercard® Classic Card today – $0 annual fee!

Furthermore, this card offers a number of attractive features, including contactless tap-to-pay technology and compatibility with popular mobile payment apps. So, check out!

- Credit Score: 680 or higher (good to excellent);

- Annual Fee: $0;

- Purchase APR: 14.50% Variable APR;

- Cash Advance APR: None;

- Welcome Bonus: None;

- Rewards: None.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

R.I.A. Federal Credit Union Mastercard® Classic Card: how does it work?

Indeed, the R.I.A. Federal Credit Union Mastercard® Classic Card is a standard credit card that allows you to make purchases at any merchant that accepts Mastercard.

It also offers contactless tap-to-pay technology, which allows you to make purchases simply by tapping your card on a compatible payment terminal.

In addition, this card is compatible with popular mobile payment apps like Apple, Android, and Samsung Pay, so you can easily make purchases using your smartphone.

R.I.A. Federal Credit Union Mastercard® Classic Card: should you get one?

If you’re considering the R.I.A. Federal Credit Union Mastercard® Classic Card, it’s important to weigh the pros and cons before making a decision.

While this card offers a number of benefits, there are also some potential drawbacks to consider.

So, take a closer look at the pros and cons of this credit card to help you decide if it’s the right choice for you.

Advertisement

Pros

- No annual fee: indeed, this card doesn’t charge an annual fee, which makes it a great option for those who want to save money on credit card fees;

- Contactless tap-to-pay technology: The contactless feature allows for a quick and easy checkout process without having to swipe or insert your card;

- Compatible with mobile payment apps: This card works with popular mobile payment apps like Apple, Android, and Samsung Pay, which makes it easy to make purchases with just your smartphone.

Cons

- No welcome bonus: This card doesn’t offer a welcome bonus, which may be a drawback for some consumers who are looking for immediate rewards for signing up.

Advertisement

Credit score required

Besides, to be eligible for the R.I.A. Federal Credit Union Mastercard® Classic Card, you’ll need a credit score of 680 or higher.

If your credit score is lower than this, you may want to consider other credit card options that are more geared toward consumers with fair or poor credit.

R.I.A. Federal Credit Union Mastercard® Classic Card application: how to do it?

If you’re interested in applying for the R.I.A. Federal Credit Union Mastercard® Classic Card, the process is indeed straightforward.

So in this “how to apply” guide below, we’ll walk you through the steps to apply for this credit card and provide tips to help you maximize your chances of being approved.

Furthermore, if you’re ready to start the application process, read on to learn more!

Apply R.I.A. Credit Union Mastercard® Classic

Ready to take control of finances? Learn how to apply for the R.I.A. Federal Credit Union Mastercard® Classic Card today – $0 annual fee!

Trending Topics

Aeroplan® Credit Card review: Up to 60,000 bonus points

This Aeroplan® Credit Card review is your one-stop for information about this card. Earn up to 3X points on every purchase! Read on!

Keep Reading

Hawaiian Airlines® World Elite Mastercard® Review: earn more

Learn if the Hawaiian Airlines® World Elite Mastercard® is your dream vacation key in our review. Up to 3 miles on purchases and much more!

Keep Reading

Delta SkyMiles® Gold Business American Express Card review

Here is the Delta SkyMiles® Gold Business American Express Card review to help you understand how it works. Keep reading!

Keep ReadingYou may also like

What is APR in credit cards: understand how it works

Learn what is APR in credit cards and why is essential to avoid extra fees and save some money. Keep reading to know more!

Keep Reading

Blue Cash Everyday® Card from American Express: easily apply

Get your Blue Cash Everyday® Card from American Express easily with our guide - Read now to learn how to apply! 0% intro APR for 15 months!

Keep Reading

Quontic Bank High Interest Checking application: how does it work?

Maximize your banking benefits with the Quontic Bank High Interest Checking account. Earn APY and free over 90K free ATMs. Keep reading.

Keep Reading