You can find a loan online to buy or refinance your dream house with a Rocket Mortgage!

Rocket Mortgage: Discover what the pioneers in online mortgage have to offer!

Advertisement

Rocket Mortgage is a lender that offers an online platform for borrowers in the United States. It provides easy access to compare rates, learn more about mortgages and apply for loans from 15-30 years. They have conventional or government-backed FHA/VA financing options available. You can buy your new home with a very low 3% down payment so you won’t go house poor.

Rocket Mortgage is a lender that offers an online platform for borrowers in the United States. It provides easy access to compare rates, learn more about mortgages and apply for loans from 15-30 years. They have conventional or government-backed FHA/VA financing options available. You can buy your new home with a very low 3% down payment so you won’t go house poor.

You will remain in the same website

Find out the main perks of applying for a Rocket Mortgage. Check them out!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

In today's digital age, the home buying process has been revolutionized by platforms like Rocket Mortgage.

As one of the premier online mortgage lenders, Rocket Mortgage offers a blend of speed, efficiency, and digital convenience.

However, as with any service, there are both advantages and considerations to mull over.

Strengths and Special Offerings

- Digital Convenience: Bid farewell to stacks of paper and time-consuming visits to the bank. Rocket Mortgage offers a streamlined online application process that can be completed from the comfort of your home.

- Instant Verification: With its advanced platform, it can verify your assets, income, and credit almost instantaneously, speeding up the loan approval process.

- Customizable Loan Options: Whether it’s a fixed-rate or an adjustable-rate mortgage, Rocket Mortgage provides a wide array of loan options tailored to various financial situations.

- Transparent Fees: With its straightforward layout, the platform breaks down all fees, ensuring you understand where every penny goes.

- Award-Winning Client Service: Recognized for its customer service excellence, Rocket Mortgage ensures that expert help is just a chat or call away.

Limitations to Consider

- Less Personal Interaction: Those accustomed to face-to-face interactions might find the digital-first approach less personal.

- Not Always the Lowest Rates: While competitive, Rocket Mortgage might not always offer the lowest interest rates in the market.

- Potential for Overwhelming Options: The vast array of loan options, while comprehensive, might be confusing for first-time homebuyers.

- No Physical Branches: If you’re someone who prefers discussing financial matters in person, the lack of physical branches might be a downside.

- Not Ideal for Complex Financial Situations: People with complicated financial backgrounds might benefit from a more traditional lender who can provide specialized guidance.

Rocket Mortgage is undeniably at the forefront of modern home financing, offering unparalleled digital convenience.

While it’s an excellent fit for many, prospective borrowers should evaluate their preferences and needs to determine if this digital powerhouse aligns with their home buying journey.

A Rocket Mortgage will not hurt your credit score but might lower it after they check it. However, Rocket Mortgage can improve your credit score after some time because it shows that you can handle credit responsibly. Remember, the higher your credit score, the lower your interest rate will be on future loans. So if you're considering buying a home soon, a Rocket Mortgage is definitely the way to go.

Rocket Mortgage offers a variety of loan types, including Purchase, Refinance, Jumbo, Fixed, Adjustable, FHA, and VA loans. You can also use Rocket Mortgage to get pre-approved for a mortgage.

Yes. The Rocket Mortgage mobile app makes it easy to apply for a mortgage on your phone or tablet. You can complete your mortgage application in minutes, and you can track the progress of your loan application 24/7.

Yes. The Rocket Mortgage mobile app gives you access to powerful mortgage tools and calculators to help you find the right mortgage for your needs. So if you're looking for a fast, easy, and convenient way to apply for a mortgage, check out the Rocket Mortgage mobile app.

To get a Rocket Mortgage, you'll need to be a U.S. citizen or permanent resident and have a valid social security number. You'll also need to be at least 18 years old and have a steady source of income. Finally, you'll need a good credit history and meet certain debt-to-income requirements.

How to apply for Rocket Mortgage

Find out how to apply for a Rocket Mortgage with us. Keep reading to find the tips you need.

If you want to learn about other loan options, consider SoFi Mortgage. It can help you save money on your monthly payments and get you into a home sooner.

Plus, there are no origination fees or prepayment penalties, and SoFi has some of the lowest rates in the industry.

So, if you're looking for a hassle-free mortgage experience with competitive interest rates and flexible terms, then a SoFi mortgage is the right choice. Have a look at the application process below.

How to apply for SoFi Mortgage

Do you want to apply for a mortgage with SoFi mortgage? Read on to a complete guideline that covers all you need to know.

Trending Topics

Aspire® Cash Back Rewards Mastercard review

Is this credit card the best option to beat your ruined credit? Find out the Aspire® Cash Back Rewards Mastercard review.

Keep Reading

First Progress Platinum Prestige Mastercard® Secured Credit Card application

Looking for a card for bad credit? Read more to learn about the First Progress Platinum Prestige Mastercard® Secured Credit Card application!

Keep Reading

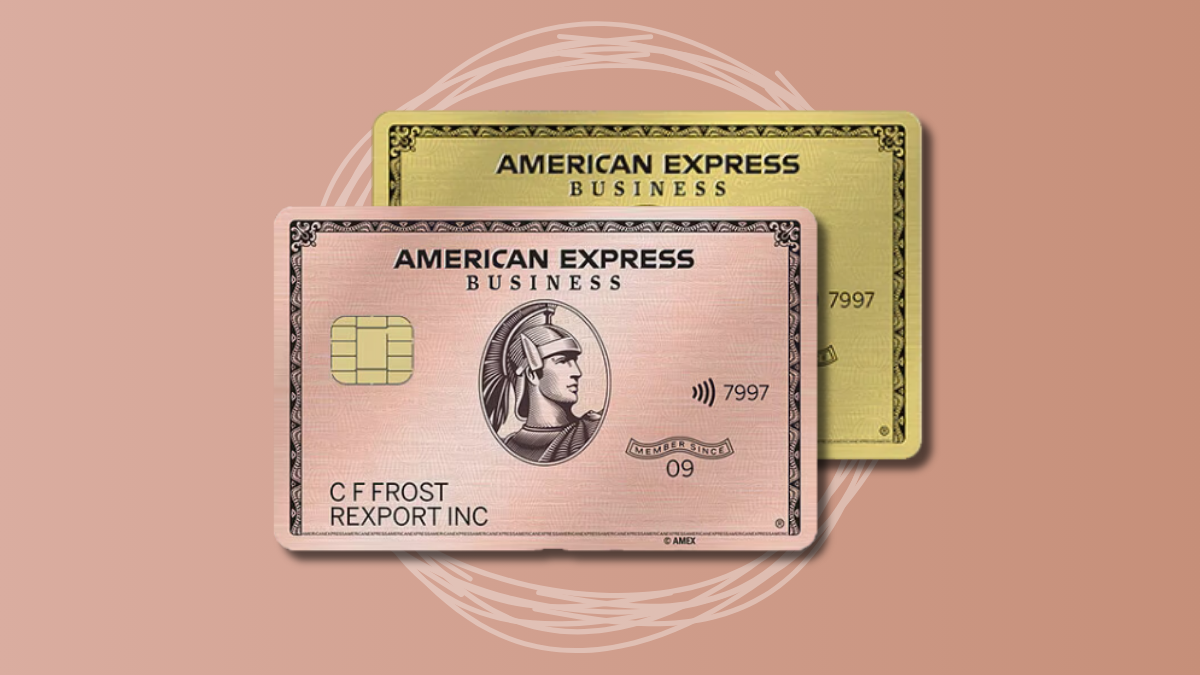

Gold benefits: American Express® Business Gold Card review

Read our American Express® Business Gold Card review and discover why this card is a must-have! Earn 70k bonus points and more!

Keep ReadingYou may also like

How to create a weekly budget that works for you in 10 steps

Do you find it hard to stick to a budget? Check out these 10 tips on how to create a weekly budget that will work for you!

Keep Reading

A 101 guide on how to invest your money: tips for beginners

Do you want to know how to invest your money? This article is for you! Here you will learn more and find easy tips to start investing.

Keep Reading

Condo vs. apartment: the pros and cons

Understand the difference between condo vs. apartments, and learn what to consider before choosing one of them. Read on!

Keep Reading