Get pre-approved without impacting your credit score!

Rocket Loans: Up to $45,000 in loans approved at lightspeed

Advertisement

Rocket Loans has some attractive features for those who need money fast but have fair credit scores. They offer competitive rates and quick approval times, which makes them ideal for those who don’t want to waste time going through traditional banks or lenders who take weeks or months to approve loans. All in all, Rocket Loans is definitely worth considering if you’re looking for an unsecured personal loan quickly! You can qualify for up to $45,000 and use it for several purposes!

Rocket Loans has some attractive features for those who need money fast but have fair credit scores. They offer competitive rates and quick approval times, which makes them ideal for those who don’t want to waste time going through traditional banks or lenders who take weeks or months to approve loans. All in all, Rocket Loans is definitely worth considering if you’re looking for an unsecured personal loan quickly! You can qualify for up to $45,000 and use it for several purposes!

You will remain in the same website

Don't waste time dealing with traditional banks. Take advantage of all that Rocket Loans personal loans. Check out the benefits below!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Meet Rocket Loans, your digital companion in navigating the financial seas.

With an aim to fuel your aspirations, Rocket Loans offers a streamlined, online platform where acquiring personal loans is no longer a rocket science but a smooth sail.

Strengths and Special Offerings

- Quick and Easy Application: Dive into a user-friendly platform where applying for a loan is as simple as 1-2-3. A few clicks, and you’re well on your way to financial empowerment.

- Speedy Fund Disbursement: In a financial pinch? Rocket Loans lives up to its name, offering lightning-fast approval and fund disbursement, often on the same day of application.

- Transparent Terms: Clarity is key. Enjoy transparent loan terms with clear interest rates and repayment schedules, ensuring you’re well-informed every step of the way.

- Versatile Loan Options: Whether it’s home renovation or debt consolidation, Rocket Loans offers a spectrum of loan purposes, catering to diverse financial needs.

- Credit Building Potential: Timely repayments could potentially reflect positively on your credit score, building a foundation for your financial future.

- Educational Resources: Empower your financial journey with access to a wealth of educational resources, helping you make informed decisions.

Limitations to Consider

- Fees on the Horizon: Stay vigilant of the origination fees, which can add to the overall cost of the loan.

- Limited Loan Amount Range: With a range of $2,000 to $45,000, the loan amounts may not cater to all, especially those seeking higher loan values.

- Higher Interest Rates for Lower Scores: Individuals with lower credit scores may face higher interest rates, making the borrowing costlier.

- No Secured Loan Option: The absence of secured loan options may limit the borrowing choices for individuals who prefer leveraging assets for lower rates.

Rocket Loans emerges as a beacon of financial solutions, offering a seamless, transparent, and swift lending experience.

While the vigilant borrower should consider the associated fees and interest implications, the versatility, educational support, and credit-building potential position Rocket Loans as a worthy companion in your financial voyage.

Ready to launch your dreams? Rocket Loans is on the launchpad!

You can use Rocket Loans personal loans for a variety of purposes, such as debt consolidation, home improvement, or medical expenses. However, the loan amount cannot be used for student loans or illegal activities.

Rocket Loans offers personal loans from $2,000 to $45,000. The amount you can borrow depends on a number of factors, including your credit score and income.

Rocket Loans have an APR range of 9.116% - 29.99%. Keep in mind that this is just an estimate and that your actual APR may vary depending on a number of factors, including your credit score.

Rocket Loans offers personal loans in 47 states. Loans are not available in Iowa, Nevada, or West Virginia.

Rocket Loans requires a credit score of 640 or higher for a personal loan. This is to ensure that you have a good borrowing history and are likely to repay your loan on time. You can learn about other requirements in our application guide post below.

Learn to apply easily for Rocket Loans

Learn how to apply for Rocket Loans and take control of your finances today! Borrow up to $45K and receive it in one business day!

Here is a second personal loan alternative to compare: Prosper Personal Loan. They also offer competitive rates, combining multiple loans into one application if necessary! Qualify for up to a whopping $50K.

Discover an unbeatable financial solution fit for you today – read on and see why we're so highly rated, and learn how to make your application easily. Check out our post as follows!

How to apply for Prosper Personal Loan

Find out how to apply for the Prosper Personal Loan and quickly get the money you need. Read on!

Trending Topics

ClearMoneyLoans.com review: how does it work and is it good?

Get to know a personal loan lender platform that accepts different credit scores. Read on to a ClearMoneyLoans.com review.

Keep Reading

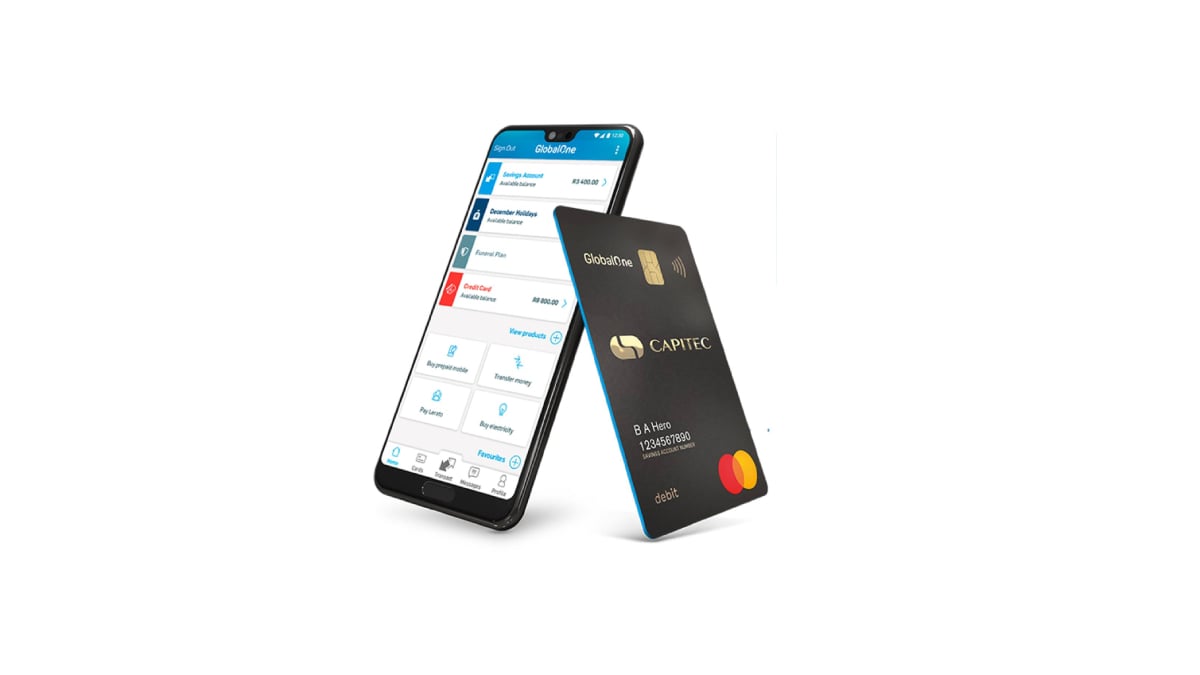

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep Reading

Reflex® Platinum Mastercard® credit card review: is it worth it?

The Reflex® Platinum Mastercard® credit card is a solid choice for anyone looking to rebuild their credit scores. Learn more in our review!

Keep ReadingYou may also like

What is a checking account and how can it benefit you: find out here!

A checking account can offer you convenience, security, and flexibility - find out what is a checking account and get the best one!

Keep Reading

What credit score do you start with?

Want to know what credit score you start with when opening a new account? Here's all you need to know about.

Keep Reading

What is the lowest credit score possible?

What is the lowest credit score possible? Learn about factors impacting credit scores and find out how to improve yours. Read on!

Keep Reading