Reviews

Petal 2 “Cash Back, No Fees” Visa Credit Card review

Find out why this credit card is a great option for building your credit. It has no annual fee and offers Cash back on purchases. Read our Petal 2 "Cash Back, No Fees" Visa Credit Card review to find out more!

Advertisement

Petal 2 “Cash Back, No Fees” Visa Credit Card: A solid option to build your credit without fees!

Are you looking for a Petal 2′ “Cash Back, No Fees” Visa Credit Card review? Here you go! With no annual or other fees, it’s perfect for those who want to make their money work harder.

How to apply for Petal 2 Visa Credit Card

Do you know how to apply for the new Petal 2 "Cash Back, No Fees" Visa Credit Card? Read our step-by-step guide on how to go through the process.

Let’s explore all the great features of Petal 2 and why it’s a different kind of credit card. Stay tuned!

- Credit Score: Excellent/Good/Limited/No Credit;

- Annual Fee: No annual fee;

- Regular APR: 17.99% – 31.99% variable;

- Welcome bonus: No welcome bonus;

- Rewards: Up to 1% cash back on eligible purchases. Up to 1.5% cash back on eligible purchases after making 12 on-time monthly payments.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Petal 2 “Cash Back, No Fees” Visa Credit Card: how does it work?

The Petal 2 “Cash Back, No Fees” Visa Credit Card is a suitable alternative for improving their scores without paying fees. Let’s have a look at it.

APR and Cash back

Petal 2 offers competitive variable APRs ranging from 17.99% – 31.99%.

With up to 1.5% cash back on eligible purchases after making 12 on-time monthly payments.

Plus, with 1% cash back on eligible purchases right away, you’re sure to get more out of your bucks.

Plus, you can get even more Cash back at select merchants with 2% – 10% cash back rewards.

Advertisement

Credit Limits & Credit Building

Not only does Petal 2 offer great rewards, but it also comes with a $300 – $10,000 credit limit.

And that makes it the perfect option for those looking to build their credit score or establish a new one.

Additionally, Petal reports to all three major credit bureaus so you can easily track your progress as your credit score improves over time.

Other features

Petal 2 “Cash Back, No Fees” Visa Credit Card connects to Apple Pay® or Google Pay™, so you don’t need to carry it.

Also, the app regularly shows your credit score, so it’s easy to track it. Lastly, you can set spending limits to save more money.

Advertisement

Petal 2 “Cash Back, No Fees” Visa Credit Card: should you get one?

Pros

- No fees whatsoever. No late fee, foreign transaction fee, annual fee, or any-other-kind-of-fee, fee.

- Variable APRs range from 17.99% – 31.99%

- Up to 1.5% cash back on eligible purchases after making 12 on-time monthly payments.

- 1% cash back on eligible purchases right away

- 2% – 10% cash back at select merchants $300 – $10,000 credit limits

- No credit score? No problem. If eligible, we’ll create your Cash Score instead.

- See if you’re pre-approved within minutes without impacting your credit score.

- Build credit alongside hundreds of thousands of Petal card members.

- Petal reports to all 3 major credit bureaus.

- No deposits required

- Card issued by WebBank

Cons

- No intro APR;

- No welcome bonus.

Credit score required

The Petal 2 “Cash Back, No Fees” Visa Credit Card doesn’t hurt your score by checking it. Applicants must have average to excellent credit scores to apply.

Petal 2 “Cash Back, No Fees” Visa Credit Card application: how to do it?

Discover how to get your Petal 2 “Cash Back, No Fees” Visa Credit Card, and never worry about paying fees again.

Check out our application post below.

How to apply for Petal 2' "Cash Back, No Fees"

Do you know how to apply for the new Petal 2 "Cash Back, No Fees" Visa Credit Card? Read our step-by-step guide on how to go through the process.

Trending Topics

High-yield savings vs. money market: find the best account for you

High-yield savings or money market? Find out the pros and cons and which account is best for saving your money. Keep reading!

Keep Reading

Cheap Delta Air Lines flights: flights from $79.99!

Delta Air Lines cheap flights: find out where you can explore! Enjoy comfort, safety, and affordable fares. Start planning your next trip!

Keep Reading

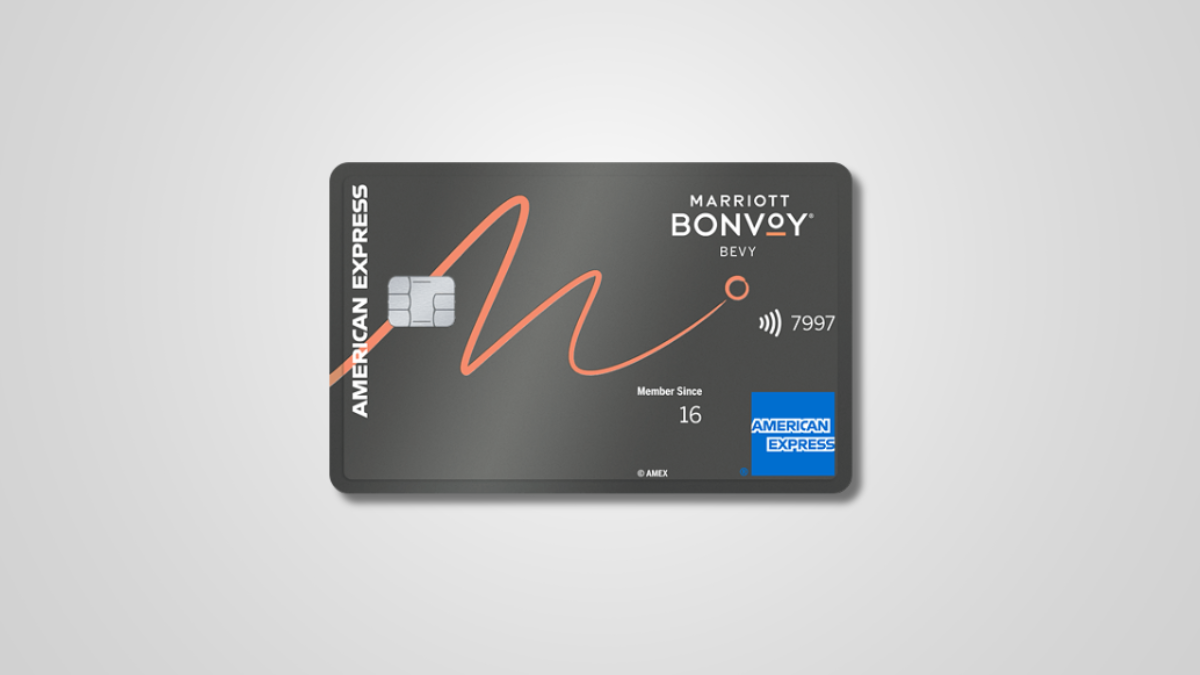

Marriott Bonvoy Bevy™ American Express® Card Review: Earn more

Check out our full review of the Marriott Bonvoy Bevy™ American Express® Card - earn 155,000 bonus points + elite benefits! Read on!

Keep ReadingYou may also like

What is APR in credit cards: understand how it works

Learn what is APR in credit cards and why is essential to avoid extra fees and save some money. Keep reading to know more!

Keep Reading

Bank of America Business Advantage Travel Rewards Card review

Get a full Bank of America Business Advantage Travel Rewards Credit Card review. Enjoy 0% intro APR for 9 months and much more!

Keep Reading

Aeroplan® Credit Card review: Up to 60,000 bonus points

This Aeroplan® Credit Card review is your one-stop for information about this card. Earn up to 3X points on every purchase! Read on!

Keep Reading