Reviews

opensky® Secured Visa® Credit Card review

A secured credit card that doesn't require a bank account or a credit check? The opensky® Secured Visa® Credit Card is perfect for consumers looking to build or boost their credit.

Advertisement

A simple and secure way to build credit!

If you have a bad credit score or no bank account, you may feel like you’re out of options when it comes to getting a credit line. But there is one option that may be worth considering: the opensky® Secured Visa® Credit Card!

There is no credit check needed to apply for this card, and it also doesn’t require a checking account. The card can be a powerful tool in repairing damaged credit.

| Credit Score | No credit, Poor, Fair |

| Annual Fee | $35 |

| Late Fee | Up to $41 |

| Regular APR | 24.64% variable APR for purchases and cash advances |

| Welcome bonus | None. |

| Rewards | Up to 10% cash back rewards. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

opensky® Secured Visa® Credit Card

When you apply for the opensky® Secured Visa® Credit Card, you’ll need to put down a security deposit. This will be your credit limit on the card. So, if you put down a $200 deposit, your credit limit will be $200.

The opensky® Secured Visa® has a 24.64% variable APR for purchases and cash advances. There is also a $35 annual fee, and you also get free access to your credit score.

One of the biggest benefits of this card is that it can help you rebuild your credit. OpenSky reports your payment history to all three major credit bureaus, so using this card responsibly can help improve your credit score over time.

But it also comes with a few drawbacks. First, it’s not a rewards card, so you won’t earn any points or cash back on your purchases. Second, there is a late payment fee up to $41.

opensky® Secured Visa® Credit Card: should you get one?

Overall, the card is a good option if you’re looking to rebuild your credit. The annual fee is relatively low, and you get free access to your credit score.

Plus, the card issuer reports your payment history to all three major credit bureaus, so using this card responsibly can help improve your credit rating over time.

- Earn up to 10% cash back on everyday purchases

- No credit check required – 89% approval rate with zero credit risk to apply!

- Boost your credit score fast—2 out of 3 opensky® cardholders see an average increase of 47 points after 6 months

- Track your progress with free access to your FICO® score in our mobile app

- Build your credit history with reporting to all three major credit bureaus: Experian, Equifax, and TransUnion

- Seamless payments—add your card to Apple Pay, Google Pay, and Samsung Pay

- Start with just $200—secure your credit line with a refundable deposit

- Fast and easy application—apply in minutes with our mobile-first experience

- Flexible payment options—pick a due date that works for you

- More time to fund—spread your security deposit over 60 days with layaway

- Join 1.6 million+ cardholders who have used opensky® to build better credit!

Advertisement

Credit score required

There is no credit score required to apply for this product. However, you’ll need to put down a security deposit when you apply for the card. The minimum security deposit is $200.

opensky® Secured Visa® Credit Card application: how to do?

If you’re interested in applying for the opensky® Secured Visa® Card, you can apply online or by phone. You’ll need to provide some basic information, including your name, address, and Social Security number.

Keep reading to learn the details of the application process.

Advertisement

Apply online

The online application process for the opensky® Secured Visa® Credit Card could not be simpler. Just go to the OpenSky website and click on “Apply Now.”.

You will need to provide some personal information, like your name, address, and Social Security number.

You will also need to provide information about your employment and your income. OpenSky will review your credit history and determine whether you are eligible for the card.

If you are approved, you will need to provide a security deposit in order to get the product.

Once you have been approved, OpenSky will send you your new secured Visa card in the mail. You can start using it as soon as you receive it!

Keep in mind that this is a secured card, so you should only use it for emergencies or occasional purchases.

If you use the opensky® Secured Visa® Credit Card responsibly, you can start rebuilding your credit history and improve your credit score.

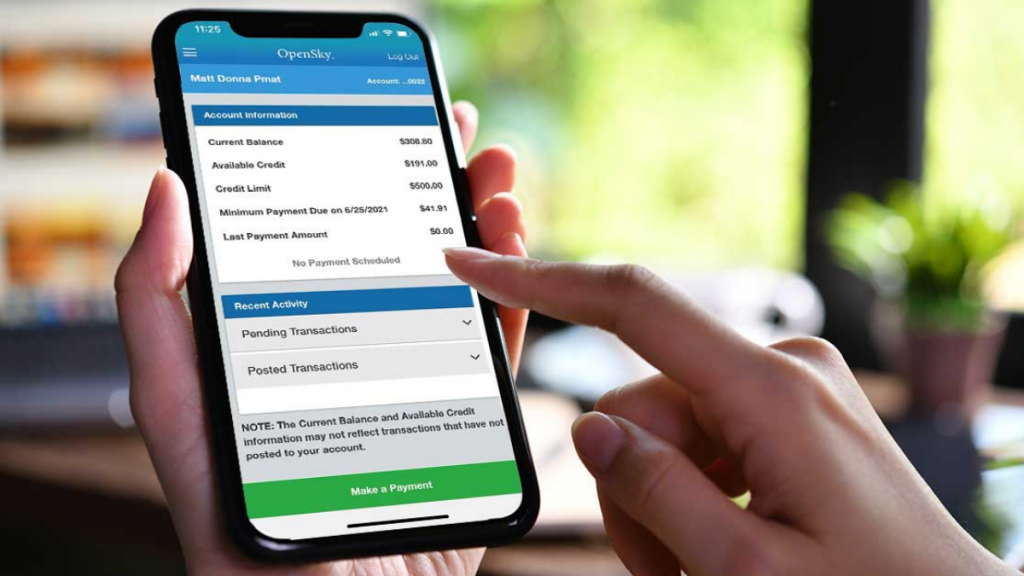

Apply using the app

OpenSky provides a mobile app for customers to manage their accounts.

You can activate your card on their website and use the application on your phone to view recently posted transactions and make payments. You can even check your next payment date and minimum payment due.

However, the application process is available only on their website.

opensky® Secured Visa® Credit Card vs. Assent Platinum Secured credit card

If you’re unsure whether the OpenSky Secured Visa is the best option for you, we brought another option. The Assent Platinum Secured card offers a low ongoing APR rate and is a great alternative to help you rebuild your credit history!

So check the comparison between the two cards below and follow the recommended link for the Assent credit card application process!

| opensky® Secured Visa® Credit Card | Assent Platinum Secured credit card | |

| Credit Score | No credit | Bad – Fair |

| Annual Fee | $35 | $49 |

| Regular APR | 24.64% variable APR for purchases and cash advances | 12.99% variable |

| Welcome bonus | N/A | N/A |

| Rewards | Up to 10% cash back rewards on purchases at over 40,000 retailers (see terms and conditions) | None |

Learn how to apply for the Assent Platinum Secured

Learn how to apply for Assent Platinum Secured, a card with no credit history required and that helps you build your credit score!

Trending Topics

Learn to apply easily for Rocket Loans

Learn how to apply for Rocket Loans and take control of your finances today! Borrow up to $45K and receive it in one business day!

Keep Reading

Costco Anywhere Visa® Business Card by Citi review

The Costco Anywhere Visa® Business Card by Citi review will help you decide if it's the right card for your business. Read on!

Keep Reading

High-yield savings vs. money market: find the best account for you

High-yield savings or money market? Find out the pros and cons and which account is best for saving your money. Keep reading!

Keep ReadingYou may also like

Calm App review: Find relaxation to your anxious mind

Anxious? Stressed? Can't seem to find peace? Check out our Calm app review and learn how to relax finally. Read on!

Keep Reading

Pick a Lender Personal Loan review: how does it work and is it good?

Looking for a financial boost? Then read this Pick a Lender Personal Loan review and find out! Get up to $40K in no time!

Keep Reading

Consolidate Your Debt with Confidence: Best Loans

Discover if debt consolidation loans are right for you and learn all about the benefits, drawbacks, and options available. Keep reading!

Keep Reading