Credit Cards

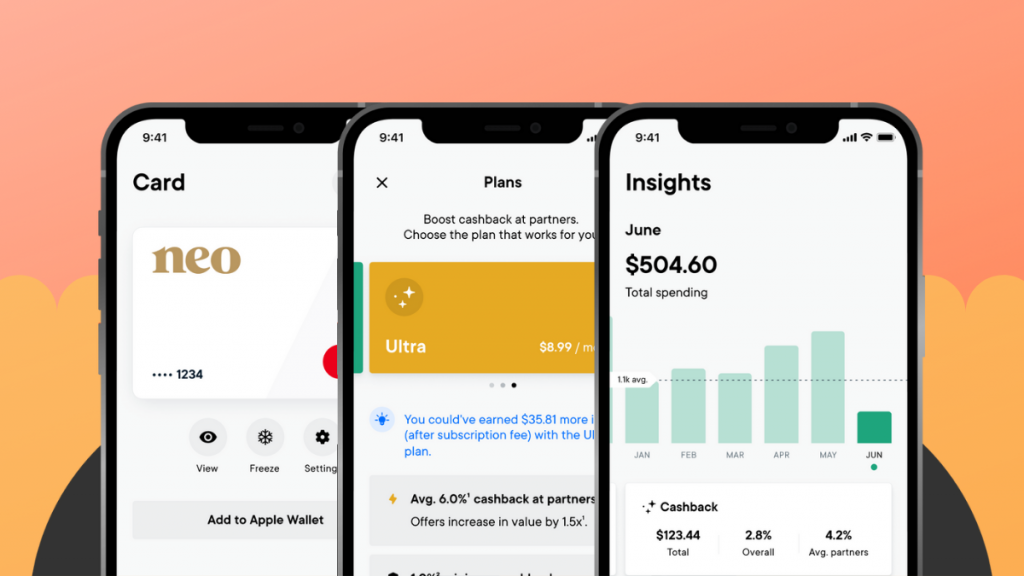

Neo Credit Card review: Up to 15% cashback on first-time purchases!

The Neo Credit Card offers an exceptional blend of benefits for modern consumers: high cashback rewards, no annual fees, and a user-friendly digital platform. Perfect for those seeking value and convenience.

Advertisement

Earn More with ZERO annual or monthly fees!

Are you tired of outdated banking services not delivering what you deserve? The Neo Credit Card is here to change that. With great benefits, the card is a game-changer.

Check our comprehensive review to learn eveything there is to know about this financial solution, and how it can benefit you on the long run.

How do you get the Neo Credit Card?

Learn how to apply for the Neo Credit Card and enjoy exclusive perks without the common fees!

- Credit Score: You need a fair to good credit score to become eligible for this card.

- Annual Fee: There are no annual or monthly fees attached to the Neo Credit Card.

- Regular APR: A variable between 19.99% and 29.99%.

- Welcome bonus: Get up to a 15% cash back on your first purchase with Neo’s partners.

- Rewards: Get up to 5% cash back on selected purchases at Neo’s partners.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Neo Credit Card: how does it work?

The Neo Credit is a fantastic alternative for Canadians who love cashback rewards. It’s even better without the hussle of annual or maintenance fees.

This card offers a flat 1% cashback rate on daily purchases, but you can spice things up. Using your card to pay for selected purchases can give you up to 5% back.

Newcomers can also take advantage of a 15% rebate on first-time purchases with Neo’s participating partners. New offers are constantly added to the app.

Neo also offers a premium subscription at $4.99 a month. This plan will boost your cashback rewards to 3% and gives you access to other exclusive perks.

Neo Credit Card: should you get one?

The Neo Credit Card benefits are plenty. However, and as with any financial products, there are potential drawbacks to consider before applying.

Advertisement

Pros

- The card offers significant cashback rewards, particularly at partner stores.

- This makes it a cost-effective choice for those who want to avoid additional yearly charges.

- The streamlined, digital application process allows for quick and convenient approval, which is ideal for those who need a credit card without a lengthy waiting period.

- The Neo app provides an easy-to-use interface for managing the card, tracking spending, and viewing cashback rewards.

- The card includes modern security features to protect against fraud and unauthorized transactions.

Cons

- Being primarily digital, it lacks traditional branch support, which some users might miss.

- May carry higher interest rates compared to some other cards, increasing costs for those who carry balances.

- Maximum cashback rewards are attached to spending at specific partner stores, which might not align with everyone’s shopping habits.

Advertisement

Credit scores required

The Neo Credit Card is accessible, often accepting applicants with a variety of credit scores. It’s suitable for those with fair credit rebuilding their score.

Neo’s flexible credit score requirements cater to a broader audience. This inclusivity makes the card an appealing option for many consumers.

Neo Credit Card application: how to do it?

Begin your financial journey with the Neo Credit Card, known for its rewarding features and ease of use. Our detailed guide below outlines the simple steps to apply for it.

How do you get the Neo Credit Card?

Learn how to apply for the Neo Credit Card and enjoy exclusive perks without the common fees!

Trending Topics

Capital One Venture Rewards Credit Card review: is it worth it?

Wondering if Capital One Venture Rewards Credit Card is worth it? It has excellent benefits for travelers. Check the pros and cons here!

Keep Reading

Navy Federal Visa Signature® Flagship Rewards Review: earn points

Discover the perks of the Navy Federal Visa Signature® Flagship Rewards in this review. $0 annual fee in the 1st year + rewards!

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep ReadingYou may also like

Application for the Upgrade Bitcoin Rewards Visa®: how does it work?

To get into the cryptocurrency market, apply for an Upgrade Bitcoin Rewards Visa® and start receiving your cashback as Bitcoin.

Keep Reading

HSBC Premier Checking review: Is the 75,000 minimum balance worth it?

This HSBC Premier Checking review brings a scoop on account details, benefits, drawbacks, and more. Open your account for free. Read on!

Keep Reading

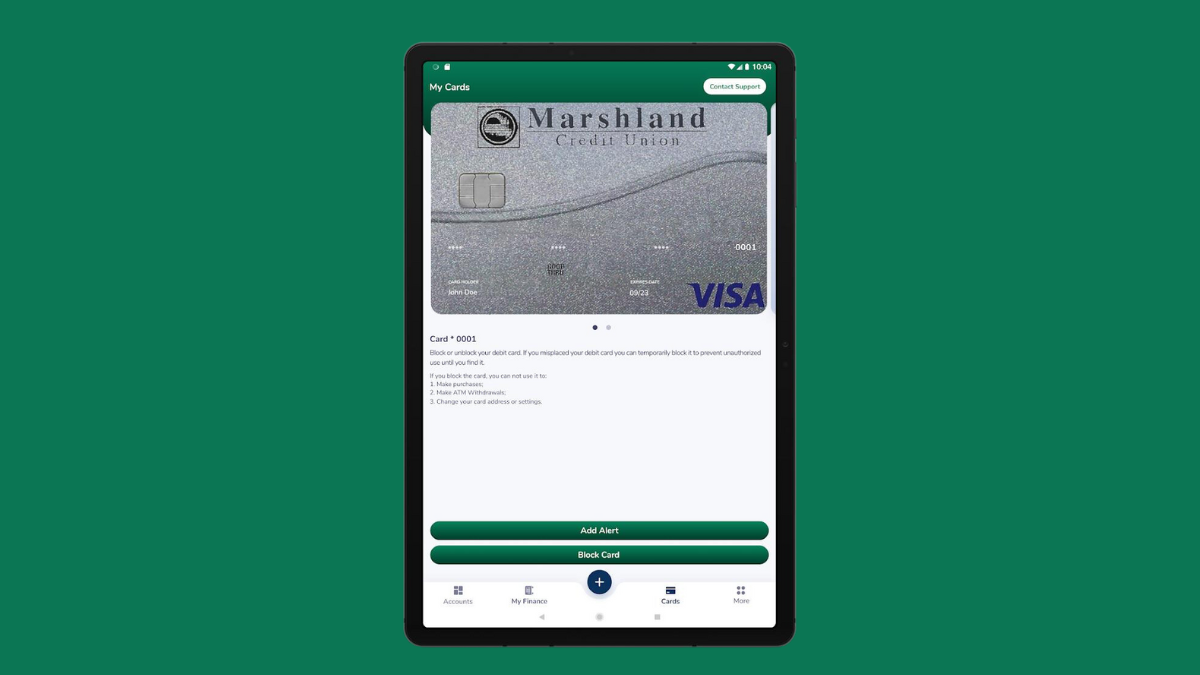

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading