Credit Cards

Macy’s Credit Card Review: enjoy amazing benefits

If you adore Macy's, applying for their credit card is a no-brainer. Discover how to enjoy discounts in our Macy's Credit Card review. Keep reading!

Advertisement

All information about Macy’s Credit Card has been collected independently by The Mad Capitalist.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Combine your love for fashion with savvy shopping

If you’re looking for a store credit card with decent rewards and no annual fee, this Macy’s Credit Card review might catch your eye.

Macy's Credit Card: Quick and Easy Way to Apply

Learn to apply for Macy's Credit Card, enjoy exclusive perks, and compare it with Torrid for smart shopping choices. Keep reading!

In this post, we’ll break down the key details, pros, and cons to help you decide if this card fits you. Keep reading!

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: 31.99% (Variable);

- Cash Advance APR: 31.99% (Variable);

- Welcome Bonus: 20% off on your $100 on purchases in the first two days of account;

- Rewards: 3 % back in rewards at restaurants (delivery included), 2% at gas stations and supermarkets, and 1% in everything else.

Macy’s Credit Card: how does it work?

First, let’s talk about the basics. Macy’s Credit Card is designed for individuals with good to excellent credit scores.

The good news is that it comes with no annual fee, so it is an attractive option for budget-conscious shoppers.

However, it’s important to note that the purchase APR and cash advance APR are both set at a high 31.99% (Variable).

Advertisement

Welcome Bonus and Rewards

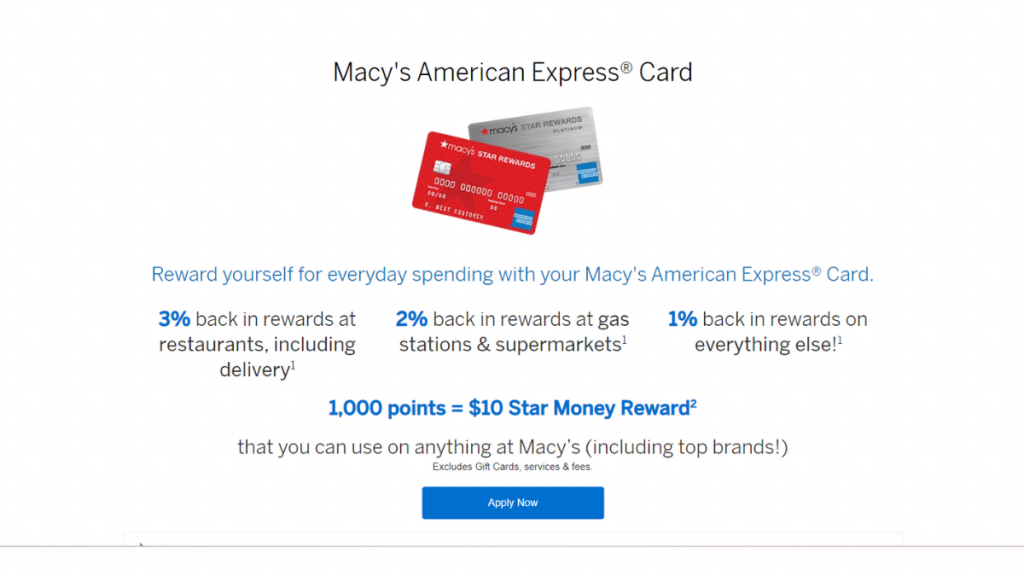

One of the perks of getting a Macy’s American Express® Card is the welcome bonus.

You can enjoy a 20% discount on your first $100 purchases for two days after opening your account.

As for ongoing rewards, you’ll earn 3% back in rewards at restaurants (including delivery), 2% at gas stations and supermarkets, and 1% on all other purchases.

Different Versions

Macy’s Credit Card comes in two types: the regular Macy’s Credit Card and Macy’s Credit Card from American Express.

Both cards offer rewards on your purchases, but here’s the catch. The Amex version can be used anywhere American Express is accepted.

At the same time, the regular Macy’s Credit Card is limited to Macy’s stores.

Advertisement

Macy’s Credit Card: should you get one?

This card could be a great fit if you’re a loyal Macy’s shopper and want to earn rewards on your purchases.

The Amex version offers even more rewards and perks, such as presale tickets to shows and travel upgrades.

Also, 1,000 points from the Amex version are equivalent to $10 in Star Money rewards to use at Macy’s or other stores.

Just remember that Star Money is valid for 30 calendar days from issuance.

Further, let’s review Macy’s American Express® Card pros and cons.

Pros

- No annual fee;

- Opportunity to earn rewards on Macy’s purchases;

- Welcome bonus for new cardholders.

Cons

- High APR (31.99% Variable);

- Limited usability for the regular Macy’s Credit Card.

Credit score required

Indeed, you should have a good to excellent credit score to qualify for the Macy’s Credit Card.

Macy’s Credit Card application: how to do it?

Apply for the Macy’s Credit Card in our post below. So keep reading for complete instructions.

Macy's Credit Card: Quick and Easy Way to Apply

Learn to apply for Macy's Credit Card, enjoy exclusive perks, and compare it with Torrid for smart shopping choices. Keep reading!

Trending Topics

How to build credit to buy a house: 10 best tips

Here are the best tips on how to build credit to buy a house and get approved for that mortgage loan. Read on!

Keep Reading

Southwest Rapid Rewards® Plus Credit Card application: how does it work?

Apply for the Southwest Rapid Rewards® Plus Credit Card faster and easier with our tips! Read on to learn how to apply!

Keep Reading

How to build credit fast from scratch with our tips for beginners!

Learn how to build credit and get the best offers from lenders and credit card issuers. This can make a difference in achieving your plans.

Keep ReadingYou may also like

Milestone® Mastercard® Review: Boost your credit

Read the Milestone® Mastercard® review to find out if it is right for you. Take a look at its features, benefits, and drawbacks.

Keep Reading

Milestone Mastercard – Unsecured For Less Than Perfect Credit review

Here is a credit card to improve your score: Check out this Milestone Mastercard - Unsecured For Less Than Perfect Credit review. Read on!

Keep Reading

How to buy cheap Southwest Airlines flights

Get the scoop on how you buy cheap Southwest Airlines the next time you travel. Find where to look and how to save your cash. Read on!

Keep Reading