Credit Cards

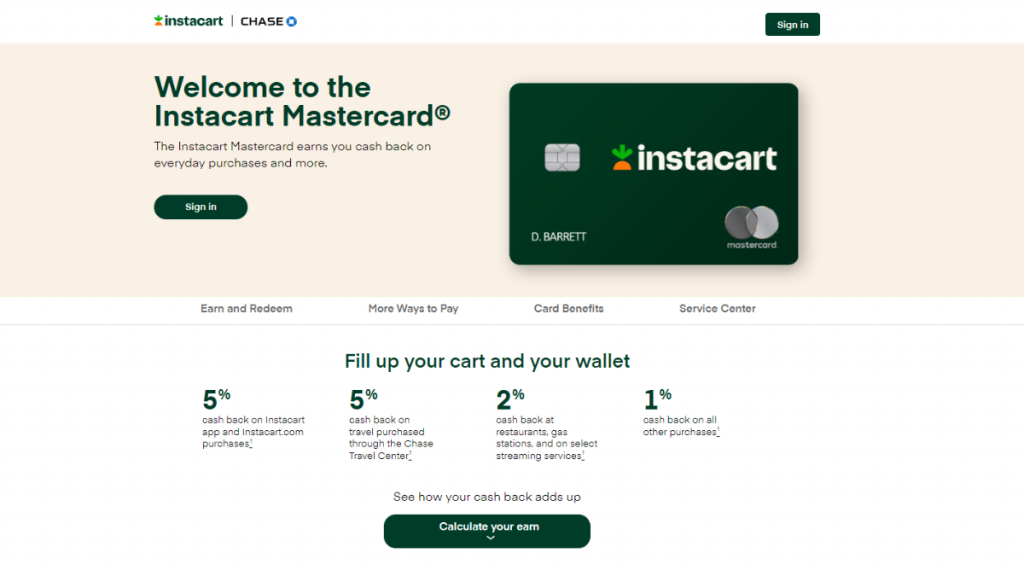

Instacart Mastercard® Review: Shop, Earn, Save!

Access the best deals and rewards while shopping with Instacart. Our Instacart Mastercard® review has got you covered! Pay $0 annual fee!

Advertisement

Cashback guarantee on all your purchases!

Boost your shopping experience with up to 5% cash back with the Instacart Mastercard® – the card under our review.

Apply for Instacart Mastercard® today

Apply for the Instacart Mastercard® quickly with our guide. Elevate your grocery shopping experience and enjoy exclusive rewards. Read on!

What’s more in it for you? Learn how it works, its fees, and cash back redemption options on travel, groceries, and more. Keep reading!

- Credit Score: Good – Excellent;

- Annual Fee: None;

- Purchase APR: 20.24%–28.99% (variable);

- Cash Advance APR: 29.99% (variable);

- Welcome Bonus: Get a free year of Instacart + (Instacart membership) and $100 free Instacart credit (upon approval);

- Rewards: 5% cash back on Instantcart.com and the Instantcart app, 5% cash back on travels purchased over the phone with Chase Travel Center, 2% cash back at restaurants, gas stations, and eligible streaming services, plus 1% on everything else;

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Instacart Mastercard®: how does it work?

Instacart is a popular grocery delivery and pick-up service to shop for essentials without leaving the comfort of your home.

With its credit card, the Instacart Mastercard®, it’s possible to combine convenience with up to 5% cashback on grocery shopping needs.

Rewards: Shop, Dine, Travel, and More

Let’s break down the rewards categories to give you a better understanding of what this card has to offer:

Shop through Instacart.com or the Instacart app and enjoy a generous 5% cash back. It’s also valid for booking your travels over the phone through the Chase Travel Center.

Enjoy 2% cash back when dining out, refueling at gas stations, or subscribing to eligible streaming services.

For all other purchases, you’ll still earn 1% cash back. Also, it has no caps on rewards, so your earnings potential is limitless. Terms apply!

Advertisement

Cash Back Redemption

Redeeming your cashback is easy. You can opt for direct deposit into your bank account or apply it as a statement credit to reduce your card balance.

In addition, for those who love to travel, the Instacart Mastercard® allows you to use your points to book flights, hotels, car rentals, and cruises.

Additional Benefits

The Instacart Mastercard® offers other rewards and benefits such as:

- Rental car;

- Purchase and baggage protection;

- Roadside assistance;

- Travel and emergency services.

Advertisement

Instacart Mastercard®: should you get one?

The Instacart Mastercard® is good for those who want to earn cashback rewards on frequent online grocery purchases.

Review the drawbacks and advantages of the Instacart Mastercard® to decide if it’s the best card for your financial needs.

Pros

- Best Offer: Get a free year of Instacart+ and a $100 Instacart credit automatically upon approval. Membership auto-renews. Terms apply.

- Earn 5% cash back on Instacart app and Instacart.com purchases

- Earn 5% cash back on Chase Travel℠ purchases, including flights, hotels, and more

- Earn 2% cash back at restaurants, gas stations and on select streaming services

- Earn 1% cash back on all other purchases

- No annual card fee

Cons

- High APR;

- Monthly fee.

Credit score required

Indeed, since this credit card offers amazing benefits to the cardholder, it will require a higher credit rate!

Therefore, you’ll need a good to excellent credit score to apply and enjoy its amazing benefits!

Instacart Mastercard® application: how to do it?

Furthermore, make your purchases easier and more affordable with an Instacart Mastercard®. Then keep reading to learn how to do it.

Apply for Instacart Mastercard® today

Apply for the Instacart Mastercard® quickly with our guide. Elevate your grocery shopping experience and enjoy exclusive rewards. Read on!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Apply for the First Latitude Select Mastercard® Secured Credit Card

The First Latitude Select Mastercard® Secured Credit Card is a low maintenance option with a modest annual fee. Check out how to apply!

Keep Reading

Build credit fast: Merrick Bank Classic Secured Card review

Read to build credit with confidence? Then don't miss our Merrick Bank Classic Secured Card review! Ensure a credit limit of up to $3K!

Keep Reading

Checking account pros and cons: what to consider before opening one

If you're looking for a new checking account, these are the pros and cons to consider before opening one. Find out if it's right for you!

Keep ReadingYou may also like

Surge® Platinum Mastercard® credit card application: how does it work?

A credit card can be the best choice to build your score. Read on to learn how to apply for the Surge® Platinum Mastercard® credit card!

Keep Reading

Learn all the main pros of rewards credit cards

Do you know the pros of credit card rewards? You can take advantage of your credit cards and get a lot of benefits. Learn how to do it.

Keep Reading

Learn to apply easily for Home Depot Project Loan

Apply for the Home Depot Project Loan and take your renovations to the next level. Borrow up to $55,000 fast! Read on!

Keep Reading