Reviews

HSBC Cash Rewards Mastercard® credit card review: is it worth it?

Would you like to have a card with no annual fee that gives you rewards every time you use it? Your wish has been granted. The HSBC Cash Rewards Mastercard® will give you this and more. Please, keep reading this article to find out more about its benefits!

Advertisement

HSBC Cash Rewards Mastercard® credit card: an easy-to-use card with no fees and 1.5% cashback

If you got an HSBC Cash Rewards Mastercard® credit card, take a look at this review to learn about its features.

Most people are familiar with the HSBC brand – but what about their credit card offerings? In this post, we’ll take a close look at the HSBC Cash Rewards Mastercard® credit card to see if it’s worth your while.

We’ll break down the facts on fees, rewards, and perks, so you can decide for yourself if this is the right card for you. Ready to learn more? Let’s get started!

How do you get the HSBC Cash Rewards Mastercard®?

We love a good cashback. Even better if it comes with no annual fees. That's the case with the HSBC Cash Rewards Mastercard® card, so take a look on how to apply for it.

| Credit Score | Good/Excellent |

| Annual Fee | $0 |

| Regular APR | 12.99% – 22.99%, Variable |

| Welcome bonus | In the first year, you’ll get 3% instead of 1.5% cashback on all your purchases. |

| Rewards | 1.5% cashback on every purchase. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

HSBC Cash Rewards Mastercard® credit card

The HSBC Cash Rewards Mastercard is a good credit card. Not great, but not bad either. A regular card for everyday use. Their rewards program is very simple, with a flat rate of 1.5% on every purchase. This simplifies its use as you know you are always getting some cashback.

But it has a few more perks, like the $0 annual fee and no foreign transaction fee. In the first year, you get double cashback: 3% on all purchases. This is very good, considering that you are not paying any fees for it.

The Mastercard’s signature grants reliability for the card, and it is accepted virtually everywhere. Plus, you’ll get Mastercard perks like fraud insurance and coverage against theft and damage to your cell phone for up to $600.

HSBC Cash Rewards Mastercard® credit card: should you get one?

This card doesn’t offer a big range of benefits. On the other hand, it also doesn’t charge you an annual fee. Anyone looking for a credit card to use on a daily basis without complicated bonus categories can get this card.

Advertisement

Pros

- The flat rate cashback simplifies the usability of the card

- In the first year you’ll get twice as much cash back as a welcome bonus. That means 3% cashback on every purchase.

- After the first year, get 1.5% cashback on every purchase. You can redeem it for cash, gift cards, travel, or merchandise.

- No foreign transaction fees.

- With the Mastercard signature, you’ll get excellent benefits, such as cellphone damage or theft insurance coverage, access to special events, and experiences with the Mastercard Travel service.

Cons

- No bonus categories to earn more cashback.

- Requires a good credit score for approval.

Advertisement

Credit scores required

HSBC is a demanding bank for its cardholders. They’ll require a credit score at least good or even excellent to accept your application for a new credit card.

HSBC Cash Rewards Mastercard® credit card application: how to do?

If you’d like to get an HSBC Cash Rewards for you, take a look at the following content. We’ll tell you the eligibility requirements and the step-by-step.

How do you get the HSBC Cash Rewards Mastercard®?

We love a good cashback. Even better if it comes with no annual fees. That's the case with the HSBC Cash Rewards Mastercard® card, so take a look on how to apply for it.

Trending Topics

Bank of America® Travel Rewards review: Perfect for Travelers

Get a complete Bank of America® Travel Rewards review to find out its travel perks - 0% intro APR and no annual fee! Read on and learn more!

Keep Reading

How to buy cheap JetBlue Airways flights

Ever wonder how to buy cheap JetBlue Airways flights? Learn the strategies people are using that save them hundreds. Read on!

Keep Reading

Chase Freedom Flex vs Chase Freedom Unlimited: card comparison

Learn the main differences between the Chase Freedom Flex or Chase Freedom Unlimited credit cards, their perks, benefits and rewards.

Keep ReadingYou may also like

The Platinum Card® from American Express review: is it worth it?

The Platinum Card® from American Express is one of the best travel cards, with outstanding reliability. Learn everything about it!

Keep Reading

HSBC Premier Checking review: Is the 75,000 minimum balance worth it?

This HSBC Premier Checking review brings a scoop on account details, benefits, drawbacks, and more. Open your account for free. Read on!

Keep Reading

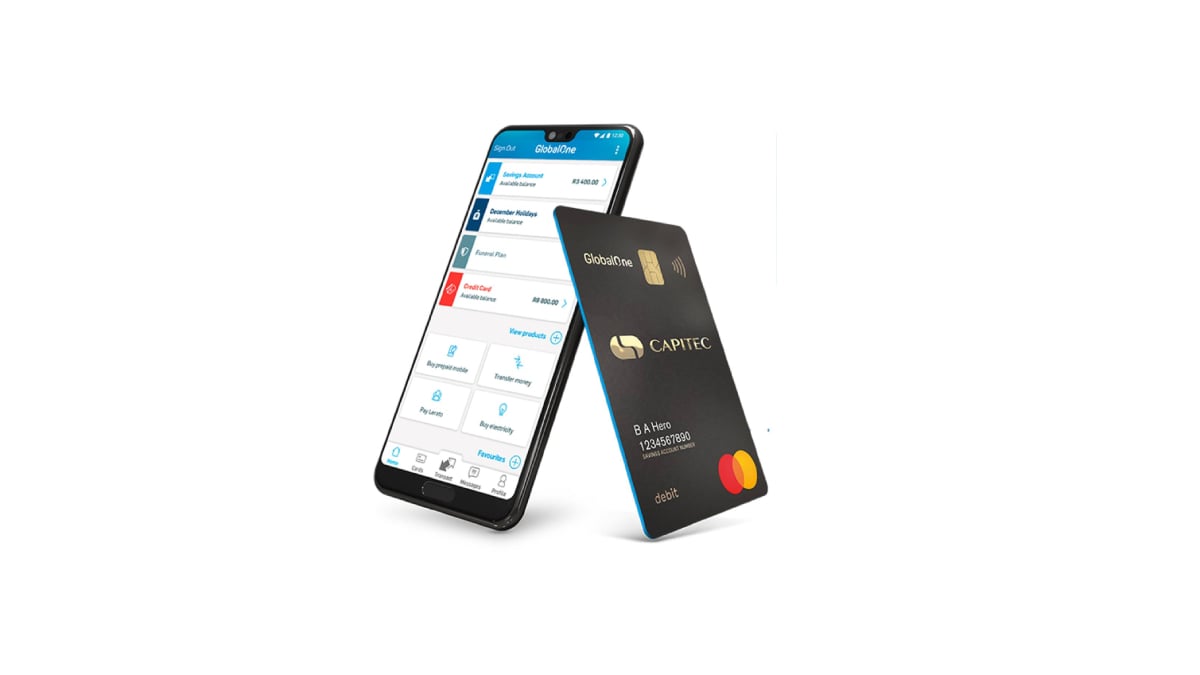

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep Reading