Credit Cards

Home Depot Consumer Credit Card Review: Is it a smart choice?

Explore our Home Depot Consumer Credit Card review to discover its special financing options. Stay tuned to find out if it's the right fit for your projects.

Advertisement

Special financing options, but carrying a balance can be costly

Are you seeking a financial ally to enhance your property or make essential repairs? Look no further than the Home Depot Consumer Credit Card review.

Home Depot Consumer Credit Card: Apply Now!

Discover the simple steps to apply for the Home Depot Consumer Credit Card, a valuable shopping tool. Keep reading for details.

Learn how this card caters to the unique needs of homeowners, the costs you should watch out for, and its pros and cons. Keep reading!

- Credit Score: 640 or higher;

- Annual Fee: $0;

- Purchase APR: Variable, ranging from 17.99% to 26.99%;

- Cash Advance APR: Not applicable;

- Welcome Bonus: None;

- Rewards: None.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

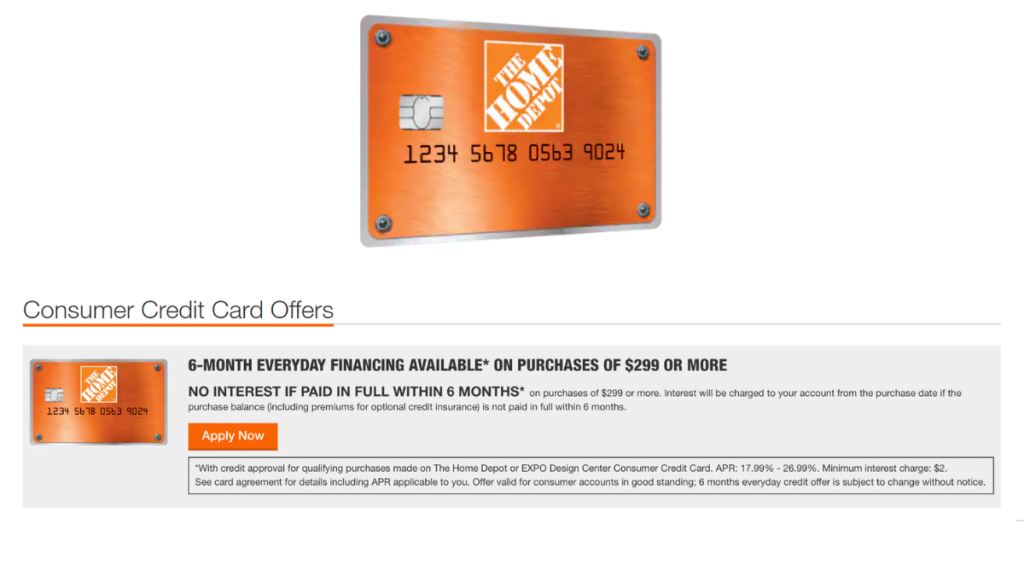

Home Depot Consumer Credit Card: how does it work?

The Home Depot Consumer Credit Card is primarily a store card designed for Home Depot shoppers. Your credit limit will depend on your creditworthiness.

While it offers a $0 annual fee, it doesn’t provide ongoing rewards like cash back or discounts on purchases.

It’s important to note that this card has a variable interest rate, meaning the APR can range from 17.99% to 26.99%.

So, it’s crucial to pay your balance in full to avoid accumulating interest charges.

6 months Financing

The card’s standout feature is the special financing options it offers.

You can enjoy six months of interest-free financing for purchases of $299 or more, provided you pay the balance in full within that time frame.

Additionally, you may be eligible for up to 24 months of financing during special promotions.

So, it can be particularly beneficial for larger home improvement projects.

Advertisement

Other features

As a cardmember, you get four times longer to make returns, making it more convenient.

Also, you’ll be protected from unauthorized charges with zero liability.

One notable advantage is that applying for the Home Depot Consumer Credit Card involves a soft pull on your credit.

Then, you can check if you are eligible for this card without impacting your credit score negatively.

Home Depot Consumer Credit Card: should you get one?

If you’re a new homeowner, frequently tackle home improvement projects, or shop at Home Depot, then this card can be a valuable tool.

However, other rewards non-store credit cards could offer the same, with ongoing rewards.

So, review the pros and cons of the Home Depot Consumer Credit Card before deciding.

Advertisement

Pros

- Special financing for larger purchases;

- No annual fee;

- Extended return policy;

- Zero liability on unauthorized charges.

Cons

- No welcome bonus;

- No ongoing rewards;

- High APR.

Credit score required

To get this credit card, you’ll need fair credit – excellent credit. So don’t hesitate to take your chances.

Home Depot Consumer Credit Card application: how to do it?

Ready to tackle those home renovations with the Home Depot Consumer Credit Card? We’ve got you covered with a step-by-step guide on how to apply.

Keep reading to learn more!

Home Depot Consumer Credit Card: Apply Now!

Discover the simple steps to apply for the Home Depot Consumer Credit Card, a valuable shopping tool. Keep reading for details.

Trending Topics

Upgrade credit card review: a credit card that works like a personal loan

If you're looking for a good card to rebuild your score, you've just found the Upgrade credit card. It will give you excellent benefits.

Keep Reading

Achieve Personal Loan (formerly FreedomPlus) review

Our Achieve Personal Loan review will examine its pros and cons, from fees to loan amounts. Borrow up to $50k and enjoy a rate discount!

Keep Reading

Marcus by Goldman Sachs Personal Loans application: how does it work?

The Marcus by Goldman Sachs Personal Loans application process is simple and you can find your loan options in under five minutes!

Keep ReadingYou may also like

Refinancing a car: learn the pros and cons

Are you wondering what are the pros and cons of refinancing a car? Wonder no longer! Read our full article and learn more!

Keep Reading

Citi Rewards+® Card application: how does it work?

Here's all you need to know about the Citi Rewards+® Card application online and straightforward. Keep reading to learn more!

Keep Reading

CashUSA.com review: how does it work and is it good?

Read our CashUSA.com review and discover how to get the money you need fast! Connect with several lenders and borrow up to $10,000 fast!

Keep Reading