Credit Cards

Earn 80K bonus points: Hilton Honors American Express Card Review

Earn hotel and other travel-related points every time you spend: Here is our complete review of the Hilton Honors American Express Card.

Advertisement

Score high travel rewards!

Generous reward points, no annual and transaction fees? Find out the ins and outs of the Hilton Honors American Express Card in this ultimate review (See Rates & Fees).

Apply for the Hilton Honors American Express Card

Here is the quickest way to apply for the Hilton Honors American Express Card – earn up to 7 points on purchases with $0 annual fee! Read on!

See how the card works, its benefits and fees, and whether it’s worth getting one. Keep reading!

- Credit Score: Good – Excellent;

- Annual Fee: $0;

- Purchase APR: 20.99% to 29.99% variable;

- Cash Advance APR: 29.99% variable;

- Welcome Bonus: Earn 80,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership;

- Rewards: 7 points on eligible hotels and resorts; 5 points on dining (U.S restaurants, takeout, and delivery), groceries (U.S supermarkets), and U.S. gas stations; plus 3 points on all other eligible purchases;

- See Rates & Fees

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Hilton Honors American Express Card: how does it work?

Do you love to stay at Hilton hotels? Then, the Hilton Honors American Express Card is packed with rewards that will make your travels more comfortable and rewarding.

With this co-branded option, you won’t pay an annual fee. Also, you will enjoy elite perks on Hilton hotels and resorts. Check out it stacks up.

Welcome Offer

When you sign up for this card, you can earn 80,000 points by spending $2,000 in the first 6 months of card membership.

Advertisement

Rewards

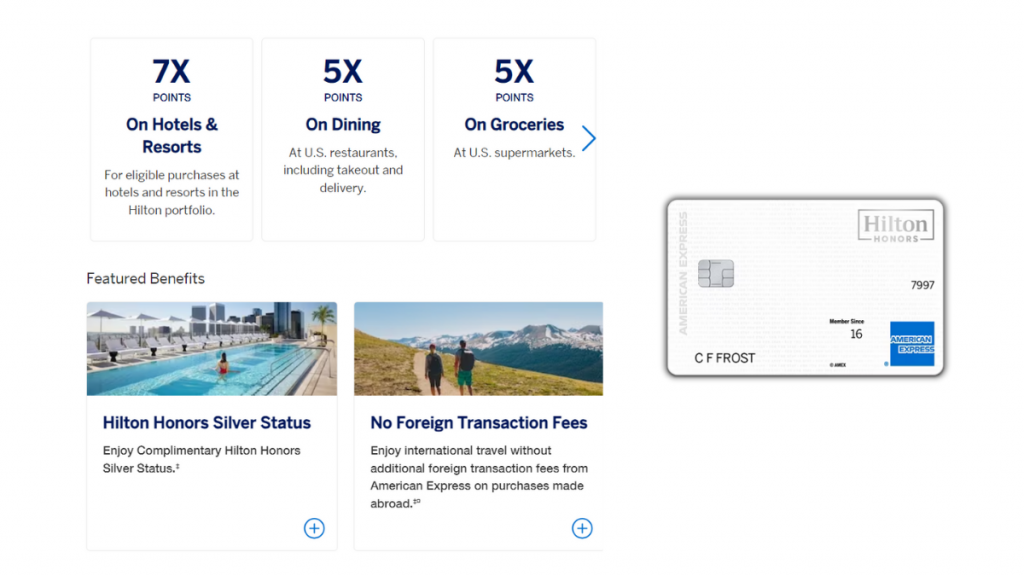

Let’s review the Hilton Honors American Express Card tiered rewards system that will make you accumulate extra points.

- 7x points on eligible Hilton hotel and resort purchases;

- 5x points on U.S. gas stations, U.S. restaurants, as well as U.S. supermarkets;

- 3x points on all other eligible purchases.

You can redeem your points for valuable rewards such as stays at Hilton hotels, room upgrades, rental cars, and even airline transfers to miles.

Fees

Indeed, one of the biggest benefits of the Hilton Honors American Express Card is its no annual or foreign transaction fee.

So you can use this card abroad without additional costs for transactions.

However, it’s important to be aware of other fees, such as:

- Cash advance fee: $10 or 5% of the amount, whichever is greater;

- Late payment fee: Up to $40, depending on your balance.

- See Rates & Fees

Advertisement

Hilton Honors American Express Card: should you get one?

The Hilton Honors American Express Card is a highly rewarding option if you frequently stay at Hilton Hotels.

Find out how this card benefits you and the potential drawbacks before applying for one.

Pros

- Earn 80,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership.

- Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio.

- Earn 5X Points per dollar on purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- Earn 3X Points for all other eligible purchases on your Card.

- Enjoy complimentary Hilton Honors Silver status with your Card. Plus, spend $20,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors Gold status through the end of the next calendar year.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- No Annual Fee.

Cons

- No anniversary-free night.

Credit score required

The minimum credit score required for a Hilton Honors Card is 690. So, make sure you have at least a good credit to apply.

Hilton Honors American Express Card application: how to do it?

Take advantage of your travels while enjoying the benefits of a Hilton Honors American Express Card.

Further, read our post below to find out how to apply for one today!

Apply for the Hilton Honors American Express Card

Here is the quickest way to apply for the Hilton Honors American Express Card – earn up to 7 points on purchases with $0 annual fee! Read on!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Delta SkyMiles® Platinum American Express Card application

Do you love to travel and earn card perks while doing so? Read our post about the Delta SkyMiles® Platinum American Express Card application!

Keep Reading

750 credit score: what does it mean?

Your credit score is essentially your financial identity. Discover the advantages of a 750 credit score and how to achieve it!

Keep Reading

Elon Musk is about to cut 10% of Tesla’s workforce

Musk has been talking about recession recently, and it looks like he’s prepared to do what it takes to protect his electric carmaker company.

Keep ReadingYou may also like

How to buy a second home with no down payment

Looking for help on how to buy a second home with no down payment? Here's our step-by-step guide to make it happen. Read on!

Keep Reading

100 Lenders personal loan review: how does it work and is it good?

Do you need a personal loan for an emergency or to pay off debt? If so, read our 100 Lenders personal loan review and learn more about it!

Keep Reading

Upgrade Rewards Checking application: how does it work?

Get ready to take advantage of our Upgrade Rewards Checking! Apply now and enjoy no hidden fees and cash back on expenses! Read on!

Keep Reading