Credit Cards

DoorDash Rewards Mastercard® review: Get up to 4% cash back on Food

Discover the main benefits of the DoorDash Rewards Mastercard®. Earn rewards and pay no annual fee! Keep reading and learn more!

Advertisement

DoorDash Rewards Mastercard®: earn $100 cash bonus!

If you enjoy receiving cash back and ordering food for delivery, you’ll love this DoorDash Rewards Mastercard® review of its benefits, rewards, and features.

Stay tuned to find out how to earn up to 4% cash back on your purchases using it. This credit card is perfect for foodies. So check it out!

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Regular APR: 20.24% – 28.99% variable APR for purchases and balance transfers and a 29.99% variable APR for cash advances;

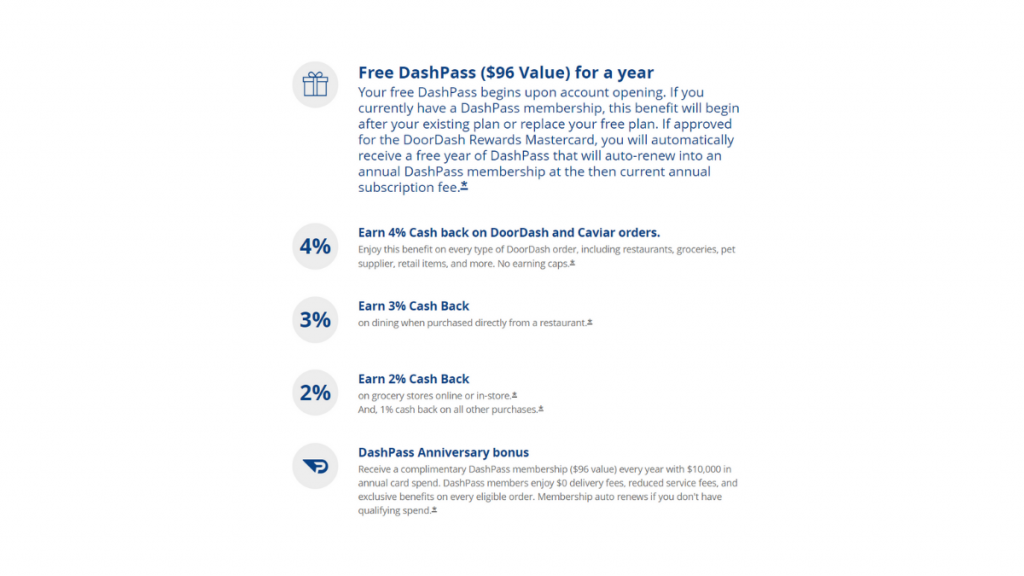

- Welcome bonus: With the New DoorDash Rewards Mastercard get a Free year of DashPass ($96 value).

- Rewards: 4% cash back on Caviar and DashDoor orders; 3% cash back on restaurant purchases, 2% cash back at online grocery stores or in-store, and 1% cash on all other purchases;

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

DoorDash Rewards Mastercard®: how does it work?

Are you a foodie who loves DoorPass and Caviar? Get rewarded for all your delicious meals with this Chase credit card.

1. Sign-up bonus and annual fee

When you apply for this card, you earn a free year of DashPass, DoorDash’s subscription service that offers zero delivery fees and reduced service fees on eligible orders.

The card has no annual fee, so you can enjoy its benefits without paying to use it.

Advertisement

2. Cash back rewards

With the DoorDash Rewards Mastercard®, you’ll get cash back on multiple categories of food purchases:

- 4% on eligible DoorDash and Caviar orders;

- 3% on purchases at restaurants;

- 2% on grocery stores or in-store;

- 1% on all other purchases.

Cash back Redemption

Redeem your cash-back rewards for statement credits, gift cards, direct deposits to your bank account, and even towards DoorDash and Caviar purchases.

Also, your rewards never expire as long as your account remains open.

Advertisement

3. Shipping and ride credit benefits

In addition to cash-back rewards, you can earn discounts and credits using the DoorDash Rewards Mastercard®. For example:

- $25 off your first two national shipping orders of $100 or more;

- As an exclusive Cardmember benefit, get 10% off one Convenience, Grocery, Alcohol, Retail or DashMart order every month. Maximum discount of $15 per order. Offer expires 12/31/2024.

- A $5 credit for one order on DashPass every month and a $5 Lyft credit after taking three Lyft rides in a calendar month.

DoorDash Rewards Mastercard®: should you get one?

Indeed, this credit card may provide advantages if you are a frequent DoorDash customer. Then read about its benefits and drawbacks below.

Pros

- With the DoorDash Rewards Mastercard get a free year of DashPass ($96 value).

- 4% cash back on DoorDash and Caviar orders. Enjoy this benefit on every type of DoorDash order, including restaurants, groceries, pet supplies, retail items, and more. No earning caps.

- 3% cash back on dining when purchased directly from a restaurant. No earning caps.

- 2% cash back on purchases from grocery stores, online or in person. 1% cash back on all other purchases. No earning caps.

- Get a complimentary DashPass membership ($96 value) every year with $10k in annual card spend. DashPass members enjoy $0 delivery fees & reduced service fees on every eligible order.

- No annual card fee, just cash back on every purchase.

- As an exclusive Cardmember benefit, get 10% off one Convenience, Grocery, Alcohol, Retail or DashMart order every month. Maximum discount of $15 per order. Offer expires 12/31/2024.

- Member FDIC.

Cons

- Credit card for good-excellent credit scores.

Credit score required

The minimum credit score required for this card is good credit. Thus, good to excellent credit is required.

DoorDash Rewards Mastercard® application: how to do it?

But how can you apply for this card? Discover the simple steps to apply for the DoorDash Rewards Mastercard®. Read on!

Apply online

The DoorDash Rewards Mastercard® is co-branded with Chase. Then the first step of your application is to visit the Chase website.

You can learn about the credit card’s perks, fees, rates, and rewards program there.

Fill out the application form

The second step is to fill out the application form. Insert your personal information, such as your name, address, phone number, email, and social security number.

After completing the application form, submit it to proceed to the next step.

Wait for the approval process

The third step is to wait for the approval process. It may take several minutes, hours, or days, depending on the bank’s verification process and your credit score.

If your application is approved, you will receive a confirmation email or letter containing your credit limit, card delivery details, and activation instructions.

Perks and rewards

As a cardholder, you can earn up to 4% back on DoorDash and Caviar orders, 3% on grocery and dining purchases, and 1% on all other purchases.

Also, you can redeem your rewards as statement credits, gift cards, or cash deposits to your bank account.

Moreover, you can take advantage of other benefits such as cellphone insurance, purchase protection, and extended warranty.

Apply using the app

The application for Chase cards is not available through the app yet. Visit its website.

DoorDash Rewards Mastercard® vs. Wells Fargo Autograph℠ Card

Indeed, the Wells Fargo Autograph℠ Card is a Visa travel card with up to 3 points on travel categories and a 0% intro APR period.

The DoorDash Rewards Mastercard®, on the other hand, is a food category card, perfect for those who love to spend money on DashDoor.

You can earn up to 4% Cashback using it. Find out more about these cards below and choose the one that is better for your financial status.

DoorDash Rewards Mastercard®

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Regular APR: 20.24% – 28.99% variable APR for purchases and balance transfers and a 29.99% variable APR for cash advances;

- Welcome bonus: With the New DoorDash Rewards Mastercard get a FREE year of DashPass ($96 value).

- Rewards: 4% cash back on Caviar and DashDoor orders; 3% cash back on restaurant purchases, 2% cash back at online grocery stores or in-store, and 1% cash on all other purchases;

- Terms apply.

Wells Fargo Autograph℠ Card

- Credit Score: Good to excellent;

- Annual Fee: $0 annual fee;

- Regular APR: 0% intro APR for the first 12 months, then 19.74%, 24.74%, or 29.74% variable;

- Welcome bonus: Earn 30K bonus points (equals $300 cash redemption value) after spending $1,500 in purchases during the first three months of account ( limited time offer);

- Rewards: Unlimited 3 points for purchases on restaurants, travel, gas, transit, popular streaming, and phone plans; 1 point on all other purchases.

So are you ready to get the Wells Fargo Autograph℠ Card? Keep reading for a complete guide in our post below.

Wells Fargo Autograph℠ Card application

Learn how to apply for the Wells Fargo Autograph℠ Card. Enjoy cash back reward and welcome bonus! Read on for more!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Learn to apply easily for the Honest Loans

Do you want to know how to apply for Honest Loans? Keep reading to find out, and understand the requirements.

Keep Reading

Qtrade Direct Investing Review: Build Your Wealth

Explore our Qtrade Direct Investing review for exceptional customer service and a user-friendly platform, ideal for smart investing choices.

Keep Reading

The Definitive Guide to Apply for Blaze Mastercard® Credit Card

Get your credit back on track with the unsecured Blaze Mastercard® Credit Card- Learn how to apply now. Read on!

Keep ReadingYou may also like

Luxury Black or Luxury Gold card: choose the best!

Are you thinking about getting a Luxury Black or Luxury Gold card? First, read this article to learn about their benefits to choose the best.

Keep Reading

SoFi Student Loans Review: No Fees at All!

Looking for a no-fee student loan to finance your education? Check out our review of SoFi student loans - pay no fees! Read on!

Keep Reading

Upgrade credit card review: a credit card that works like a personal loan

If you're looking for a good card to rebuild your score, you've just found the Upgrade credit card. It will give you excellent benefits.

Keep Reading