Reviews

Destiny Mastercard® Review: Reclaim Your Finances!

Destiny Mastercard® will give you a $700 credit limit with no security deposit required. Is that what you are looking for? If so, read this article to learn more about this card.

Advertisement

Destiny Mastercard®: The card you need to build your credit with confidence

If you’re wondering whether or not there’s a card out there that can help you improve your score, this Destiny Mastercard® review is tailor-made for you.

In this article, we’ll go over the pros and cons of getting a Destiny Mastercard®, so that you can weigh them and make an informed decision.

We’ll also give you tips on improving your credit score so that you may be eligible for a better card in the future.

If you’re interested in this information, please, keep reading.

| Credit Score | Poor to Good. |

| Annual Fee | See terms. |

| Regular APR | See terms. |

| Welcome bonus | No welcome bonus is offered. |

| Rewards | No rewards program. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Destiny Mastercard®

If you are facing a challenging financial situation and have a low score, know that you are not alone. According to a consumer credit review by Experian, 16% of North Americans have a bad credit score, and 18% have a fair credit score. We know this can make accessing a credit card or loan difficult.

But how to build credit without credit? Some financial institutions have cards specifically for these cases to solve this issue. The Destiny Mastercard® is one of these options.

Concora Credit Inc. issues the Destiny Mastercard®. Your application will be considered even if you have a bad credit score. But some factors will affect the card offer. So, the annual fee is $175 for the first year and $49 thereafter.

The card doesn’t offer any reward program or welcome bonus. The focus is just on the credit line. Pay attention to late payments, or you’ll pay a high fee for it.

Destiny Mastercard®: should you get one?

If you’re on a low score, you probably don’t have many options. While Destiny doesn’t offer many benefits, it can be a gateway. Use it for a few months until you can apply for a card with more benefits and lower fees.

Check out some pros and cons to help you decide:

Advertisement

Pros

- Every credit score is accepted for application (but not everyone will get approved)

- Start with a $700 credit limit

- Do not require a security deposit.

- Help to build your credit score by reporting your credit history to all three major credit bureaus.

Cons

- Have an annual fee, and it is deducted from your credit limit in the first month.

- $175 the first year; $49 thereafter

- High late payment fee of up to $41.

Advertisement

Credit scores required

Destiny is targeted toward people with a not-so-good credit score. So you don’t have to worry if you have a bad or fair score. You can apply and you might be approved.

When you receive your card, make responsible use with no late payments to build a strong and healthy credit score. Keep a low rate between your credit limit and how much of it you’re using. A good way to do it is constantly paying your credit card bill.

In the future, you can apply for a better credit card with reward programs and other benefits.

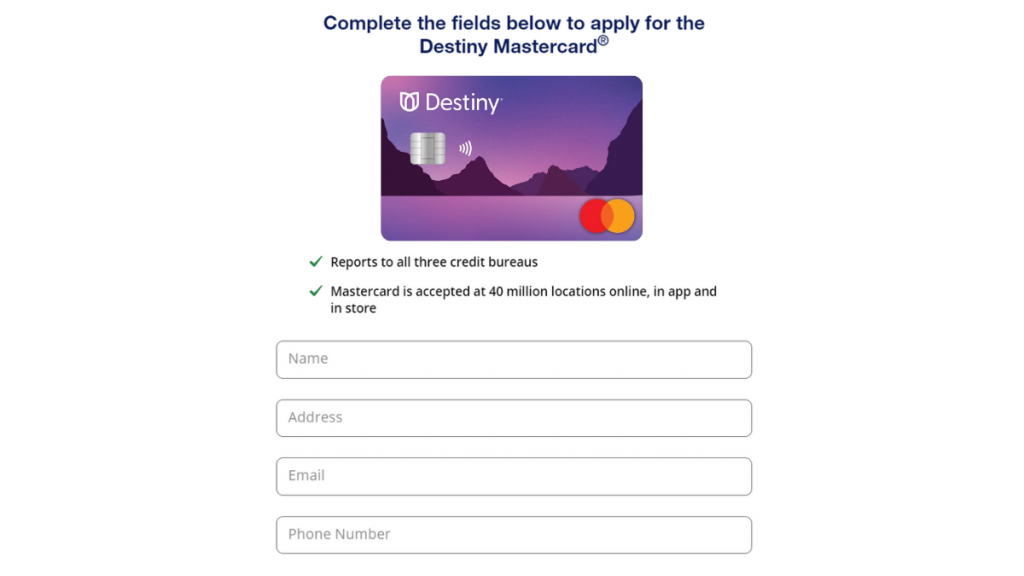

Destiny Mastercard® application: how to do?

Applying for the Destiny Mastercard® is easy, and you can do it online. We’re going to explain everything about the application process. Just keep reading to get one step closer to your new credit card.

Apply online

Just like almost everything nowadays, the application for this card can be done online. You just need a computer, internet, and you’re ready to go.

Access the Destiny Website. It is very simple, and you’ll easily find the information you need. The card doesn’t have many features, so there is not much to read about.

You’ll be redirected to a form where basic info is required. All you need to inform is your name, address, contact info, and Social Security Number. Submit the form and you’ll get an answer right away.

Apply using the app

Unfortunately, you can’t apply using the app. The only way to apply for a Destiny Mastercard® is through the website.

Destiny Mastercard® vs. First Digital Mastercard®

Let’s put the Destiny Mastercard® side by side with another card for comparison.

| Destiny Mastercard® | First Digital Mastercard® | |

| Credit Score | Poor to Good. | Bad – Fair |

| Annual Fee | See terms. | $75.00 for the first year. After that, $48.00 annually. |

| Regular APR | See terms. | 35.99% |

| Welcome bonus | No welcome bonus is offered. | N/A |

| Rewards | No rewards program. | None |

If you’d rather get the First Digital Mastercard®, this is a good option too. We have content to show you how to apply for it. Stay at The Mad Capitalist to read the First Digital Mastercard® review and apply for it.

How to apply for First Digital Mastercard®

Learn how to apply for the First Digital Mastercard® in just a few easy steps.

Trending Topics

100 Lenders personal loan review: how does it work and is it good?

Do you need a personal loan for an emergency or to pay off debt? If so, read our 100 Lenders personal loan review and learn more about it!

Keep Reading

How to download the best offline GPS apps?

No more getting lost! Learn how to download the best offline GPS to help you get around town without using data or a cellular signal.

Keep Reading

Veterans United Home Loans review: how does it work and is it good?

Check out this Veterans United Home Loans review to see how it works. This #1 VA Lender will help you buy your dream home! Read on!

Keep ReadingYou may also like

Citi® / AAdvantage® Platinum Select® World Elite Mastercard® application: how does it work?

Are you planning to apply for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®? Check out this guide for the application!

Keep Reading

Competitive rates: Apply for Marshland Credit Union Mortgage

Apply to MarshLand Credit Union Mortgage using our guide and take the first step towards homeownership today - streamline process!

Keep Reading

Discover it® Balance Transfer Credit Card application: how does it work?

Get the lowdown on how to apply for Discover it® Balance Transfer Credit Card! Enjoy 0% intro APR and more! Keep reading!

Keep Reading