Reviews

Better Mortgage review: how does it work and is it good?

We have made a Better Mortgage review to tell you why this can be the place to find the money you need. You'll find finance and buying options, understand how it works, and discover its pros and cons. Read on!

Advertisement

Better Mortgage: Buyers can bargain and find the best deals!

If you’re considering refinancing a house, you need to read this complete Better Mortgage review we’ve prepared.

How to apply for Better Mortgage

Do you want to apply for Better Mortgage but don't know how? This post will help you to understand step-by-step. Read on!

They are an online mortgage lender that can help you buy the house of your dreams. We’ll explain how it works, what rates you can expect, and whether or not it’s a good option.

| Credit Score | 620 or higher. |

| Loans Offered | Purchase, Refinance, Jumbo, Fixed, Adjustable, FHA. |

| Minimum Down Payment | 3% minimum down payment for conventional loans. 10% minimum for Jumbo Loans. |

| APR | It varies from mortgage to mortgage. |

| Terms | 15 to 30 years. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is the Better Mortgage?

Better Mortgage is an online platform that makes it easier for you to buy our home. Borrowers can complete the application through their website.

With this lender, you can find fixed, and adjustable-rate refinance and purchase loans.

There are regular loans that consider a 3% down payment. However, a Jumbo loan will charge at least 10%.

Better Mortgage works with Notable Finance to offer a $50K credit line for customers’ home repairs, purchases, and related expenses. They call it a “Home Card.”

On the other hand, Better Mortgage doesn’t offer any government-backed loans. So, if you are looking for it, this is not the lender for you.

Still, Better Mortgage has a guarantee and cash offer program.

On the website, you can get pre-approval. Once you do that, you can make offers over the ones you received and try to bargain for better conditions.

Buyers can then work with a Better agent to offer all cash to the home sellers.

If they accept it, Better Mortgage will pay it and then work with you on what terms and conditions you’ll close the deal.

If you do this process with them, it might save you time and money.

Is the Better Mortgage good?

Better Mortgage is interesting for those who avoid branches and prefer to work online on deals.

However, before you make sure this is the loan for you, it’s important to consider some advantages and drawbacks. Let’s see them below.

Advertisement

Pros

- It offers an online application;

- It allows customers to make cash offers;

- You won’t have to pay an origination fee.

Cons

- There are no government-backed mortgage options, such as VA or USDA loans.

Advertisement

Does Better Mortgage check credit scores?

Yes, it does. Better Mortgage will check your credit score as one of the most important parts of the deal. They require at least a 620 score to apply.

Want to apply for Better Mortgage? We will help you!

If you are looking forward to buying your house, we are sure the Better Mortgage review has helped you.

Do you want to apply for a loan with them but don’t know how? Read our post below.

How to apply for Better Mortgage

Do you want to apply for Better Mortgage but don't know how? This post will help you to understand step-by-step. Read on!

Trending Topics

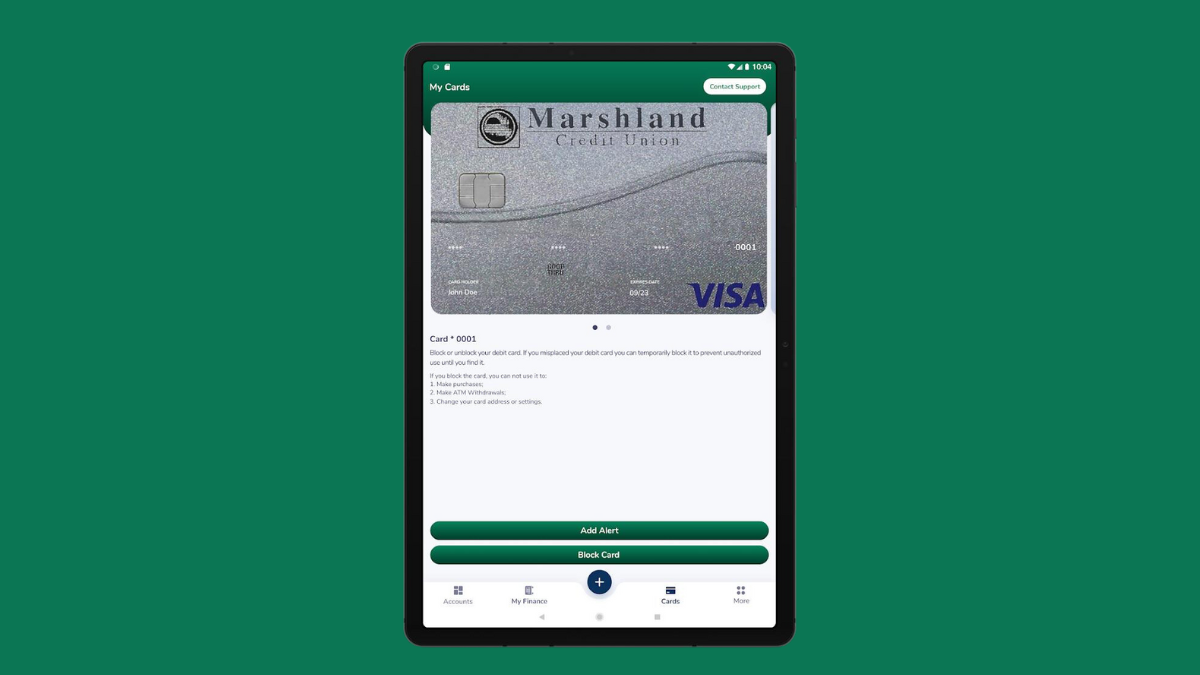

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

Learn to apply easily for the Bad Credit Loans

Need a loan fast, but have bad credit? Don't worry! Our step-by-step guide lets you easily learn how to apply for Bad Credit Loan. Read on!

Keep Reading

Learn to apply easily for the LendingClub Personal Loans

Whether you want a loan for home remodeling or debt consolidation, here are some steps to apply for LendingClub Personal Loans. Keep reading!

Keep ReadingYou may also like

Torrid Credit Card Review: Big Discounts on all Purchases

Discover the amazing benefits of the Torrid Credit Card in our review, including 40% off your first purchase, sales, and offers. Read on!

Keep Reading

Learn to apply easily for Integra Credit Personal Loan

Learn more about the requirements and how to apply for the Integra Credit Personal Loan. Qualify with no credit check! Keep reading!

Keep Reading

A guide on how to manage your mortgage the right way

Managing your mortgage can be intimidating. Don't worry! We have some tips to help you learn how to easily manage your mortgage.

Keep Reading