Reviews

Avant Personal Loan review: how does it work, and is it good?

If you need speedy cash for a personal project, but don't have a good credit score, check out our Avant Personal Loan Review, and see how it can help you achieve that goal. Keep reading to learn more.

Advertisement

Avant Personal Loan: Get a loan for any purpose!

This Avant Personal Loan Review will help you understand how this company operates in the USA. It offers loans for any purpose, such as credit card consolidation or medical expenses.

How to apply for Avant Personal Loan

Do you want to apply for the Avant Loan? It's fast, easy, and secure. Stay here to learn more.

In this article, we’ll look at how Avant works, what rates and terms you can expect, and whether or not it’s a good option for you. So keep reading to learn more!

- APR: The APR varies from 9.95% to 35.95%;

- Loan Purpose: Their loans are available for any purpose, such as home renovations and debt consolidation;

- Loan Amounts: From $2,000 to $35,000;

- Credit Needed: Most borrowers have 600 to 700. However, you can apply for a loan with a 689 or lower score;

- Origination Fee: 4.75% of the loan amount;

- Late Fee: There is a late fee;

- Early Payoff Penalty: It doesn’t charge a payoff penalty.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is the Avant Personal Loan?

Avant is a personal loan lender that offers loans to borrowers with bad or fair credit.

You can manage your loan through their app or visualize the status on their website.

Avant Personal Loans are a good option for borrowers who need money quickly, as Avant offers speedy funding.

Also, this company charges origination and late fees but has competitive APRs for bad credit borrowers.

The loan terms are 1-5 years. Initially, customers cannot choose their payment dates, but they have the right to change them twice during the loan term.

Still, Avant Personal Loan doesn’t offer to co-sign or joint loans, but some customers can add collateral to improve their chances of approval.

Finally, you can pre-qualify for an Avant loan without hurting your credit score.

So you can see and analyze the rates before actually closing the deal.

Is the Avant Personal Loan good?

Avant Personal Loan is an interesting option for people with less-than-perfect credit looking for quick money to achieve a personal goal.

You can review these personal loan perks and drawbacks to see if it’s an alternative for your profile.

Advertisement

Pros

- It has offers for bad and fair credit scores;

- You can pre-qualify for a personal loan without having your score hurt;

- The funds are deposited very fast into customers’ accounts;

- You can change the payment dates;

- It has an app to manage the loan.

Cons

- It charges an origination fee;

- There’s a late fee;

- There aren’t joint or co-signed loan options.

Advertisement

Does the Avant Personal Loan check credit scores?

Avant Personal Loan checks your credit score to find the best rates and terms for you.

However, it accepts applicants with low scores, so if you have a less-than-perfect one, you can still get the money you need.

Want to get the Avant Personal Loan? We will help you!

We hope the Avant Personal Loan Review has clarified your mind and helped you understand how it works.

Moreover, learn how to apply for Avant Personal Loan in the post below.

How to apply for Avant Personal Loan

Do you want to apply for the Avant Loan? It's fast, easy, and secure. Stay here to learn more.

Trending Topics

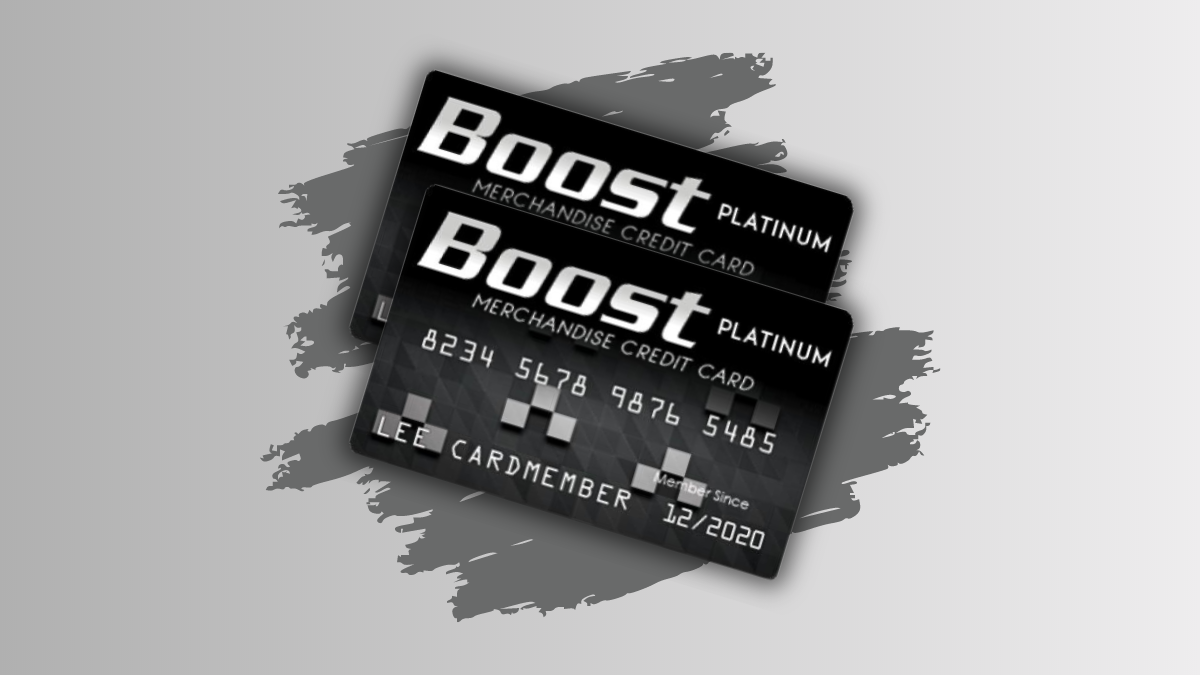

BOOST Platinum Card Review: Is it worth it?

Shop with the BOOST Platinum Card and enjoy $750 merchandise credit. No credit checks, perfect for low scores. Financial flexibility awaits!

Keep Reading

American Airlines AAdvantage® MileUp® application: how does it work?

Find out if the American Airlines AAdvantage® MileUp® is right for you, and learn how to apply here. Read on!

Keep Reading

How to buy cheap Frontier Airlines flights

Learn about the different ways to buy cheap Frontier Airlines flights and how to find the best deals. Find tickets from $19.

Keep ReadingYou may also like

Learn to apply easily for the Flagstar Bank Mortgage

Learn how to apply for a Flagstar Bank Mortgage. Enjoy several loan options and affordable pricing! Keep reading to learn more!

Keep Reading

Super+ Review: Your Key to Everyday Savings

Unlock the secrets of Super+ in our review and learn how it can improve your shopping experience for just $15/month.

Keep Reading

CreditFresh Review: Fast Cash and Flexible Credit

Get access to a credit line with CreditFresh- Read our review to learn about the amounts, repayment options, and much more. Up to $5,000!

Keep Reading