Reviews

United℠ Explorer Card application: how does it work?

Wondering how to apply for the United℠ Explorer Card? We'll show you how easy it is and what benefits you can expect. Keep reading!

Advertisement

United℠ Explorer Card: Unlocking benefits of air traveling with miles!

Are you looking to step up your financial and travel game? We’ve got just the card for you! Check out our guide on how to apply for the United℠ Explorer Card so that all of its amazing rewards can be yours in no time.

Enjoy perks from both worldwide shopping experiences as well as flying with United. Keep reading to learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

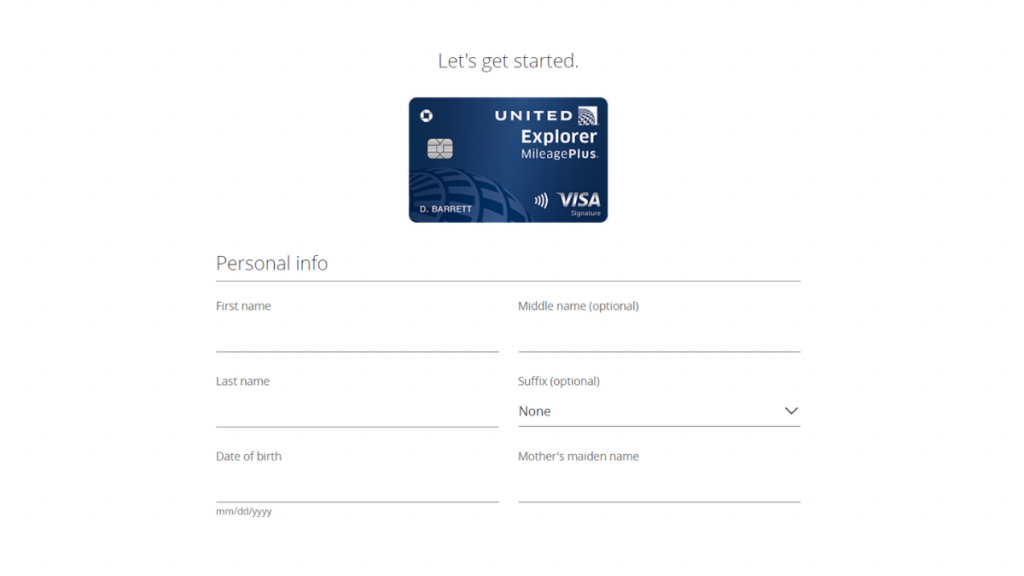

To apply for the United℠ Explorer Card, you’ll need to provide some personal and financial information.

The application process is pretty straightforward, and you can usually complete it in just a few minutes. Here’s what you’ll need to provide:

- Full name;

- Date of birth;

- Gender;

- Residential address;

- Phone number;

- Email address;

- Credit History Information;

- Employer information;

- Income information.

Here’s how to apply:

1. Go to the United website and select the “Credit Cards” button.

2. Find “United Explorer Card” and then “Apply Now.”

3. Fill out the application form with your personal information and credit history.

4. Once you’ve submitted the application, you should receive a response within minutes.

If you’re approved, you’ll be able to start using your card as soon as you have it in your hands.

Advertisement

Apply using the app

Unfortunately, customers cannot apply for the United℠ Explorer Card through the mobile app. As a result, if you want to become a cardholder, you can do so on their official website rather than through the app.

United℠ Explorer Card vs. Alaska Airlines Visa Signature® credit card

If you are looking for a travel card, the United℠ Explorer Card and the Alaska Airlines Visa Signature® credit card are good choices.

Both offer similar rewards, but the United℠ Explorer Card comes with a $0 annual fee intro offer for the first year.

However, after that period, the Alaska Airlines Visa Signature® credit card has a lower annual fee, $20 less expensive than the United one.

Advertisement

United℠ Explorer Card

- Credit Score: Good to excellent;

- Annual Fee: $0 for the first year, $95 after that;

- Regular APR: 21.99% – 28.99% variable APR for purchases and balance transfers; 29.99% variable APR for cash advances;

- Welcome Bonus: Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

- Rewards: 2 miles for each dollar spent on purchases from United, including tickets, Economy Plus®, inflight food, beverages, Wi-Fi, and others; 2 miles per $1 spent on dining, including qualifying delivery services;

- Other Rewards: 2 miles per $1 spent on hotel accommodations (valid for when you purchase directly with the hotel); and 1 mile per $1 spent on all other purchases;

- Terms apply.

Alaska Airlines Visa Signature® credit card

- Credit Score: Good-Excellent;

- Annual Fee: $75;

- Regular APR: 20.24% – 28.24% variable APR;

- Welcome bonus: Earn 50K bonus miles plus Alaska’s Famous Companion Fare™ (time-limited offer) from $121 ($99 fare plus taxes and fees from $22). To qualify, make $2,000 or more in purchases within the first 90 days;

- Rewards: Earn unlimited 3 miles on the dollar for eligible Alaska Airlines purchases; 1 mile for all other purchases; and 20% back on Alaska Airlines purchases (wifi, food, and drinks).

Ready to take the plunge on your Alaska Airlines Visa Signature® credit card journey? Then you won’t want to miss our guide post below. Keep reading!

How to apply for Alaska Airlines Visa Signature®?

Interested in the details of the Alaska Airlines Visa Signature® credit card? Find out more here.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

How to get an 800 credit score? A complete guide

Don't miss out on the financial opportunities that come with excellent credit - start your journey to an 800 credit score today.

Keep Reading

What is cashback and its advantages: is it a good idea?

One of the main cash back advantages is way of earning money while spending. Sounds counter intuitive? That’s because it is. Check it out!

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card review: is it legit and worth it?

Petal® 1 "No Annual Fee" Visa® Credit Card will help boost your score. In this post, we'll take a closer look at its benefits!

Keep ReadingYou may also like

The Plum Card® from American Express application: How does it work?

Get approved for The Plum Card® from American Express! Master the application process with our tips. Pay early and earn 1.5% cash back!

Keep Reading

Citi® Secured Mastercard® review: Build your credit history from scratch

Read on to a Citi® Secured Mastercard® review and find out its pros and cons and how it can help you build your credit.

Keep Reading

A guide on how to manage your mortgage the right way

Managing your mortgage can be intimidating. Don't worry! We have some tips to help you learn how to easily manage your mortgage.

Keep Reading