Credit Cards

Apply for a Target RedCard: $0 annual fee

Learn the easy steps to apply for the Target RedCard and boost your shopping experience. Earn rewards at Target and save money!

Advertisement

Unlock 5% Savings Today – Apply for Target RedCard

Ready to make every Target shopping trip count? Here is how to apply for the Target RedCard in just 5 steps.

Join us as we demystify the application process, making it easy for you to enjoy the benefits of this fantastic credit card. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Whether you prefer the credit, reloadable, or debit version of the Target RedCard, the application process is the same.

Start by visiting the Target website and follow these three easy steps:

1. Get to Know You

Provide your contact information and address. It helps Target get in touch with you and also send your card to the right place.

Advertisement

2. Verify Your Identity

To maintain security, you’ll need to supply your Social Security Number (SSN) as well as other necessary details.

3. Approval and Delivery

Once your application is approved, you can choose to receive your card by mail, typically arriving within 7-10 days, or start using it online right away.

Advertisement

Apply using the app

It’s worth noting that applying for the Target RedCard cannot be done through the app or over the phone.

So, an online application is the way to go. You can also apply in-store if you prefer.

Target RedCard vs. Costco Anywhere Visa® Card by Citi

Both the Target RedCard and the Costco Anywhere Visa Card by Citi offer some great benefits, so it depends on what you’re looking for in a card.

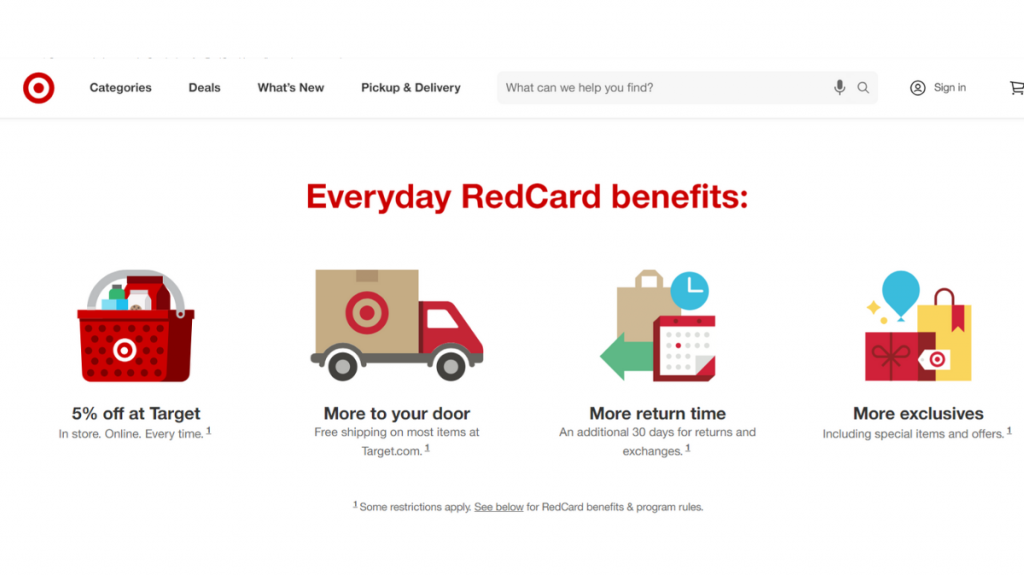

For example, the Target RedCard offers 5% off on all Target purchases and free shipping on most items. However, it can only be used at Target.

The Costco Anywhere Visa Card by Citi offers 4% cashback on gas purchases, 3% cashback on restaurant and travel purchases, and 2% cashback on Costco purchases.

So, if you’re wondering how the Target RedCard stacks up against the Costco Anywhere Visa Card by Citi, let’s break it down for you.

Target RedCard

- Credit Score: 690-850 (Good – Excellent);

- Annual Fee: $0;

- Purchase APR: 28.15% variable;

- Cash Advance APR: N/A;

- Welcome Bonus: N/A;

- Rewards: Credit Score: 690-850 (Good – Excellent);

- Annual Fee: $0;

- Purchase APR: 28.15% variable;

- Cash Advance APR: N/A;

- Welcome Bonus: N/A;

- Rewards: 5% off on purchases at Target and Target’s website.

Costco Anywhere Visa® Card by Citi

- Credit Score: Excellent;

- Annual Fee: No annual fee ( requires Costco Membership);

- Regular APR: 17.49% variable APR for purchases and balance transfers;

- Welcome bonus: None;

- Rewards: 4% cash back on eligible EV charging and gas worldwide for the primary $7K a year, then 1%; also, 3% for eligible travel purchases and restaurants around the world; 2% on Costco and Costco.com purchases; and 1% on other purchases ( you must have a membership at Costco).

Do you want to learn how to apply for a Costco Anywhere Visa® Card by Citi? Keep reading to find out how to do it in our post below!

How to apply for Costco Anywhere Visa® by Citi

Do you want a credit Card to help you earn cash back at Costco? Read on to learn how you can make the application for the Costco Anywhere Visa® Card by Citi.

Trending Topics

10 reasons not to refinance your home

There are many reasons why you might choose not to refinance your home. Here are the top 10! Check them out!

Keep Reading

Copper – Banking Built For Teens application: how does it work?

Copper - Banking Built For Teens is a checking account for kids and teenagers. Earn APY. Find out how to apply in this post.

Keep Reading

Luxury Titanium or Luxury Black card: choose the best!

Choosing between Luxury Titanium or Luxury Black is not easy, as they're both excellent travel credit cards. Check these review to decide.

Keep ReadingYou may also like

Learn all the main pros of rewards credit cards

Do you know the pros of credit card rewards? You can take advantage of your credit cards and get a lot of benefits. Learn how to do it.

Keep Reading

70K bonus points: Apply for American Express® Business Gold Card

Get an in-depth understanding of the American Express® Business Gold Card and its application process. Earn up to 4 points on purchases!

Keep Reading

How to get an 800 credit score? A complete guide

Don't miss out on the financial opportunities that come with excellent credit - start your journey to an 800 credit score today.

Keep Reading