Credit Cards

R.I.A. Federal Credit Union Mastercard® Classic Card: apply today

Get the financial freedom you deserve with the R.I.A. Federal Credit Union Mastercard® Classic Card - pay $0 annual fee! Read on and learn more!

Advertisement

Easy and fast online application

The R.I.A. Federal Credit Union Mastercard® Classic Card is designed for those with good to excellent credit scores.

The process is simple if you’re interested in applying for the R.I.A. Federal Credit Union Mastercard® Classic Card. So, check out below!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

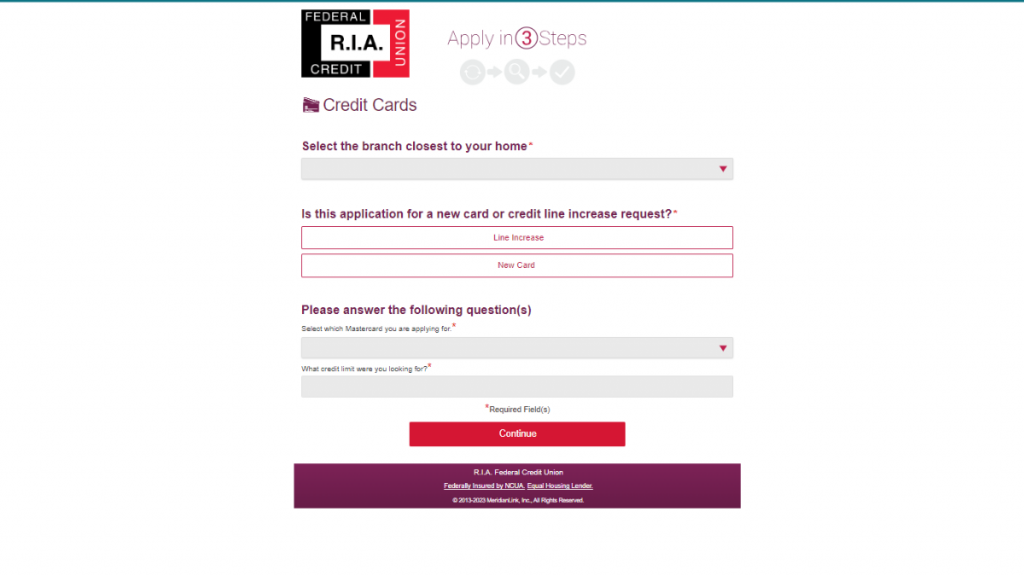

Apply online

To apply online, visit the R.I.A. Federal Credit Union website and navigate the credit cards section.

Further, you can view the R.I.A. Federal Credit Union Mastercard® Classic Card details and start the application process.

Moreover, you must provide personal and financial information, including your income, employment status, and credit history.

Once you’ve submitted your application, you’ll typically receive a decision within a few business days.

If approved, you’ll receive your card in the mail and can use it immediately.

Apply using the app

If you prefer to apply using the R.I.A. Federal Credit Union mobile app, you can download the app from the App Store or Google Play.

Once you’ve downloaded the app and logged in, navigate to the credit cards section and select the R.I.A. Federal Credit Union Mastercard® Classic Card.

Thus, you can start the application process and provide the necessary information from there.

One benefit of using the app to apply is that you can easily track the status of your application and receive notifications when a decision has been made.

This can be particularly helpful if you’re on the go and want to stay up-to-date on the status of your application.

Advertisement

R.I.A. Federal Credit Union Mastercard® Classic Card vs. R.I.A. Federal Credit Union Mastercard® Rewards Card

Indeed, the R.I.A. Federal Credit Union Mastercard® Classic is a solid choice for those looking for a basic credit option.

On the other hand, the R.I.A. Federal Credit Union Mastercard® Rewards Card offers additional benefits and rewards for cardholders.

Thus, you’ll earn 1.5% cashback on selected purchases, which can add to significant savings over time.

Further, check a quick comparison below and learn more about both card’s main features.

R.I.A. Federal Credit Union Mastercard® Classic Card

- Credit Score: 680 or higher (good to excellent);

- Annual Fee: $0;

- Purchase APR: 14.50% Variable APR;

- Cash Advance APR: None;

- Welcome Bonus: None;

- Rewards: None.

Advertisement

R.I.A. Federal Credit Union Mastercard® Rewards Card

- Credit Score: 680 or higher (good to excellent);

- Annual Fee: $0;

- Purchase APR: 17.50% – variable;

- Cash Advance APR: Not disclosed;

- Welcome Bonus: None;

- Rewards: Credit Score: 680 or higher (good to excellent);

- Annual Fee: $0;

- Purchase APR: 17.50% – variable;

- Cash Advance APR: Not disclosed;

- Welcome Bonus: None;

- Rewards: 1.5% of cashback on selected purchases.

Do you want to learn how to apply for R.I.A. Federal Credit Union Mastercard® Rewards Card? So, check out the article below.

R.I.A.F.C.U. Mastercard® Rewards

Unlock the potential of shopping with the R.I.A. Federal Credit Union Mastercard® Rewards Card! Apply today and start saving big!

Trending Topics

Busy Days, Easy Meals: Time-Saving Airfryer Recipes in Minutes!

Cook delicious and crispy snacks with these 11 irresistible air fryer recipes anyone can make. Find out more!

Keep Reading

What happens if you don’t use your credit card?

Wondering what happens if you don't use your credit card? Well, then keep reading and learning! We'll explain everything you need!

Keep Reading

Consolidate Your Debt with Confidence: Best Loans

Discover if debt consolidation loans are right for you and learn all about the benefits, drawbacks, and options available. Keep reading!

Keep ReadingYou may also like

Scotiabank Preferred Package Account Review

Explore our in-depth Scotiabank Preferred Package review for insights on its unlimited transactions, savings perks, and fee waiver criteria!

Keep Reading

Gemini Credit Card® review: Earn crypto on your purchases

Love crypto? Get a Gemini Credit Card® review with pros and cons! Pay no annual fee and earn crypto on every purchase!

Keep Reading

How to move out of your parents’ house [Checklist]

How to move out of your parents' house? This checklist offers everything you need to do before making the big move. Read on!

Keep Reading